Seems like just yesterday it was Q2 reporting season. But time flies—quarter by quarter—in the public company universe.

EnerCom, Inc. has compiled third quarter earnings per share, revenue, EBITDA and cash flow per share analyst consensus estimates on 110 E&P and 81 Oilfield Service companies in the EnerCom database.

Download EnerCom’s full chart of estimates.

The median OilServices company earnings estimate for the quarter ending September 30, 2017, is ($0.01) per share compared to actual earnings per share of ($0.07) and ($0.12) for Q2’17 and Q1’17, respectively. The median E&P company earnings estimate for the quarter ending September 30, 2017, is $0.01 per share compared to actual earnings per share of $0.07 and $0.10 for Q2’17 and Q1’17, respectively.

Energy Commodities

Crude Oil

U.S. oil consumption in July 2017 was 20 MMBOPD, down 2.3% from the previous month and up 1.6% from the same month in 2016. For July 2017, U.S. crude oil production was 9.2 MMBOPD, up 1.5% from June production and up 6.4% from a year ago. The average spot price for WTI in September 2017 was $49.82 per barrel, up 3.7% from the prior month and up 10.3% from the same month last year. The five-year strip at October 12, 2017 was $50.11 per barrel.

The median analyst estimate at the beginning of October for 2018 NYMEX oil was $52.25 per barrel with a high of $65.00 and a low of $43.00 per barrel.

Natural Gas

For July 2017, total natural gas consumption was 68.1 Bcf/d, up 8.1% from the month prior and 37% lower than the same month last year. Total natural gas production in July 2017 was 73.5 Bcf/d, up 0.8% from the month prior and up 3% from the same month last year.

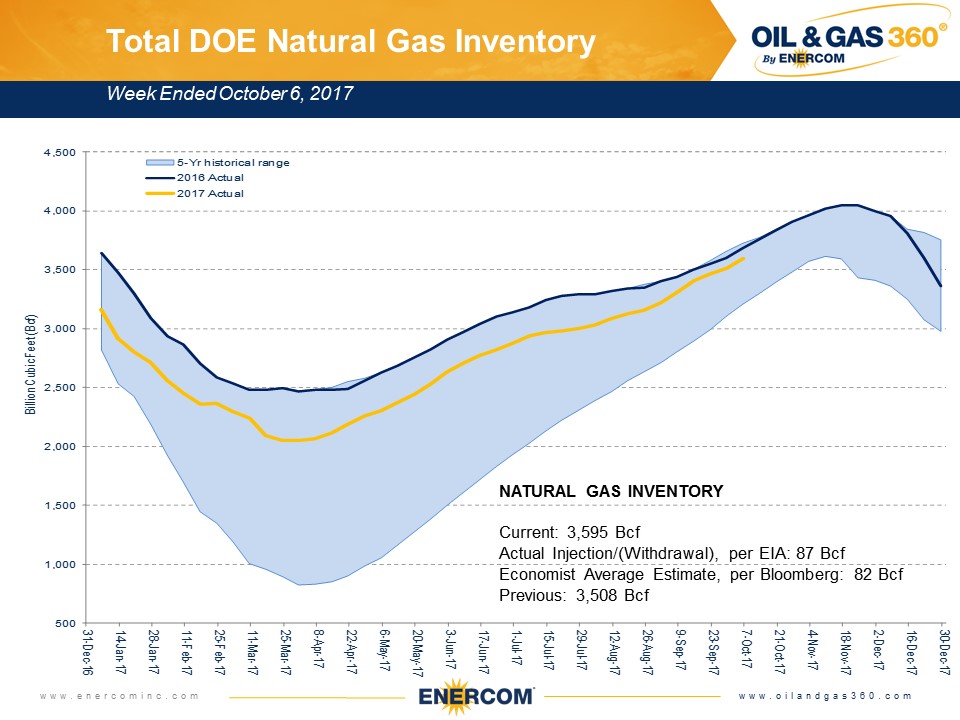

At 3.6 Tcf (week ending 10/6/17), natural gas storage was 0.2% below the five-year historical average, and 4.1% below the five-year high. The average spot price for Henry Hub in September 2017, was $2.98 per MMBtu, 2.8% higher than the previous month and 0.1% lower than in September of last year. The five-year strip at October 12, 2017 was $2.858 per MMBtu.

The median analyst estimate at the beginning of October for 2018 NYMEX Henry Hub was $3.22 per MMBtu with a high of $3.59 and a low of $3.00 per MMBtu.

Rig Count

The U.S. rig count stood at 928 for the week ended October 13, 2017, down six from the week ended October 6, 2017, and an increase of 394 from the same week last year.

For the week ended October 13, 2017, there were 786 horizontal rigs active in the United States, an increase of 82.4% from the same week a year ago. By play and as compared to the same week last year, rig count changes for the week ended October 13, 2017, include Haynesville (+28 rigs), Fayetteville Shale (-1 rig), Woodford Shale (+30 rigs), Appalachian Basin (+26 rigs), Williston Basin (+21 rigs), Eagle Ford Shale (+32 rigs), DJ Niobrara (+7 rigs) and Permian Basin (+183 rigs).

Equity Markets

From EnerCom’s E&P Database: For October 13, 2017, year-to-date large-cap, mid-cap, small-cap and micro-cap E&P stocks changed by -21%, -26%, -40% and -41%, respectively. Year-to-date, oil-weighted and gas-weighted companies moved -39.3% and -26.5%, respectively.

By region as of July 14, 2017, year-to-date, Bakken, Midcontinent, Marcellus, Gulf of Mexico, Canada, and Diversified stocks changed by -55%, -32%, -6%, -27%, -34%, and -32% respectively.

From EnerCom’s Oil Service’s Database: As of July 14, 2017, year-to-date, OilService’s large-cap and mid-cap stocks changed by -18%, -25%, respectively, while small-cap and micro-cap stocks changed by -17%, and -19% respectively.

Expected Themes for Conference Calls

Below are some themes and thoughts we expect to take prominence on this quarter’s conference calls.

E&P Companies:

- Activity levels in light of current oil prices

- Activity needed to hold acreage

- Full cycle returns

- Potential for midstream joint ventures

- Potential to spin off midstream assets

- Operating efficiencies

- Liquidity, capital market funding and debt maturities

- Size of drilling inventory

- Completions availability

- Potential for M&A activity

- Hedge position

- Service cost inflation

OilService companies:

- Global economic outlook

- U.S. vs international activity

- Balance sheet strength and near-term debt maturities

- Rig count projections

- Pricing trends

- Oilfield service equipment utilization rates and the potential for added capacity

- Service cost inflation

- Margin trends

- Potential for selling directly to E&P companies