Bellatrix Exploration Ltd. (ticker: BXE) is a Calgary-based E&P operating in the Western Canada Sedimentary Basin. Its main targets are the Cardium and Notikewin/Falher intervals located near Edmonton. The company was formed in 2009 through a plan of arrangement with True Energy Trust and now trades on both the Toronto Stock Exchange and the NYSE MKT.

Bellatrix was producing roughly 6.5 MBOEPD at the time of its founding in 2009, when the company was valued at approximately $440 million. In December 2013, the company purchased Angle Energy for $576 million. BXE’s progression in the field along with its sizable acquisition resulted in production more than tripling at year-end 2013. With new acreage in its portfolio and 1,251 identified drilling locations, Bellatrix projects its 2014 year-end rate to exceed 43 MBOEPD.

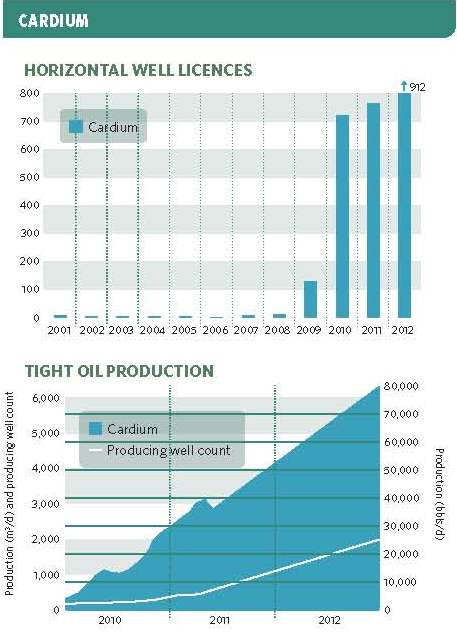

Source: Alberta Oil & Gas Industry

Cardium Snapshot

The Cardium is a tight oil play located in Alberta which consists primarily of sandstone. The formation has traditionally been difficult to access due to its depth and geology, but advances in technology and drilling techniques allows the industry to produce greater volumes in the Cardium that before.

“About five years ago, before we started drilling these horizontal wells in the Cardium, I believe the Cardium was down to about 15 MBOPD or less,” said Brent Eshleman, executive vice president of Bellatrix Exploration Ltd., in an interview with E&P Magazine. Current production in the Cardium is 155 MBOPD and continues to rise. “That’s what the technology has done,” Eshleman added.

With the use of hydraulic fracturing, the Cardium has become one of the most popular targets in Canada in a matter of years. According to a winter 2013 quarterly report by the Alberta Oil & Gas Industry, more than 2,300 horizontal well licenses were distributed between 2010 and 2012. Reserve estimates consist of as much as 15 billion barrels of oil, with 20% to 30% (3.0 billion to 4.5 billion barrels) believed to be recoverable. 2014 production is expected to average 172 BOPD – 13% higher than 2013 volumes. The estimates place potential resources per section at 6 MMBOE to 16 MMBOE, located at depths of roughly 4,000 feet to 9,000 feet. The light condensate also makes it attractive from a refinery and finance point of view.

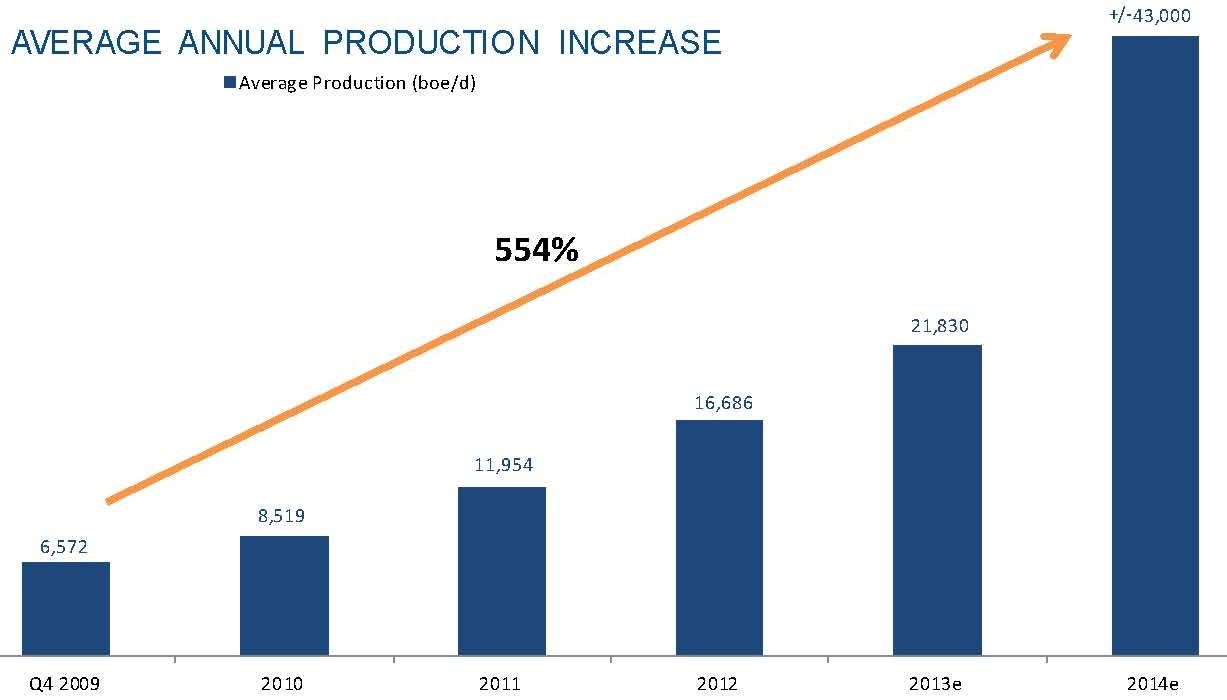

Source: BXE April 2014 Presentation

Bellatrix Growth

Bellatrix’s operations in the Cardium, its largest focus area, consist of a horizontal program with 742 identified net wells (37% of its total inventory). Its regional acreage has nearly quadrupled to 338 net sections from 81 net sections in Q4’09 – enough to rank BXE’s footprint as the second-largest in the area. The Cardium, as stated, is just more than one-third of BXE’s operations. Overall, the company believes its current inventory will last more than 40 years.

From its inception in 2009 to the end of fiscal 2013, yearly average annual production growth was 36%. The company expects growth of nearly 100% in 2014. Further, total reserves more than doubled in 2013 compared to 2012 after averaging yearly growth of 51% since the start of the company.

In its Q1’14 news release on May 6, 2014, BXE reported $1.7 billion in total assets and $84.3 million in cash flow ($0.49 per share). Cash flow for fiscal 2014 is forecasted to be $2.10 per share, which is 65% higher than fiscal 2013’s total of $1.27 per share. The company reported finding, development and acquiring costs at $9.67 per BOE, and has hedged an estimated 16.5 MBOEPD (38%) of production.

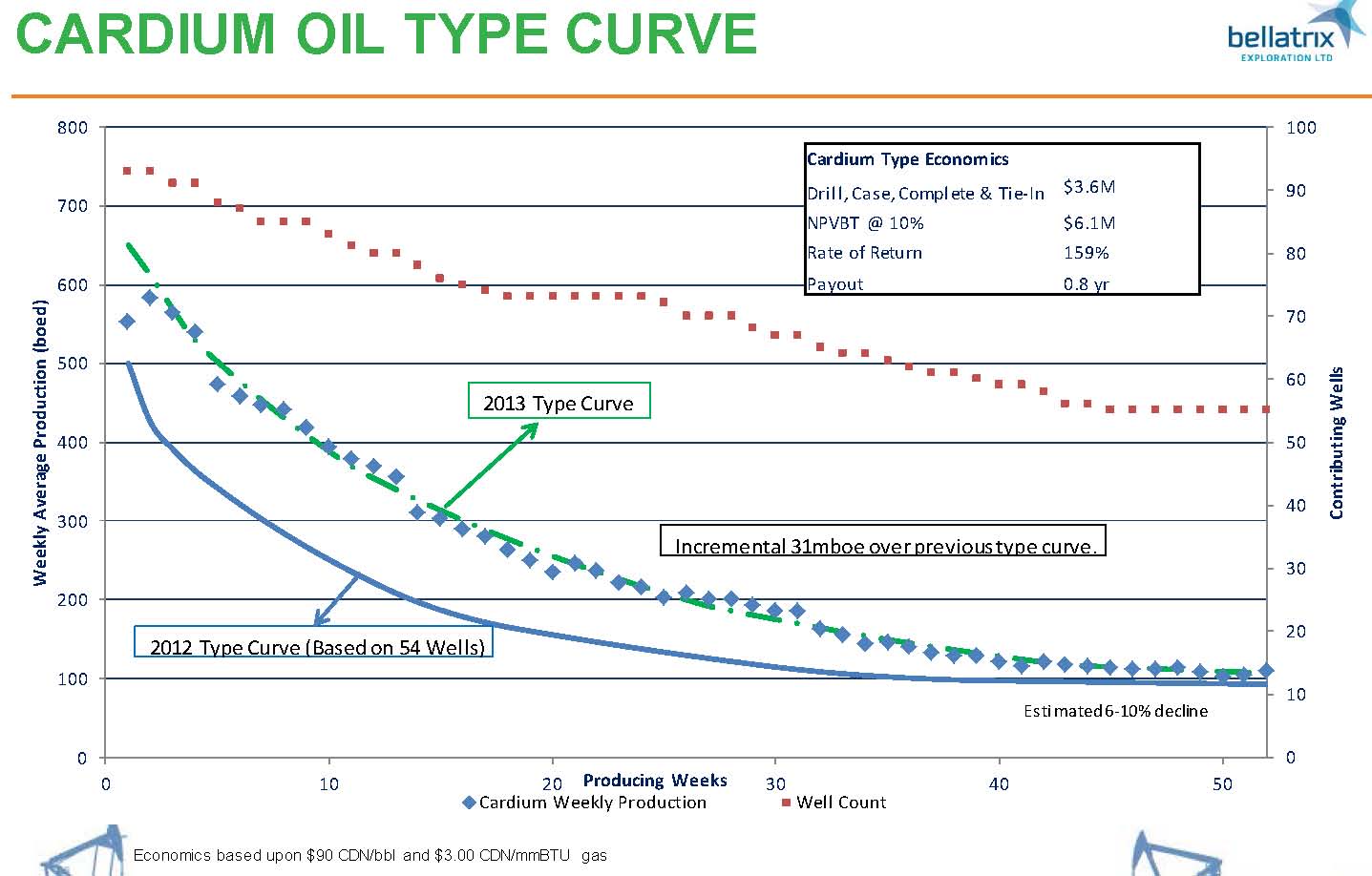

Source: BXE April 2014 Presentation

In addition, Bellatrix is increasing its efficiency and speeding up its rate of return. Its 2013 type curve represents an increment of 31 MBOE compared to type curves for the previous year and payouts are occurring in less than a year. Well costs are also just $3.6 million apiece.

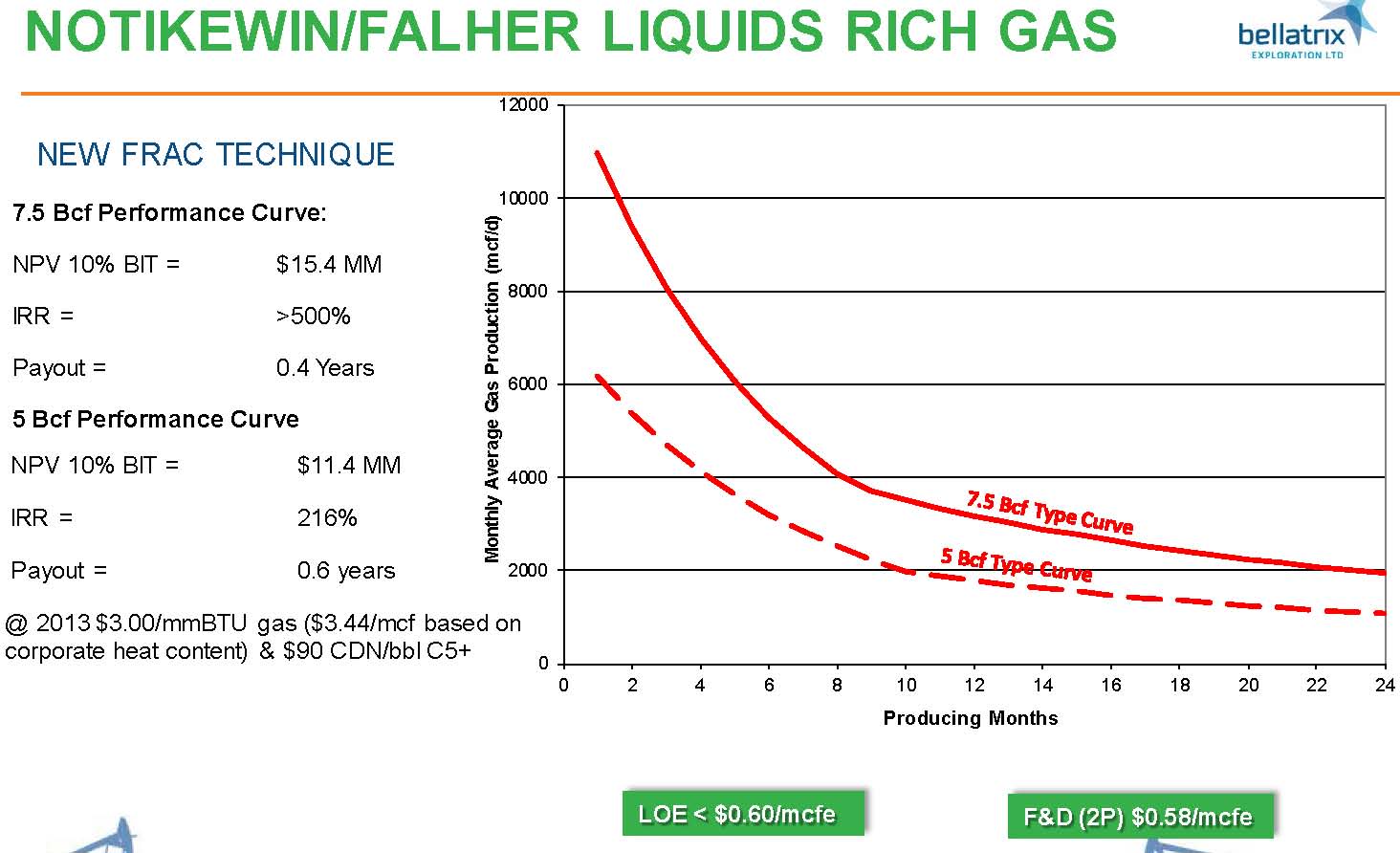

In the Notikewin/Falher intervals, a new fracturing technique has reduced payout times in as few as five to six months. The company is adding processing capacity to exploit the gas wells (roughly 77% gas) and has identified 381 locations.

Bellatrix’s Game Plan

The company said, due to its declining asset base, it relies on acquisitions and ongoing development to add to its resource base. Bellatrix exercised an over-allotment of notes on June 3, 2014, for proceeds of $172 million intended to pay down its outstanding debt of $473 million. Its credit facility increased to $500 million (nearly double the company’s previous facility) and its current debt is about 20%

Source: BXE April 2014 Presentation

higher than 2013’s total. Furthermore, BXE added processing projects that will, by 2016, add approximately 400 MMcf/d of processing capacity.

During a conference call in March 2014, Eshleman said: “The key operational strategy Bellatrix employs is to focus on full cycle profitability, indifferent to product type, with every investment decision. Bellatrix’s ability to reinvent ourselves and continuously apply new technology is one of the keys to being successful and a market leader. Our ability to be informed of these new technologies, understand their application and then try them in new ways allows us to increase deliverability and ultimate resource recovery. We focus for long-term success on our ability to manage, enhance and exploit our current assets while simultaneously developing new and potentially exciting plays in the Deep Basin for the future.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.