Bonanza Creek Energy, Inc. (ticker: BCEI) exceeded the company’s high-end of Q4 2017 estimates by producing 14.8 MBOEPD. The company is expecting Rockies production to grow by 20% in 2018 and in 2019 Bonanza Creek said it expects an increase of 50% or more.

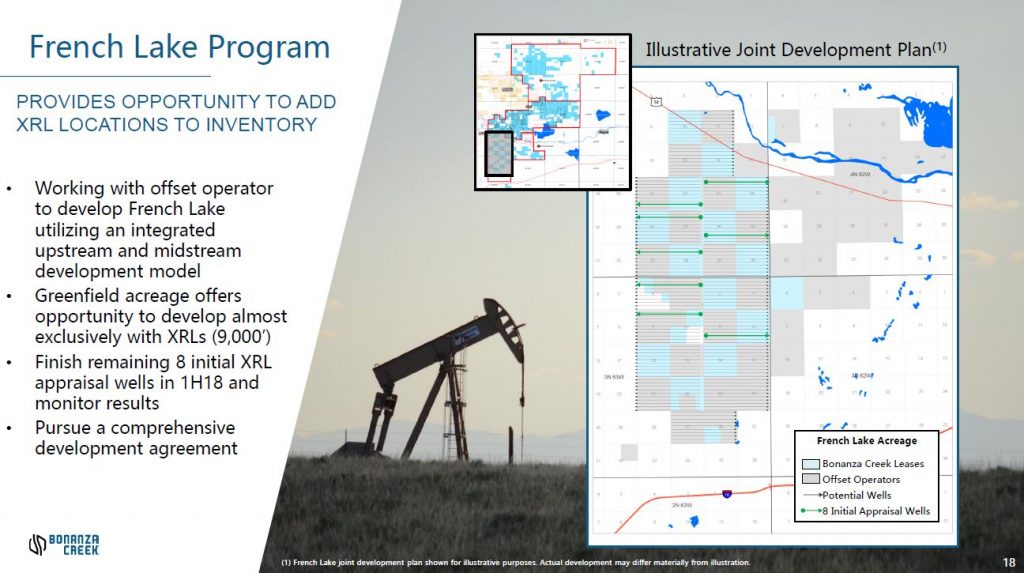

Expanding core footprint in DJ with French Lake

“In 2017, we secured our strategically important leasehold position in French Lake. In 2018, we will delineate this key acreage position with enhanced completions and lay the ground work for its future development. We will also consider the sale of non-core assets and will focus any potential acquisition activity on expanding our core footprint in the DJ Basin,” said Bonanza Creek Chairman Jack Vaughn.

Bonanza Creek recently finished drilling the last of the eight XRL wells on its French Lake acreage with one well setting a company record drill time of fewer than 4.5 days from spud to total depth. The first of these eight French Lake wells has been recently turned online. The remaining seven French Lake wells are expected to be completed and turned online in the first half of 2018.

In its western legacy acreage, the company recently drilled and completed its eight-well SRL State North Platte F-26 pad. On this pad, the company had a new SRL drilling record of 3.4 days from spud to total depth. Regarding completions, the company achieved impressive efficiencies by pumping 336 stages in 24 days, including five days of pumping 18 stages and one day that achieved a company record of 20 stages. All eight wells were recently turned online.

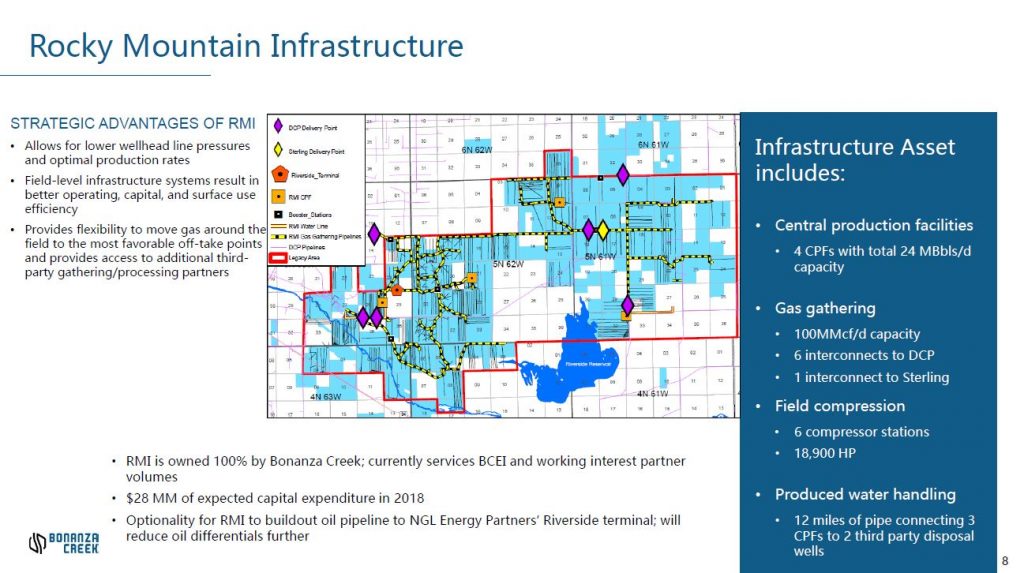

“In 2017, we reduced our annualized G&A and LOE by approximately $20 million. Further efficiency improvements will continue to be a focus for the company, with per-unit costs benefitting from production growth in 2018 and beyond. During the year, we also took important steps to improve our access to gas processing in the DJ Basin. We believe these steps will result in improved costs, greater reliability, and greater optionality than available to many other operators in the basin while enhancing the value of our Rocky Mountain Infrastructure system,” Vaughn said.

“Finally, in 2017, we began a dual-track process to secure permanent leadership for our company and to consider strategic transactions. While the transaction with SandRidge Energy was unsuccessful, this process has provided significant insights regarding the quality of our team, our assets and the desires of our shareholders,” Vaughn said.

2018 capital and production guidance

In 2018, the company plans to accelerate development while testing enhanced completion designs on large scale pads throughout the company’s acreage position. The program contemplates running one rig in the first half of 2018 with a second rig added at mid-year to coincide with additional gas processing capacity.

The first rig is planned to drill large scale pads of up to nine wells throughout the legacy acreage position. Two of the pads drilled in the first half of the year will be completed using slick-water to further test and validate the improved performance from slick-water compared to historic gel completion designs.

One of these pads is located in the western legacy acreage with the second pad located in the eastern legacy acreage. Data gathered from these tests will help inform completion design in the back half of the year. The addition of the second rig will provide additional data to inform completion techniques and development assumptions throughout the acreage position going forward.

Due to the large pads and anticipated third-quarter increase in activity, approximately 55% of the new drills for the year are expected to be turned online in 2019. The 2018 program is expected to grow Wattenberg annual production by approximately 20% in 2018 and annual production from this program is expected to grow by greater than 50% in 2019.

Allocated capital associated with this program is expected to be approximately $280 – $320 million, Bonanza Creek said, which will support drilling 90 gross wells and turning online 55 gross wells. Of the wells drilled, approximately 43 are planned as extended reach lateral (XRL) wells, 7 as medium reach lateral (MRL) wells and 40 as standard reach lateral (SRL) wells.

Of the 55 turned-online wells, 31 are expected to be XRLs, 2 as MRLs and 22 as SRLs. XRL, MRL and SRL wells are targeted to cost $5.4 million, $4.2 million and $3.0 million, respectively.

The table below provides production, capital and operating cost guidance for 2018.

| Guidance Summary | |||

| Three Months Ended March 31, 2018 |

Twelve Months Ended December 31, 2018 |

||

| Production (MBOEPD) | 16.0 – 16.6 | 17.7 – 18.7 | |

| LOE ($/Boe) | $5.00 – $6.00 | ||

| Midstream expense ($/Boe) | $1.40 – $1.80 | ||

| Recurring cash G&A ($MM)(3) | $32 – $34 | ||

| Production taxes (% of pre-derivative realization) | 7% – 8% | ||

| Total CAPEX ($MM) | $280 – $320 | ||

| Rockies Oil Differential (4) | $5.85 off WTI |

Q4 2017 operational update

Fourth quarter production rates of 14.8 MBOEPD was attributed to lower line pressures in Bonanza Creek’s Rocky Mountain Infrastructure (RMI) system and above average performance from wells using enhanced completion designs, the company said.

The November 2017 contract with third-party gas processor Sterling Energy Investments, LLC helped lower line pressures. Since November, Bonanza Creek has moved 13% of its total Wattenberg gross gas production to Sterling. According to the company, the Sterling connection, combined with added compression, reduced line pressures in the company’s RMI system by up to 40%, resulting in improved production from both new and existing wells.

To keep line pressures low, Bonanza Creek has signed up Cureton Front Range LLC, connecting another gas processer to RMI’s gathering system. Bonanza now has three separate processors and eight offtake points linked to the RMI system. The company said that this network will move gas to advantageous markets while assuring production flow.

The agreement with Cureton is a 15-year gas gathering and processing contract, under which Bonanza has dedicated approximately 22,000 net acres, or approximately 33% of its Wattenberg acreage. The company expects to start service with Cureton late in the second quarter of 2018 and commence processing service at Cureton’s new 60 MMcf/d cryogenic gas plant in the second half of 2018.

The Cureton agreement contains no minimum volume commitments, Bonanza Creek said.

Standard reach, extended reach wells update

- The North Platte 44-13 SRL wells, completed in July 2017, are forecasted to produce an average EUR of 500 MBOE per 4,100-foot SRL well

- Bonanza Creek completed five additional wells on its legacy acreage, consisting of three XRL wells and two SRLs. These wells are located on the company’s central legacy acreage and the company said that based on 75 days of data, future production looked “encouraging”

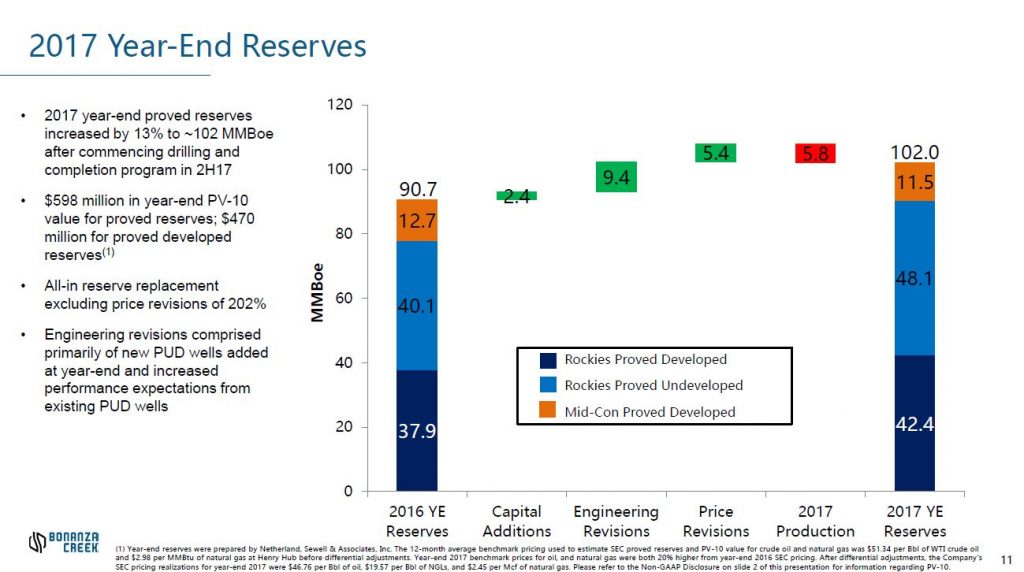

Year-end 2017 proved reserves

As of year-end 2017, the company reported preliminary proved reserves of 102.0 MMBOE, a 13% increase from year-end 2016. The company’s year-end 2017 proved reserves were comprised of 52.9 MMBbls of oil, 22.8 MMBbls of NGLs, and 157.7 Bcf of natural gas and were 53% proved developed.

Proved undeveloped reserves accounted for 48.1 MMBOE of the total proved reserves, a 20% increase in equivalent volumes from year-end 2016.

The increase in proved undeveloped reserves is a combination of new PUD cases added during the year and improved production performance expectations for previously booked PUD wells due to the utilization of enhanced completion design.

Bonanza Creek reported an all-in reserve replacement excluding price revisions of 202%. The PV-10 value, using SEC pricing for estimated total proved reserves as of December 31, 2017, was $598 million, of which $470 million was attributable to proved developed reserves.

As of year-end 2017, the company estimates that its exit-to-exit corporate PDP decline rate will be approximately 30% in 2018, 20% in 2019 and 15% in 2020. The table below summarizes estimated proved reserves for 2017. Year-end 2017 reserves were prepared by Netherland, Sewell & Associates, Inc.

| Proved Reserves | As of December 31, 2016 |

As of December 31, 2017 | |||||||||||

| Reserve Category | Equiv. (MMBOE) |

% of Total |

Oil (MMBbls) |

NGLs (MMBbls) |

Gas (Bcf) |

Equiv. (MMBOE) |

% of Total |

YoY Change |

|||||

| Proved Developed | 50.6 | 56 | % | 25.8 | 12.7 | 92.7 | 53.9 | 53 | % | 7 | % | ||

| Proved Undeveloped | 40.1 | 44 | % | 27.1 | 10.1 | 65.0 | 48.1 | 47 | % | 20 | % | ||

| Total Proved Reserves | 90.7 | 100 | % | 52.9 | 22.8 | 157.7 | 102.0 | 100 | % | 13 | % | ||

| Regional Summary | |||||||||||||

| Rocky Mountain | 78.0 | 86 | % | 46.6 | 21.2 | 136.2 | 90.5 | 89 | % | 16 | % | ||

| Mid-Continent | 12.7 | 14 | % | 6.3 | 1.6 | 21.5 | 11.5 | 11 | % | (10) | % | ||

| Total Proved Reserves | 90.7 | 100 | % | 52.9 | 22.8 | 157.7 | 102.0 | 100 | % | 13 | % | ||

Note: Totals may not add due to rounding