Blackbird Energy receives approval for pipeline gathering system

Calgary-based Blackbird Energy (ticker: BBI) announced today that the company received approval for its infrastructure development, giving it a clear line of sight on future cash flow. The company immediately commenced construction on its 100% owned and operated Elmworth facility and pipeline gathering system, which is expected to be completed in December of this year. Blackbird completed front-end engineering and ordered all long-lead items prior to the Alberta Energy Regulator’s (AER) approval, the company said in its press release today.

The facility will have initial capacity of approximately 10 MMcf/d of natural gas processing, plus capacity for approximately 1.5 MBOPD of associated liquids processing, for aggregate throughput of 3.2 MBOEPD. The gathering system will encompass approximately 10 kilometers (6.2 miles) and will facilitate the tie-in of Blackbird’s behind pipe and future production from at least seven well pads located at its western acreage, south of the Wapiti River.

“The commencement of infrastructure construction puts Blackbird on a clear trajectory to finalize its transition from a pre-production exploration company to a cash flowing Montney producer,” Said Blackbird Chairman, President and CEO Garth Braun. “Upon tie-in to production, Blackbird will generate the cash flow required to accelerate the continued delineation and development of our highly economic resource.”

“The commencement of infrastructure construction puts Blackbird on a clear trajectory to finalize its transition from a pre-production exploration company to a cash flowing Montney producer,” Said Blackbird Chairman, President and CEO Garth Braun. “Upon tie-in to production, Blackbird will generate the cash flow required to accelerate the continued delineation and development of our highly economic resource.”

Blackbird announces fall drilling program, revolving operating loan, and vice president of land

In addition to the announcement about the company’s midstream assets, Blackbird also announced today that it will commence its fall drill program with a horizontal well targeting the super condensate rich Upper Montney (greater than 100 barrels of condensate per MMcf of gas) at Elmworth/Pipestone. The well will be spud from surface location 10-8-70-07W6 with a lateral length of approximately 2,150 meters (7,054 feet) to location 02/2-20-70-7W6 (the “02/2-20 well”). Blackbird intends to spud the licensed 02/2-20 well at the beginning of October, 2016.

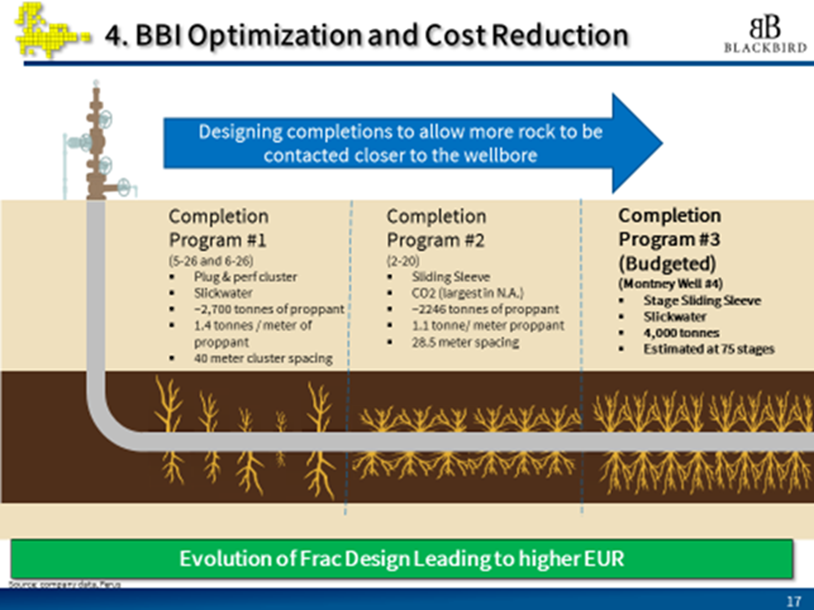

Blackbird is planning a large scale completion program at the 02/2-20 well using Stage Completions’ Bowhead II fracturing system. The slickwater completion program will place approximately 4,000 tons of proppant through approximately 71 individual fracs.

Stage Completions is a privately held Canadian well technology and services company that has developed a patented sliding sleeve completion system that utilizes a pump down collet to open the sleeves. The Stage completion system does not require a coil tubing unit and allows for greater pumping rates, reduced friction and reduced time on surface, according to Blackbird, which holds an indirect 10% minority interest in Stage Completions.

“The reason Blackbird is interested in investing in this technology is because we see it being able to reduce our cost by $1.5 million to $2 million per well, and because we’ve been able to lock down preferential access to the system. We’ll always be able to obtain the systems for our wells,” Blackbird Chairman, President and CEO Garth Braun said at EnerCom’s The Oil & Gas Conference® 21.

The well will be tied-in and placed on production upon the commissioning of Blackbird’s infrastructure solution, eliminating costly flow back and production testing.

The company also announced today that it has entered into a $1.0 million revolving operating loan facility with ATB Financial, which Braun said would be “paramount to driving value creation … particularly as we move to full-scale development.”

Blackbird announced that Josh Wylie has been appointed to the position of Vice President, Land. Wylie previously served as the company’s land manager, helping the company grow its position from 30 sections to 86.75 sections.

“Mr. Wylie was also a key team member in the successful acquisition of a processing agreement for Blackbird’s Elmworth Montney gas and a firm gas take away agreement in the Alliance pipeline to Chicago, which offers Blackbird superior pricing to that of AECO,” said Braun. “More recently, Mr. Wylie has worked with me to advance the surface land acquisition and survey requirements for pipeline and battery infrastructure. Mr. Wylie has consistently executed on an increasing breadth of responsibilities, becoming a key contributor to Blackbird’s past and future success.”