Bill Barret is pursuing a number of avenues to achieve its peer-leading margins, the company told Oil & Gas 360® this week

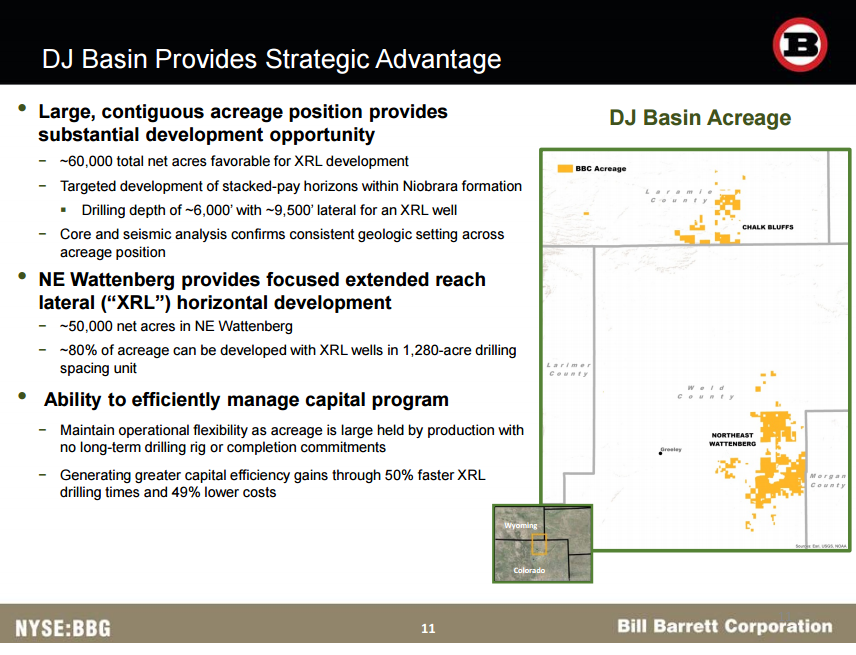

Northeast of Denver lies the Denver-Julesburg Basin, a hydrocarbon-rich formation that extends into southeast Wyoming, western Nebraska and Kansas. Since its discovery in 1901, the DJ as it’s commonly referred to, has been an important producing area for the country, and remains competitive today thanks to low drilling and completion costs, long life production reserves and a well-developed pipeline infrastructure.

Many of Denver’s top oil and gas names operate in the basin, and one in particular has been realizing higher returns thanks to increased capital efficiencies and longer laterals.

Bill Barret Corporation (ticker: BBG) said that the company is now realizing unhedged operating margins 35% greater than their peers in the DJ in a December investor presentation. The company has been able to realize these margins by reducing lease operating expense (LOE) 30% from 2015 and general and administrative expense by 27% over the same time period.

“A differentiating factor giving us a strategic advantage to other operators in the DJ Basin is not having any firm transportation commitments,” Bill Barrett executives told Oil & Gas 360®. “For the third quarter, our DJ Basin oil price differential averaged $2.21 per barrel less than WTI, and we see our operated DJ oil differentials averaging approximately $3 per barrel off WTI for the foreseeable future.

“In addition, we have a higher oil contribution than our peers as our wells produce approximately 65% oil. When combined with the significant progress that our team has achieved in lowering LOE, it has allowed us to achieve basin leading operating margins,” BBG explained.

Unlocking the value in the DJ Basin

Bill Barret looks at a number of factors when deciding how best to unlock value in its assets, the company said. Advancements in drilling methods, wellbore design and completions methods have all contributed to getting the most out of the play.

“Lateral placement and in particular proper spacing for a given area are also key to unlocking value,” the company explained. “Seismic and enhanced reservoir understanding through detailed core and petrophysical analysis of the Niobrara and Codell has served as a strong foundation for these technologic advancements. Continued advancements in all of these technologies along with multivariate statistical analysis (bringing together variables from all of these technologies) will continue to help lead to improved results.”

The amount of data oil and gas companies are collecting is prompting the industry to change the way that it manages information. The increased scrutiny on efficiency in every aspect of a business since the downturn in oil prices has led many companies to look for new ways to extract more value from the information available to them.

Longer laterals are becoming more frequent in the DJ

In pursuit of improved operational efficiencies, many companies in basins throughout the U.S. have also been drilling longer laterals, a trend best illustrated by the 18,544 foot lateral in the Purple Hayes in the Utica. While Bill Barrett’s wells are not as long as the so-called “superlateral” Purple Hayes, the company says it does see benefits to longer laterals in the DJ as well.

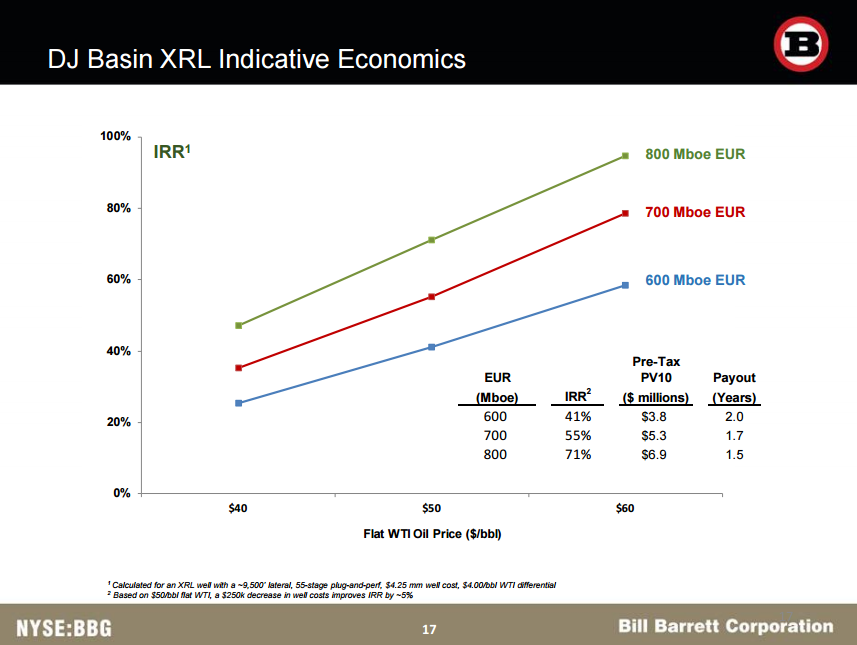

The company is focusing on its extended reach lateral (XRL) drilling program, spuding 15 (gross) XRL wells in the DJ in the final quarter of the year.

“We expect that we will finish completing the initial 4-well pad during December and that it will begin initial sales during early 2017. The remainder of the 15-wells will be completed during the first quarter of 2017 and placed on initial flowback during the second quarter of 2017,” the company told Oil & Gas360®.

“We were an early adopter of utilizing long-laterals in the DJ Basin by recognizing the economic benefit of using XRL technology. Our 50,000 net acre position in NE Wattenberg is fairly contiguous and we believed that we can develop approximately 80% of our drilling inventory utilizing XRLs.”

BBG continues to lower the cost of its XRL wells through quicker drilling, faster rig moves, more efficient running on liners and on liners, the company said. Cost savings have also come from zipper fracs, using less gas, to warm frac water, and from better design and construction of facilities, according to Bill Barrett.