$210 million in 2019 spending

By Richard Rostad, analyst, Oil & Gas 360

Berry Petroleum (stock ticker: BRY, $BRY) announced fourth quarter results and reserves today, showing net earnings of $131.8 million, or $1.56 per share. This is the best single-quarter result Berry has recorded in its short history as a public company, though it was improved by derivatives. If these and other charges are excluded, Berry earned an adjusted $35 million in Q4.

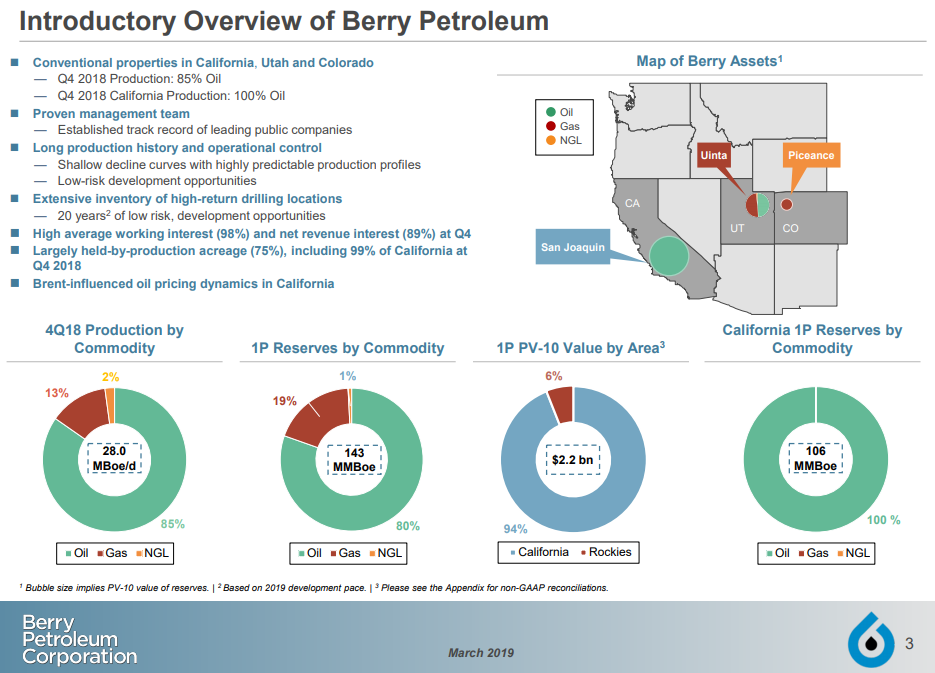

Berry produced an average of 28 MBOEPD in Q4, up slightly from the 27.4 MBOEPD the company produced last quarter. Berry produced 27 MBOEPD in the year. Berry is almost alone in the U.S. public E&P space, as the company is focused on Californian production. The company’s California operations, which only produce oil, account for about 78% of Berry’s overall output, with the remainder coming from gas-focused legacy assets in the Uinta and Piceance.

9% production growth planned

Berry has updated its 2019 guidance, pulling back spending and growth expectations after the Q4 drop in oil prices. Berry now expects to spend about $210 million in 2019, down 14% from previous forecasts. This drop in CapEx sacrifices only 3% of production, and Berry now expects to produce about 29.5 MBOEPD in 2019. This represents 9% production growth, though all this growth will likely come from the company’s California operations.

2019 CapEx exclusively for California

Berry has cut all Rockies spending for the year, all CapEx will go towards Californian drilling. About 12% of 2018 spending funded the company’s Rockies activity, so fully focusing on California is not a significant change.

Berry estimates its levered free cash flow will exceed CapEx in 2019, with free cash funding the dividend, share repurchase program and balance sheet maintenance.

Berry’s Californian wells are very different from the average unconventional well. Berry reports its new 2018 wells cost between $300,000 and $500,000 per well, a fraction of the average unconventional well. However, these wells have much lower peak production rates, with an average rate below 75 BOEPD.

Q&A from BRY conference call

Q: A question on the stock buyback plan here. So, clearly in your prepared comments you guys stated that part of the rationale was to offset some of these shares that had to be issued in some of these I guess bankruptcy claims here that were getting resolved. Just wanted to kind of clarify. So, at this point have all the prior bankruptcy claims, is that sort of behind us? Will there no longer be any further potential for stock issuance sort of under that? I wanted to kind clarify of that and you clearly made some comments as well, with free cash flow gives you guys the optionality of potentially spending a little bit more money, maybe boosting the dividend, maybe adding the stock buyback. Can you maybe kind of talk about maybe what your preference would be these days, kind of between those three options?

BRY: The bankruptcy is completely behind us and the bankruptcy shares have all been resolved. So, no more shares be issued underneath that. So, check another box and get the past behind us. So it’s great. I think again looking at returning shareholder value, obviously the dividend is extremely important to us. I think it shows our understanding of the lifecycle and the cash flow generation capability of the assets. But the other thing is the share repurchase, we didn’t just buy just because of the dilution coming out there. We bought it because we also knew the stock was extremely cheap to the cycle. And so if we see another situation that happens then we’re going to do what’s right for and what we think the company and the greatest value to our shareholders on.

Q: I guess just with respect to the regulatory side I guess you guys did mention that you may have a couple delays. That sounds like that more effective than my side of the business. You also talked about having two months of permits on hand for rig wanting to sort of increase that as the new governor in place over there in California. Can you maybe just give us a little bit more color around the regulatory landscape? Is there a pathway to kind of build the months of permits there were there kind of any slowdown as a result of any transitions in government or kind of things getting better? Can you kind of tell us about the regulations?

BRY: So just specifically back on permits again, the drilling permits have not been interrupted. There’s the change of government has not done anything there. We’re two months in advance of each of our rigs which is typically where we like to be if not more. And quite frankly we’re looking to even gaining some inventory there as well.

So on that side again, there’s no issue. The only tiny issue we had specifically was in and around some of the simulation permits that we need for the [indiscernible] (52:47) as you correctly mentioned. We’re working with the agency there to understand the timeframe necessary and that’s truly what the question comes down to so that we can plan accordingly. And I think we’ve mentioned before once we understand that and feel comfortable with it, we’ll be able to plan a little bit stronger in and around that particular development. Obviously we like that area and we’ll continue to go down that path and ultimately get it to where we feel like we can forecast it within the range of everything else that we have in our inventory.

BRY: I just want to reiterate that when we took over leadership in 2017, we’ve had a very strong focus, Leo, on what we call the Berry first approach. So we have developed significant working relationships, personal working relationships, with all the regulators, trying to understand, making sure they knew who we were, what the new Berry was, and making sure they knew how much we respected them and understood their drivers. I think that relationship is continuing to improve and we’re starting to see the results at all levels, from my level down through the working level. And we do that obviously in California, spend a lot of time in Sacramento and downtown Bakersfield, the current county administration and all those stakeholders. We also do it obviously in Colorado and Utah and it’s a significant effort.