Second attempt for BHP

Australian mining giant BHP Billiton (ticker: BBL) put out its nine months operational review today, which included a review of its shale portfolio and the statement that it might put its Fayetteville assets on the block again.

“The Fayetteville field is currently under review and we are considering all options including divestment,” the company said in a press release.

The company tried to sell its Fayetteville assets in 2014 without success.

Comments from BHP Billiton CEO Andrew Mackenzie in today’s nine month operations recap included the following: “We continued our targeted high-return investment in shale with the approval of two more rigs in the Haynesville supported by our hedging strategy.

“Plans to monetize a portion of our non-core acreage for value, such as parts of the southern Hawkville, are underway.

“In the Eagle Ford, we are increasing recoveries by testing staggered wells and larger frac jobs.

“In the Permian, we are exploring opportunities to consolidate and optimize our acreage position so that we can drill longer lateral wells to lower costs.

BHP highlighted its oil and gas activity during the recent quarter and nine months:

- In February 2017 the board approved an investment of US$2.2 billion (BHP Billiton share) for the development of the Mad Dog Phase 2 project in the deepwater Green Canyon area in the Gulf of Mexico. The project includes a new floating production facility with the capacity to produce up to 140,000 gross barrels of crude oil per day at an estimated cost of US$9 billion (US$2.2 billion BHP Billiton share). This project has now been sanctioned by all joint venture partners.

- BHP executed the contract with Pemex to acquire a 60 per cent participating interest in, and operatorship of, the Trion discovery in Mexico in March 2017.

- In Petroleum exploration, following positive drilling results at the LeClerc well in Trinidad and Tobago, commercial evaluation of the gas discovery is well advanced.

- Drilling of the Wildling appraisal well in the Gulf of Mexico is continuing with results now expected in the September 2017 quarter, which will assist with establishing the scale of the Caicos oil discovery.

- The Bass Strait Longford Gas Conditioning Plant was fully commissioned during the March 2017 quarter and is now running at design capacity, enabling full production from the Turrum and Kipper fields.

- At the end of the March 2017 quarter, BHP Billiton had three major projects under development in Petroleum and Potash, with a combined budget of US$5.1 billion over the life of the projects.

- Petroleum capital expenditure guidance of approximately US$1.4 billion (excluding US$0.2 billion from capital creditor movements) for the 2017 financial year remains unchanged. This includes conventional capital expenditure of US$0.8 billion which is focused on life extension projects at Bass Strait and North West Shelf, along with commitments related to the recently approved Mad Dog Phase 2 project.

- Onshore U.S. capital expenditure is expected to be US$0.6 billion, with development activity tailored to market conditions.

- Petroleum exploration expenditure for the nine months ended March 2017 was US$590 million, of which US$263 million was expensed. Guidance of US$820 million remains unchanged for the 2017 financial year.

Oil and gas production for the nine months ended March 2017

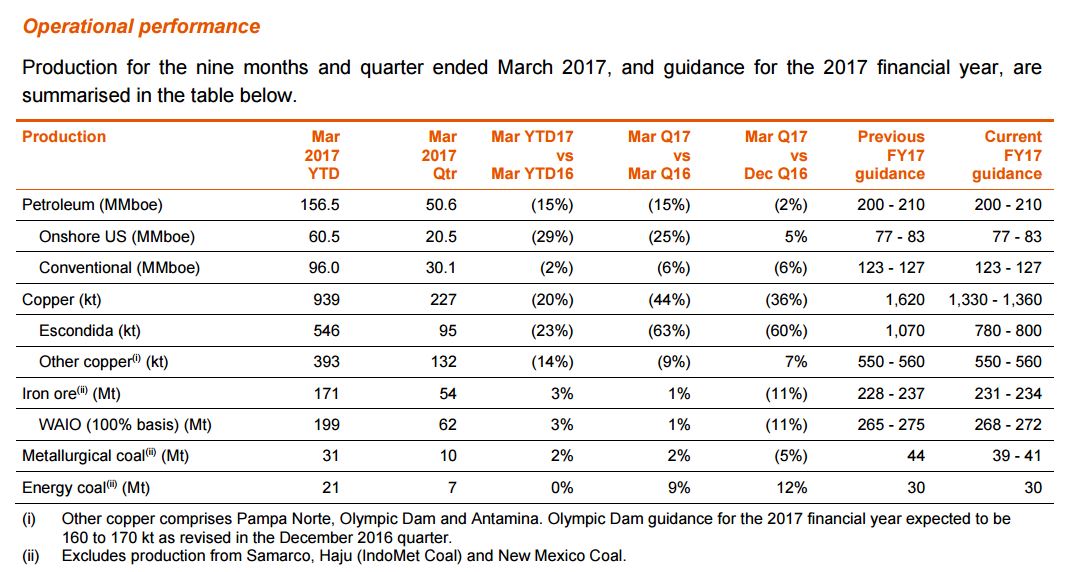

Total petroleum production for the nine months ended March 2017 decreased by 15 per cent to 156.5 MMboe. Guidance for the 2017 financial year remains unchanged at between 200 and 210 MMboe, comprising conventional volumes between 123 and 127 MMboe and onshore U.S. volumes between 77 and 83 MMboe.

Liquids production

Crude oil, condensate and natural gas liquids – Production for the nine months ended March 2017 decreased by 19 per cent to 73.0 MMboe.

Onshore US liquids volumes decreased by 33 per cent to 25.9 MMboe as a result of a reduction in activity in the Black Hawk for value, and natural field decline at Hawkville, which more than offset increased liquids production from the Permian.

Conventional liquids volumes decreased by eight per cent to 47.1 MMboe, as an additional infill well at Mad Dog and higher production at Algeria and North West Shelf partially offset planned maintenance at Atlantis and natural field decline across the portfolio.

Natural gas production

BHP said its natural gas production for the nine months ended March 2017 declined by 12 per cent to 501 Bcf.

The decline primarily reflects lower onshore U.S. gas volumes as a result of the value driven decisions to defer development activity and the divestment of our Pakistan gas business in December 2015. This was partially offset by higher demand at Bass Strait and Macedon, and increased LNG volumes at North West Shelf,” the company said.

U.S. onshore recap

BHP said onshore U.S. drilling and development expenditure for the nine months ended March 2017 was approximately US$440 million.

During the March 2017 quarter, BHP said operated rig count remained at three, with the second approved rig in the Haynesville expected to commence operation early in the June 2017 quarter.

Development activity is increasing with the approval of two further rigs in the Haynesville in this quarter, with gas prices hedged and supply contracts secured to deliver attractive rates of return. Operations are expected to commence in the September 2017 quarter.

Accelerated completion of drilled and uncompleted inventory in the Black Hawk has led to higher oil volumes in the March 2017 quarter. Tests continue on the potential for staggered wells to increase recovery, larger frac jobs to improve productivity and the potential of the Upper Eagle Ford horizon. We expect early results to be known during the September 2017 quarter.

Planning EOR in the Eagle Ford

Planning for enhanced oil recovery trials is also ongoing to drive the improvement of liquids recovery in the Eagle Ford.

Permian/Delaware

The optimization of Permian acreage has progressed through trades and swaps in the Delaware Basin. Further potential of our Permian acreage is being evaluated through a series of completions trials.

We are working with joint venture partners in the Fayetteville to assess the potential of the Moorefield horizon.

Fayetteville/Hawkville

We have initiated the divestment of non-core acreage for value. The sale of up to 50,000 acres in the southern Hawkville is well advanced, with bids received and under evaluation, BHP reported.

Our Fayetteville acreage is currently under review and we are considering all options including divestment.

Since our entry into onshore U.S., we have made significant advances in our operating capability and capital productivity which underpin the development of these fields at the optimal pace as prices recover.

“Having initially invested for growth, we have learnt from experience and our value over volume strategy, combined with strict adherence to our capital allocation framework and use of a hedging strategy to mitigate downside risks, ensures that every decision is focused on generating shareholder value.”

Shale history: BHP acquires U.S. shale in 2011

BHP got the industry’s attention in 2011 when it made a $20 billion deep dive into the U.S. shale scene, acquiring Petrohawk Energy and its Eagle Ford, Haynesville and Permian assets for US$15.1 billion and buying Chesapeake Energy’s Fayetteville unconventional gas assets for US$4.75 billion.

BHP said the Petrohawk transaction gave it operated positions in “the three world class resource plays of the Eagle Ford and Haynesville shales, and the Permian Basin.

“Petrohawk’s assets cover approximately 1,000,000 net acres in Texas and Louisiana, with estimated 2011 net production of approximately 950 million cubic feet equivalent per day (MMcfe/d), or 158 thousand barrels of oil equivalent per day (Mboe/d). At year-end 2010, Petrohawk reported proved reserves of 3.4 trillion cubic feet of natural gas equivalent (Tcfe). The company has a current non-proved resources base of 32 Tcfe for a total risked resource base of 35 Tcfe,” BHP said in its press release.

Here is how BHP described the Chesapeake assets in its February 2011 press release:

“Chesapeake’s Fayetteville shale assets include approximately 487,000 acres of leasehold and producing natural gas properties located in Arkansas, USA. This is the second largest position in one of the largest gas fields in the world. This acquisition will increase BHP Billiton’s net reserve and resource base by 45 per cent. These assets currently produce over 400 million cubic feet of gas per day and include development options that will support substantially higher production over a 40 year operating life.”

The company had previously tried to sell its Fayetteville assets in late 2014, but ended up without a deal. Gas prices had dropped to $2 per Mcf. BHP announced later it would retain the assets, but it trimmed CapEx for development in the Fayetteville throughout 2015.