California conventional producer is unique

Berry Petroleum (ticker: BRY) announced second quarter results today, giving the investment world a first look at the U.S.’s newest mid-cap E&P. Berry Petroleum went public in late July, so this is the first quarterly results Berry has published as a public firm.

Berry reported a net loss of $34 million, or ($0.84) per share in Q2, compared to earnings of 6.7 million in Q2 2017. After adjusting for derivative losses and other special charges, the company earned $9.2 million in Q2, almost exactly in line with adjusted earnings from Q1.

Many differences between Berry and shale producers

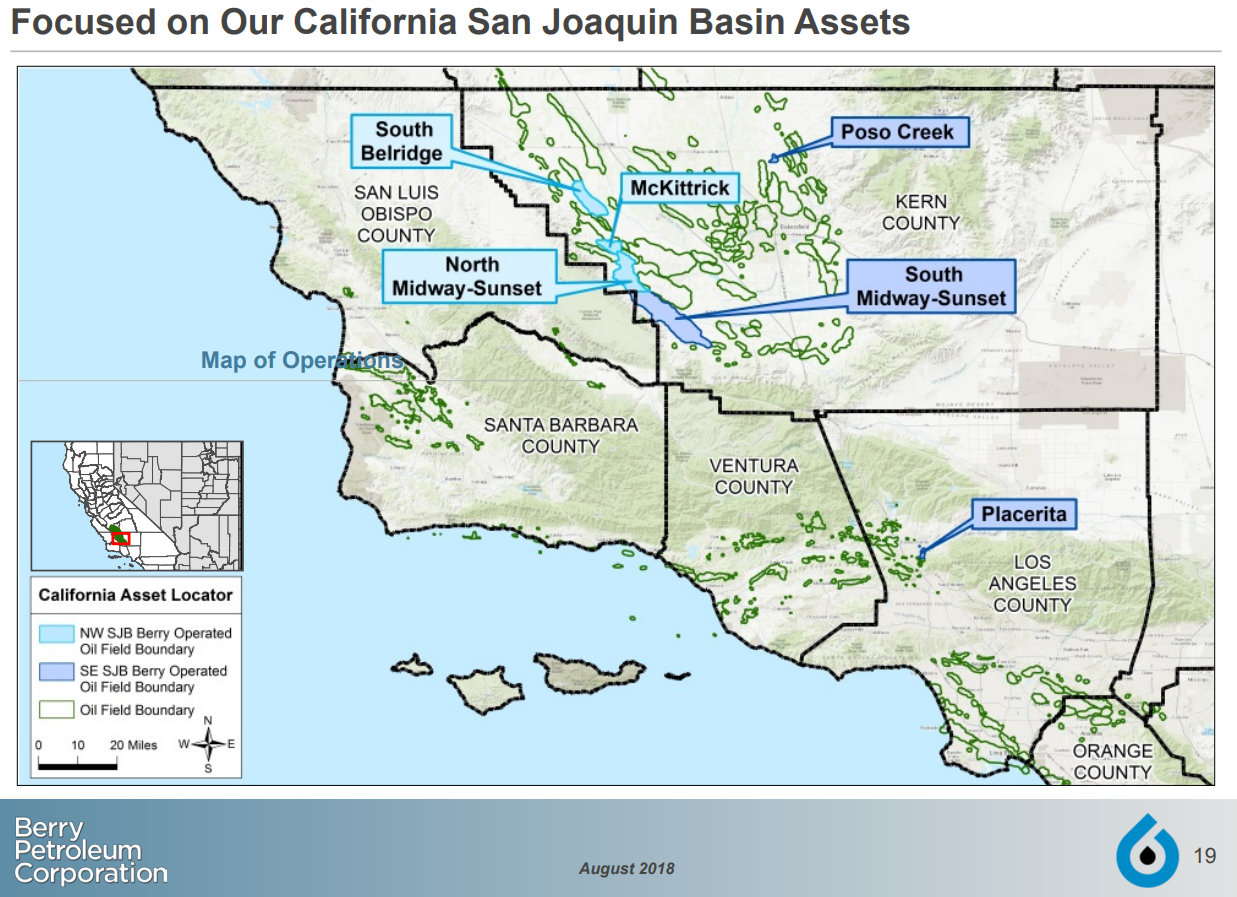

Berry Petroleum is rather unique among major U.S. E&P companies, it is wholly an onshore conventional producer. The company holds assets in California, Utah and Colorado, but its primary focus is on its California properties.

The company holds about 8,000 acres in California, a number that appears small when compared to most shale producers. However, this is because Berry is producing from conventional assets, which almost never have the extent of shale plays. Instead of covering hundreds of square miles, most conventional fields are compact.

The company is currently producing 18.8 MBOEPD from its California properties, primarily from the west side of the San Joaquin basin. Like the Permian, the San Joaquin basin has been producing since the early days of the U.S. oil industry. First commercial production from the San Joaquin began in 1887, making the basin even older than the Permian.

Despite this age, however, Berry reports that there are still significant drilling opportunities available in the basin. The company has identified nearly 5,000 gross drilling locations on its acreage, over 18 years of inventory based on current drilling rates.

Most of these wells utilize thermal oil recovery, which involves injecting steam to heat the oil, making it mobile enough to flow. Wells that do not need steam injection will be hydraulically fractured, though likely not to the extent seen in U.S. unconventional operations.

These wells are much smaller affairs than the large horizontals seen in the Permian or Bakken, Berry reports that gross CapEx per well is typically less than $1 million.

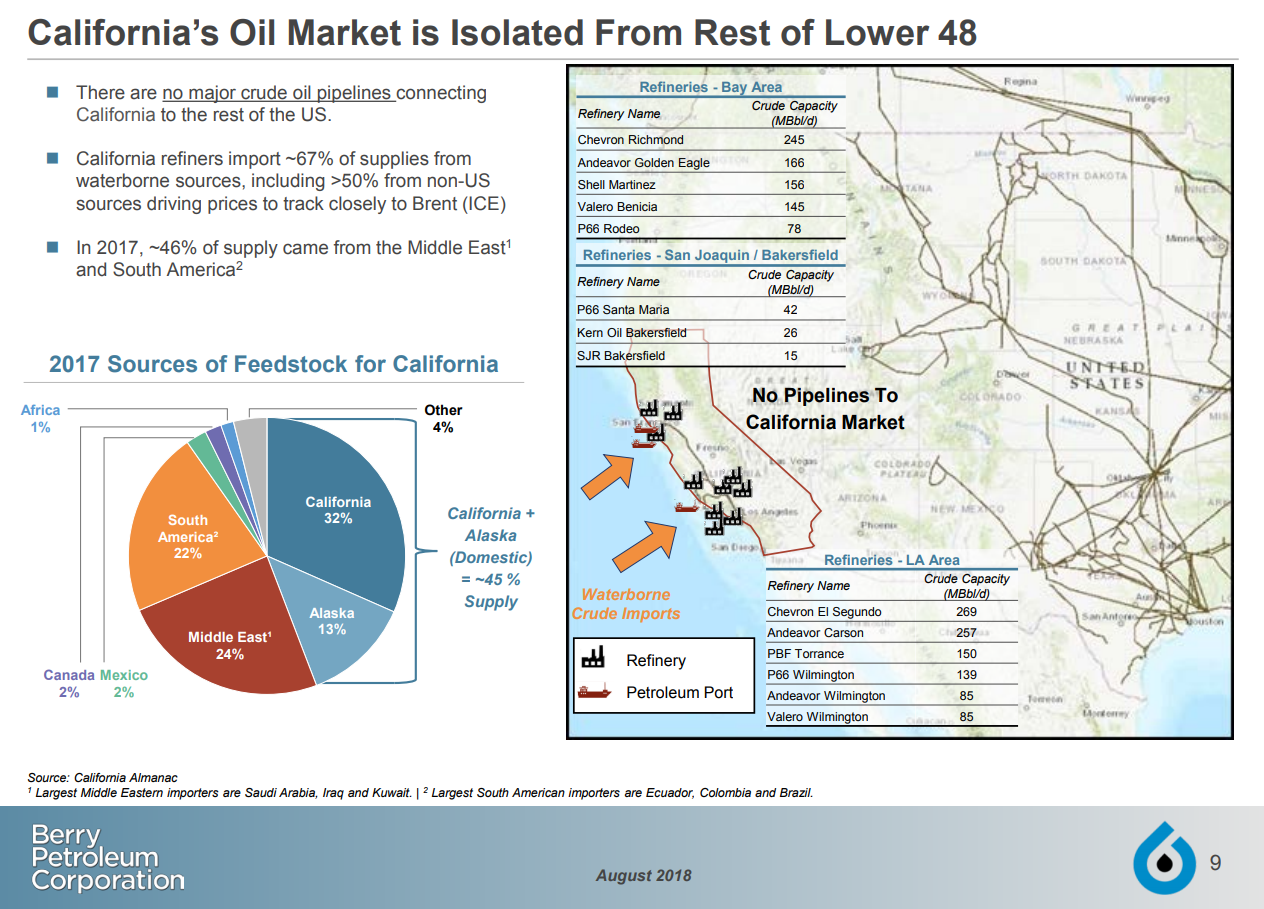

An additional unique aspect of Berry’s operations is its oil pricing. The company-realized prices are much more related to Brent than WTI, as the California oil market is relatively separate from the market east of the Rockies. The company also has minimal takeaway concerns, as it directly supplies Californian demand.

Trem Smith, Berry president and CEO commented on the company’s quarterly results, saying “We are pleased to report Berry’s 2018 second quarter financial and operational results – our first such report as a public company. Our second quarter results reflect the company’s strategy of being oil focused and growing our value and production while operating within levered free cash flow today and into the future. We are starting to see the expected quarter over quarter production growth. We expect this growth to continue as we invest in our existing, growing inventory of opportunities. Also, our Board approved our first regular quarterly dividend which demonstrates our commitment of returning capital to our shareholders. I am excited that Berry is now public, so the market can see the strength of our assets and our ability to focus on what we do best including our ability to execute our plan.”