Markets reward companies making good transactions, but sometimes even the Permian can’t move the needle

The most recent downturn in oil and gas prices has forced the industry to find the most economic acreage available in order to generate returns and attract investors. It’s no secret that for many companies, that has meant buying Permian acreage, particularly the stacked zones in the Delaware which has seen a flood of capital over the last year as companies look to buy into what is often thought of as the most attractive acreage in the United States.

Over the course of the last year, several companies have spent north of $30,000 per acre to acquire land in the Delaware, considerably more than other plays throughout the U.S., but investors continue to award companies that are able to get a foothold in the basin. By benchmarking energy companies’ stock performance against the NYSE ARCA Oil & Gas Index (XOI) three trading days prior and proceeding a deal, EnerCom Analytics was able to gauge market sentiment on a number of M&A transactions in 2016 and early-2017 for its February Energy Industry Data and Trends to decide which deals the markets found most attractive.

Unsurprisingly, deals done in the Delaware and larger Permian often elicited positive reactions from the market, but this was not true 100% of the time, and perhaps more interestingly, the deal that showed the strongest positive market reaction of those examined by EnerCom did not take place in the Permian at all.

The Permian often get the nod from investors

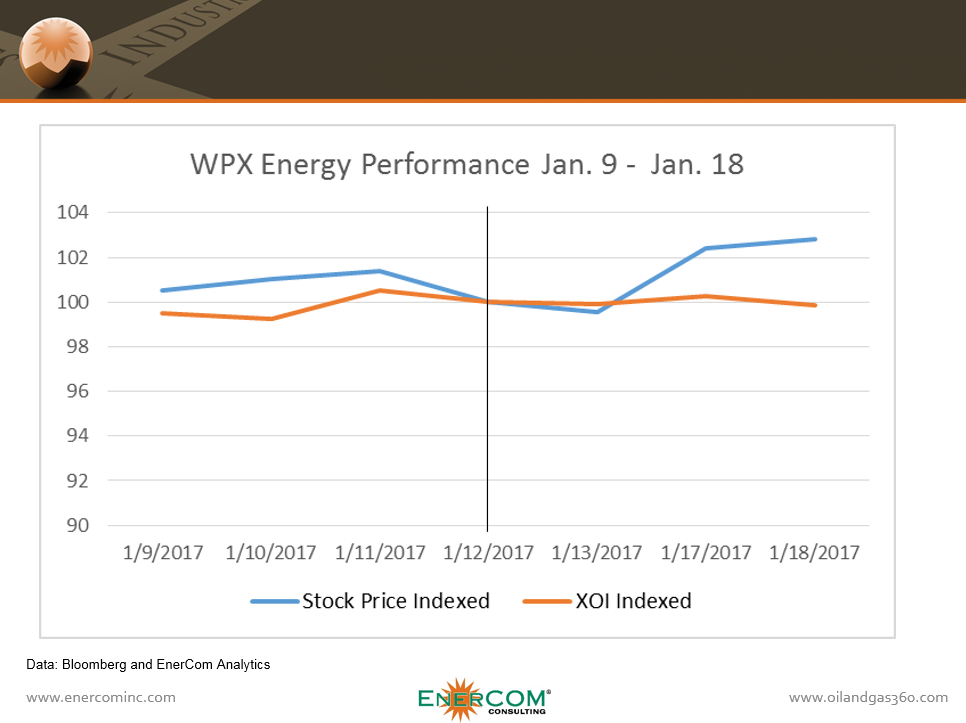

On January 12, 2017, WPX Energy (ticker: WPX) acquired Panther Energy Company II, LLC and Carrier Energy Partners, LLC, expanding its footprint in the Delaware Basin by approximately 18,100 net acres. WPX was outperforming the XOI in the days leading up to the deal but realized an even more substantial gain following the Delaware acquisition.

Including the Panther transaction, WPX has added approximately 32,000 net acres in the core of the Delaware Basin at an average cost of $18,600 per acre (excluding flowing production) since its purchase of RKI Exploration and Production in August 2015, which marked a shift in focus to the Delaware.

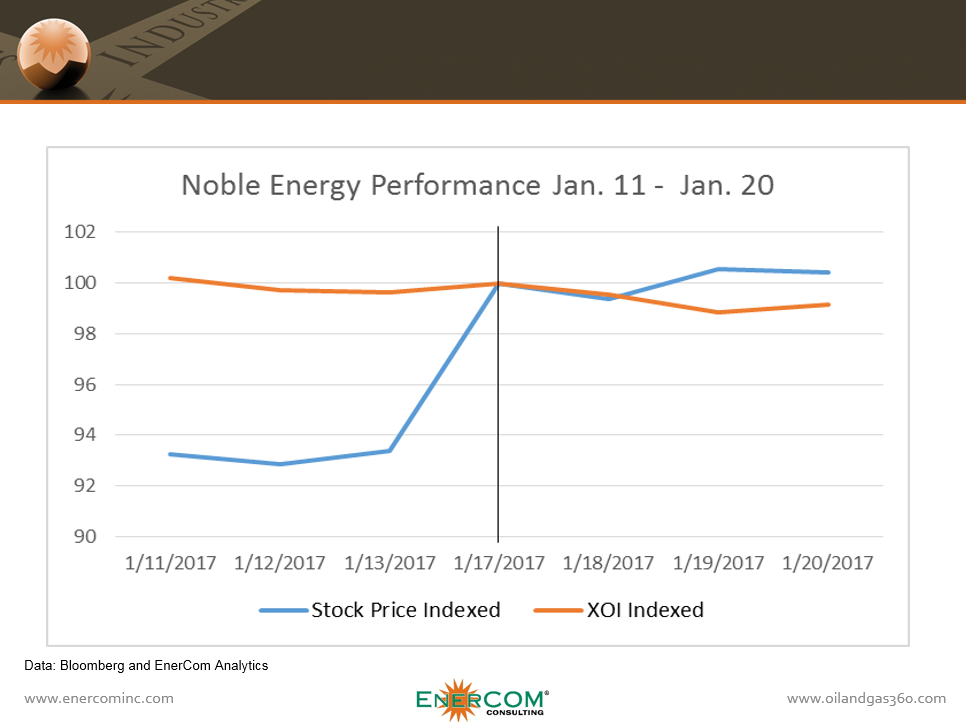

Five days after the WPX deal, Noble Energy (ticker: NBL) announced the corporate acquisition of Clayton Williams for $3.2 billion, $2.0 billion of which was covered by Noble common stock. The combined company has more than 4,200 drilling locations on approximately 120,000 net acres in the Delaware Basin, making Noble one of the largest operators in the area.

Noble was performing well below the XOI leading up to the deal on January 17, 2017, but began outperforming the benchmark index in the days that followed.

But sometimes even the Permian can’t move the needle

While the market reaction to the majority of Delaware Basin acquisitions, sometimes even buying into the premier U.S. basin was not enough to move stock prices higher.

ExxonMobil (ticker: XOM) announced the acquisition of companies owned by the Bass family of Fort Worth, Texas, on the same day as the Noble deal, more than doubling the size of the company’s Permian footprint. Despite being a large Delaware Basin acquisition, ExxonMobil’s share price went a leg lower compared to the XOI two days following the deal, before coming back to about the same performance the company saw leading up to the deal.

When talking about a company like ExxonMobil, even a 250,000-acre acquisition in the Delaware is not always enough to significantly move the needle on stock price. Another important point to consider is that, while Exxon purchased a significant chunk of Delaware assets, they are located outside of what is considered the core of the basin, whereas Noble’s acquisition was primarily in Reeves County, at the heart of the play.

Sometimes you don’t need the Delaware at all to make a splash

Given the mad dash to the Delaware Basin, it is not surprising that the companies that are able to execute on M&A in the region are often seeing strong stock performance compared to the rest of the market, but in the deals that EnerCom analyzed for this report, the deal that had the largest positive effect took place, not in the Permian, but the Eagle Ford.

Sanchez Energy Corporation (ticker: SN) and funds managed by Blackstone Energy Partners entered into a strategic 50/50 partnership and signed a definitive purchase agreement to acquire Anadarko Petroleum Corporation’s working interest in approximately 318,000 gross operated acres in the Western Eagle Ford for approximately $2.3 billion on January 12, 2017.

The surging prices in the nearby Delaware left a lot of room to execute on deals in other plays, and Sanchez reaped the rewards of focusing on the Eagle Ford as opposed to the Permian. The deal established the company as an Eagle Ford operator with strong assets in large volume. The company said the drilled uncompleted (DUC) well inventory alone amounted to 132 wells with IRRs in excess of 100%, with current production of 67 MBOEPD and 20 years of additional, economic, drilling inventory at January strip pricing, according to the company.

Sanchez had been performing relatively in-line with the wider XOI benchmark leading up to the deal but outperformed by more than 50% in the three days that followed their announcement even as the XOI’s performance stayed flat.

The Permian has become an increasingly expensive play to buy into as capital rushes in the region. Comparing the per-acre price of deals in 2013 and early-2014 — when oil prices were at their peak — to 2016, Permian deal prices have skyrocketed more than 25x despite the decline in the value of oil.

Markets are willing to give a premium to companies in the Permian, but the high cost of entry does leave a lot of room for companies to execute in other plays to great effect, much the way Sanchez did in the Eagle Ford.

The role of equity in M&A and the health of the market

In addition to deal metrics from other basins, EnerCom’s February Energy Data and Trends covered the role of equity financing in M&A transactions over the last year, and what those deals say about the health of the larger market. To learn more about EnerCom’s monthly report and benefit from the full industry insight available each month from the professionals at EnerCom, click here.