Mining giant BHP Billiton looks to capitalize on long-term oil market recovery —its highest margin business—with “value over volume” energy strategy

Even as oil prices fight their way back to a $50 per barrel level and mining companies like Freeport McMoRan (ticker: FMX) look to exit oil and gas, miner BHP Billiton (ticker: BHP) says that it plans on oil being a pillar of its business moving forward. Declining costs and future demand have BHP’s management hopeful that oil will remain a profitable part of their business.

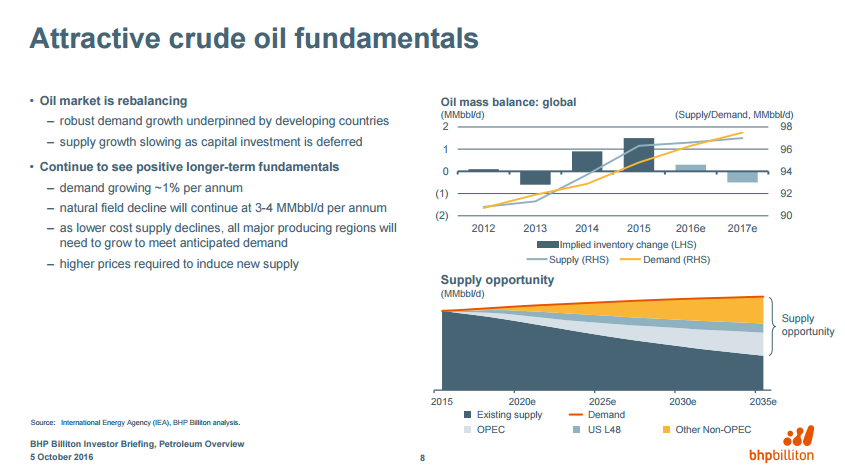

“While currently well supplied, underlying fundamentals suggest both oil and gas markets are improving more quickly than our minerals commodities,” said BHP Billiton President of Operations Petroleum Steve Pastor, in a company press release.

“Over the next decade, demand growth, natural field decline and the effects of industry wide investment deferrals are expected to create a significant opportunity to invest and maximize value in oil. By 2025 the world is expected to consume more than 100 million barrels of liquids per day – a third of which would come from new sources.”

In August, BHP recorded its worst annual loss to date, with weak oil and natural-gas markets one of the biggest weights on its bottom line. BHP’s petroleum business incurred a loss of $7.7 billion after write-downs linked to U.S. shale assets BHP acquired in 2011. Despite that, the world’s largest mining company remains certain that oil and gas will be a key source of income.

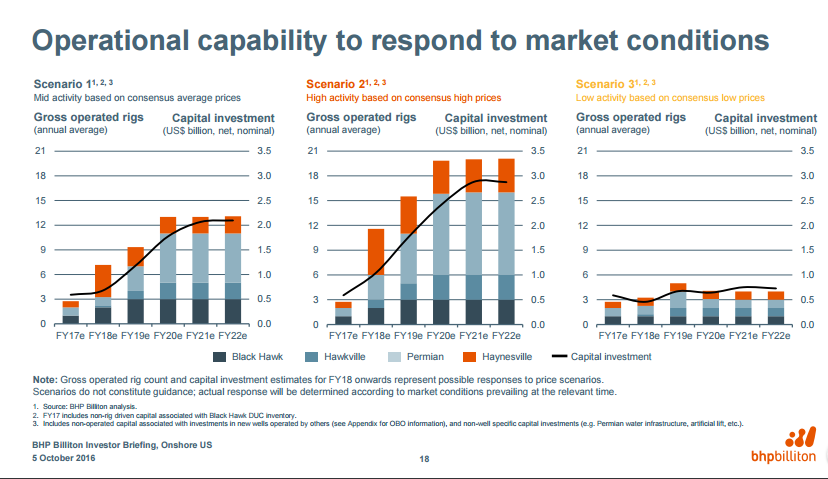

BHP Billiton runs its Onshore U.S. assets to maximize value rather than volumes and it will continue to adjust its investment plans to reflect market conditions, the company said in its presentation.

“Our Onshore U.S. business gives us valuable flexibility. Our shale assets generate cash at current prices, with significant upside should oil and gas prices recover as we expect,” Pastor said.

“We operate in the heart of some of the best shale plays and by further reducing costs and improving capital efficiency to levels among the best in the industry, we have increased our investible well inventory. As a result, we now have up to 1,200 undrilled net oil wells, contingent upon trials in the Eagle Ford, and 220 undrilled net gas wells that generate a minimum 15% internal rate of return (IRR) at $50 per barrel of oil and $3 per MMbtu.”

Interestingly, BHP’s commodities price numbers seem prophetic. WTI traded above $50 much of today after an arduous journey back to that level during the past few months, and natural gas is presently trading at $3.03.

Pastor said the company may even consider acquisitions, but “it has to be at the right price and it has to play to our strengths,” he said.

BHP looks to hold on to oil as others cut and run

BHP’s commitment to its oil and assets stands in stark comparison to fellow mining giant FCX, which has struggled to find a buyer for its oil and gas assets after prices dropped and the company was left with $20.8 billion in debt after acquiring its oil and gas assets.

The company has been able to make small sales of its onshore assets to Black Stone Minerals, and more recently, .

“We are well placed to capitalize on this opportunity,” said Pastor. “We have a large, high quality resource base. Our focus on productivity has significantly reduced both operating and capital costs, supporting a range of shale and conventional investment opportunities that would generate compelling returns at today’s prices. As a result, petroleum is well placed to maintain its position as BHP Billiton’s highest margin business and to grow its free cash flow contribution.”

On the mining side, the company’s Americas division includes projects, operated and non-operated assets in Canada, Chile, Peru, United States, Colombia and Brazil that focus on copper, zinc, iron ore, coal and potash. In Australia BHP has operated assets in Western Australia, Queensland, New South Wales and South Australia that mine copper, iron ore, coal and nickel. BHP is headquartered in Melbourne, Australia.