LONDON – Top U.S. and European oil and gas companies are forecast to swing into a second quarter loss after coronavirus lockdowns destroyed fuel demand, hit prices and squeezed margins, analysts said and Refinitiv Eikon data showed.

Source: Reuters

The expected rare losses for BP (BP.L), Chevron, Eni, Exxon Mobil, Royal Dutch Shell and Total follow a collapse in oil and gas prices and demand to levels not seen in decades, creating a perfect storm for the energy companies that produce, refine, trade and sell fuel.

During previous price slumps, integrated oil producers’ results were boosted by refining operations whose margins typically benefit from low oil prices and provide an internal hedge.

But as travel, industry and business were all halted by lockdowns, margins for refined oil products, such as gasoline, diesel and kerosene, dipped into negative territory.

Graphic: Global refining margins – here

Trading divisions can make money even when prices slump by exploiting choppy market moves.

Oil price benchmarks Brent LCOc1 and U.S. WTI CLc1 are down around a third year-to-date, falling around 66% in the first quarter and jumping 81% and 92% respectively in the second quarter.

Graphic: Oil price extremes – here

Equinor’s (EQNR.OL) marketing and midstream unit, which includes trading, was the company’s only department to make a pre-tax profit in the second quarter, as it found itself on the right side of a steep contango structure, with prompt oil prices cheaper than later-dated contracts. LCOc1-LCOc7

BP (BP.L) and Shell have already downgraded their long-term oil price outlooks, flagging non-cash impairments of $13-17.5 billion and $15-22 billion for the second quarter, respectively.

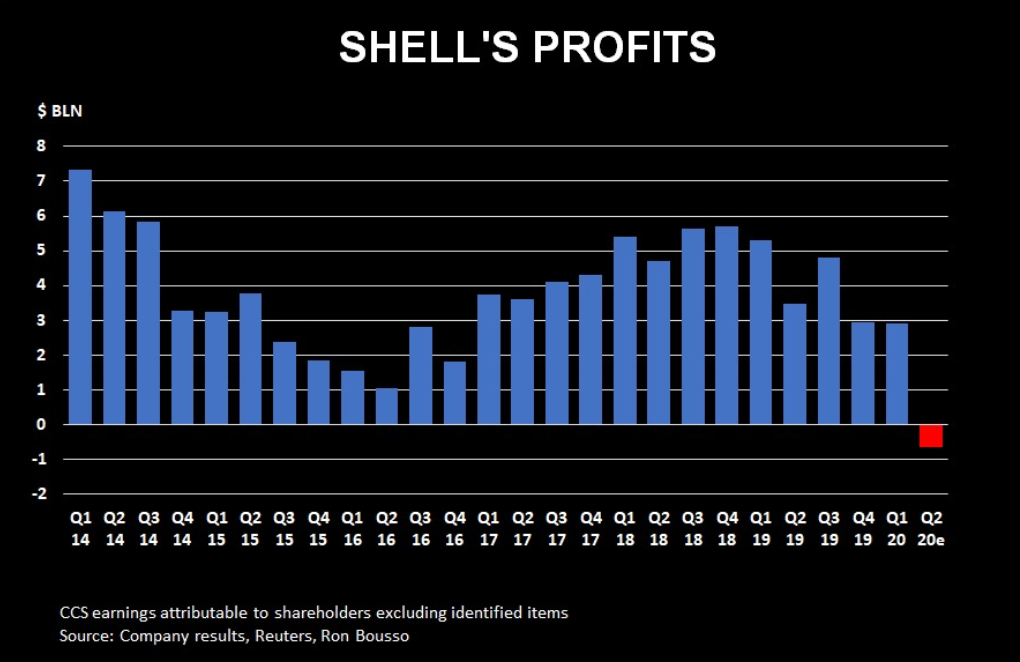

Shell has provided an average estimate of analysts’ expectations of its quarterly adjusted earnings, slumping to its first-ever loss at minus $674 million.

Graphic: Shell earnings forecast – here

Shell, Eni (ENI.MI) and Total (TOTF.PA) are due to report on July 30.

Exxon (XOM.N) and Chevron (CVX.N) are due to report on July 31 and BP on Aug. 4.