Bloomberg reported last week that Goldman Sachs, Societe Generale SA and BlackRock all see natural gas staying in the $4.00 – $5.50 range for the next 10-20 years. “Rising U.S. shale gas production is driving fear out of the futures market, says Goldman Sachs Group Inc., and will constrain prices for the next two decades,” Bloomberg reported.

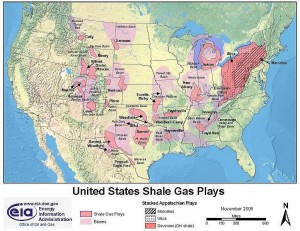

Steadily growin g domestic natural gas production, largely from the proliferation of horizontal drilling throughout North America’s shale basins, combined with new infrastructure to move the gas to customers—more pipeline capacity coming on line—are two key factors bringing stability to natural gas prices.

g domestic natural gas production, largely from the proliferation of horizontal drilling throughout North America’s shale basins, combined with new infrastructure to move the gas to customers—more pipeline capacity coming on line—are two key factors bringing stability to natural gas prices.

Conventional gas such as that from the Gulf of Mexico’s offshore fields has been dwarfed by onshore shale gas production. Gas produced from production platforms serving wells in the Gulf of Mexico are vulnerable to severe weather events such as the damage and supply interruptions inflicted by hurricanes Katrina and Rita in 2005.

Since the shale boom began a decade ago, development of improved drilling and completion techniques such as hydraulic fracture stimulation and horizontal drilling have unlocked access to vast new natural gas supplies. U.S. shale deposits, particularly gas with high liquids content, have become the most prolific targets for natural gas explorers and producers. Offshore gas has dropped to 5% of U.S. gas supply for 2013, down from 17% in 2005, Bloomberg reported.

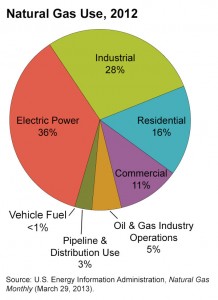

Shale has already delivered big benefits to the U.S. For one, it is fueling cheap, reduced-carbon baseload electricity (natural gas emits approximately half the carbon dioxide as coal-fueled electricity) that is powering U.S. businesses and residential customers. Two, it is delivering prosperity to the citizens in states where it is being drilled and produced. Three, it is bringing long term stability to the U.S. natural gas market and the industries it fuels. Predictable fuel costs over the long term (at levels predicted to remain between $4-$5.50 per MMBtu) breed confidence in the industrial sector—electricity providers can better predict rates and manufacturers, fertilizer, chemical companies, and other large industrial users of natural gas can more reliably forecast costs and plan for growth.

Shale has already delivered big benefits to the U.S. For one, it is fueling cheap, reduced-carbon baseload electricity (natural gas emits approximately half the carbon dioxide as coal-fueled electricity) that is powering U.S. businesses and residential customers. Two, it is delivering prosperity to the citizens in states where it is being drilled and produced. Three, it is bringing long term stability to the U.S. natural gas market and the industries it fuels. Predictable fuel costs over the long term (at levels predicted to remain between $4-$5.50 per MMBtu) breed confidence in the industrial sector—electricity providers can better predict rates and manufacturers, fertilizer, chemical companies, and other large industrial users of natural gas can more reliably forecast costs and plan for growth.

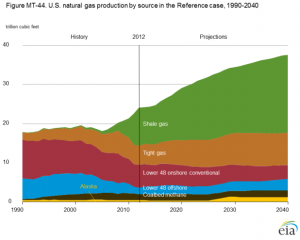

Most who study the energy industry agree that shale gas is here for the long term. In its Annual Energy Outlook 2014, the EIA predicts “a 56% increase in total natural gas production from 2012 to 2040 in the AEO2014 Reference Case. Shale gas production is the largest contributor, growing by more than 10 Tcf, from 9.7 Tcf in 2012 to 19.8 Tcf in 2040. The shale gas share of total U.S. natural gas production increases from 40% in 2012 to 53% in 2040.”

Most who study the energy industry agree that shale gas is here for the long term. In its Annual Energy Outlook 2014, the EIA predicts “a 56% increase in total natural gas production from 2012 to 2040 in the AEO2014 Reference Case. Shale gas production is the largest contributor, growing by more than 10 Tcf, from 9.7 Tcf in 2012 to 19.8 Tcf in 2040. The shale gas share of total U.S. natural gas production increases from 40% in 2012 to 53% in 2040.”

EnerCom Managing Director James Constas believes “three years is a long time to try to project commodity prices, much less 10 or 20 years.” Constas points to the fact that “most of the U.S. natural gas demand variations are driven by temperature. If we have a warmer winter, demand drops and larger supply will depress prices in the short term. Or if supply starts growing at a lower rate than what we’ve been seeing during the shale boom, the price for natural gas could climb.

“Looking at the supply trends I think the bias is toward oversupply, and gas prices are likely to be in the $4-$5.50 range for the foreseeable future, but prices will be peppered with upward weather-induced surges. In the next few years, when LNG exports actually begin, that’s another wild card.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.