Blackbird announces a 522% increase in proved plus probable reserves

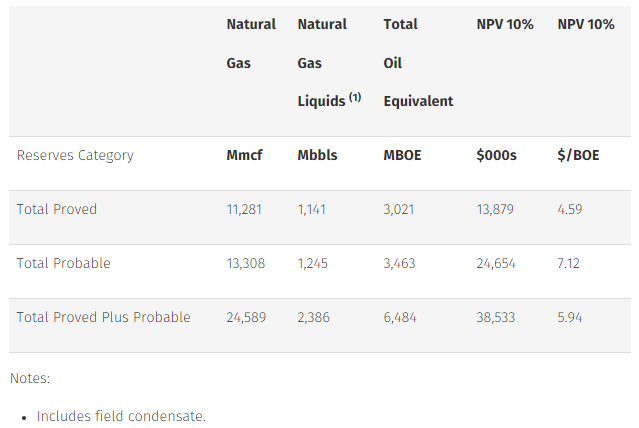

Alberta-based Blackbird Energy (ticker: BBI, BlackbirdEnergy.com) continued to grow both the size and value of its reserves at its Elmworth Montney position over the last six months. The company announced that it increased proved plus probable reserves by 522% as of January 31, 2016, according to a press release. The company’s total proved reserves increased 313% to 3,021 BMOE (38% NGLs).

The net present value of those reserves also increased 120% to $38.5 million before tax using forecast prices and costs, discounted at 10%. Blackbird was able to double the net present value of its reserves despite the fact lower price forecast from the third-party reserves evaluator compared to the company’s last reserves evaluation.

Delineating the Elmsworth

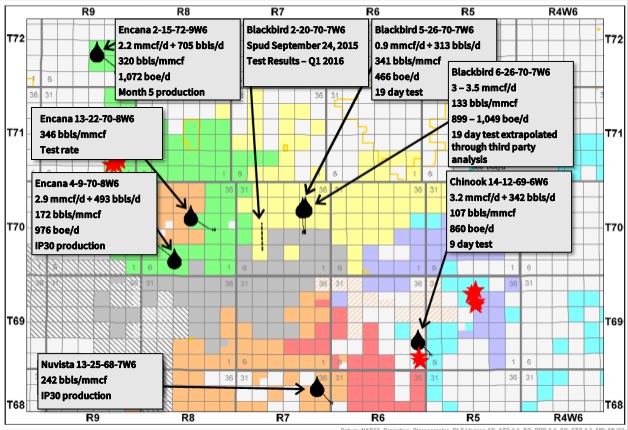

Blackbird has built up a substantial position in the Elmsworth play for relatively little capital. BBI’s 75 sections in the play was acquired for approximately $6.9 million, according to a company presentation.

The company has completed two wells targeting the Upper and Middle Montney, which confirmed liquids-rich production in the play. Blackbird’s 2-20 well produced 1,768 BOEPD (36% liquids) in a 24-hour test, beating its gas and BOE type curves by 109% and 80%, respectively.

“This is much more important than the BOE,” said Garth Braun, Chairman, President and CEO of Blackbird, to Oil & Gas 360®. “We believe it demonstrates the productivity of the Middle Montney throughout a minimum of 25 sections of our land. We’ve established the deliverability and the liquids component of the area, and with the near proximity drilling that was completed by Encana Corp. (ticker: ECA, www.encana.com) just to the west, we believe Blackbird has three distinct Montney intervals throughout those 25 sections.”

BBI management believes its delineated acreage holds four drilling locations per interval. With three intervals per section, that amounts to 12 wells per section and 300 wells total for its 25 delineated sections, which accounts for about one-third of Blackbird’s position.

In the company’s press release announcing its reserves increases, Blackbird also said it estimates drilling, completions, equipping and tie-in costs of approximately $7.25 million per location. These costs lower finding and development costs to $6.65/BOE on a proved plus probable reserves basis.

The company announced last month that it has acquired 5 MMcf/d of firm full path service on the Alliance Pipeline system to the Alliance Chicago Exchange Hub from October 1, 2016 to October 31, 2020 with renewal rights thereafter.

“The acquisition of firm transportation capacity in the Alliance Pipeline system for our sales gas allows Blackbird to now proceed with finalizing a firm sour gas processing agreement in addition to proceeding with our infrastructure buildout,” said Braun.

Blackbird presenting at EnerCom’s The Oil & Service Conference 14™

Blackbird Energy will be presenting tomorrow in San Francisco at the Le Méridien hotel as part of EnerCom’s The Oil & Service Conference 14™. Blackbird will be presenting at 2:30 PST.

The full-day agenda provides attending institutional investors, family wealth offices, private equity firms and high-net worth investors the opportunity to hear from publicly traded oil and gas management teams. Executives will present their company’s value proposition to a live and webcast audience of investment professionals.

Other public companies presenting at TOSC14 include:

- Core Laboratories – 8:30 a.m. Pacific Time (PST)

- Sanchez Energy Corp. – 9:00 a.m. PST

- Panhandle Oil & Gas – 9:30 a.m. PST

- PetroQuest Energy – 10:00 a.m. PST

- Resolute Energy – 10:30 a.m. PST

- Tamarack Valley Energy – 11:30 a.m. PST

- Evolution Petroleum – 1:30 p.m. PST

- Manitok Energy – 4:00 p.m. PST

- BetaZi – 4:30 p.m. PST

- Petro River Oil Corp. – 5:00 p.m. PST