Shares of Bonanza Creek fall 37% on news of hiring a financial advisor

Shares of Bonanza Creek (ticker: BCEI) took a nosedive Wednesday, falling 38%, with investors reacting negatively to an 8-K filing released during trading hours that the company was hiring Perella Weinberg Partners to “advise and assist in analyzing and evaluating financial and transactional alternatives, including restructuring options.” The company made the announcement in an 8-K without a press release.

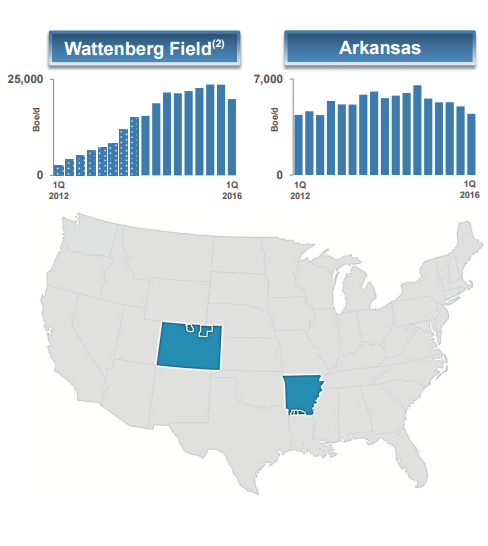

Bonanza Creek has 70,000 net acres, with focus on the Wattenberg Field in the DJ Basin of Colorado with additional assets in Colorado’s North Park Basin and the Cotton Valley sands in southern Arkansas, according to the company’s investor presentation. In the 2016 first quarter, Bonanza Creek reported average production of 24.3 MBOEPD and a net adjusted loss of $0.46 per diluted share.

A Downward Slope

Shares of Bonanza Creek closed Wednesday at $1.44 and continued to fall further throughout the week. The stock closed at $1.09 at the closing bell on Friday, July 15, 2016. Shares of the company traded for as much as $61.41 as little as two years ago, so what happened?

Bonanza Creek’s initial public offering took place in December 2011, when the company sold 10 million shares at $17.00 each for a total offer amount of $170 million. In its first full year as a public company, Bonanza Creek reported production of 9.3 MBOEPD, and had a market capitalization of $1.1 billion at year-end 2012.

From the company’s IPO, Toronto-based investment management firm West Face Capital Inc. played an integral part. West Face, together with the company management and the E.E. Shaw group, completed an equity financing of $265 million in December 23, 2010, which monetized BCEI’s corporate predecessor, Bonanza Creek Energy Company, LLC, repaying approximately $150 million in debt, and helping the company acquire its predecessor’s operating subsidiary and production. During 2012, West Face owned 53% of BCEI’s stock. In January 2013, the company sold down its position to 20%. Today, the company does not hold stock in Bonanza Creek.

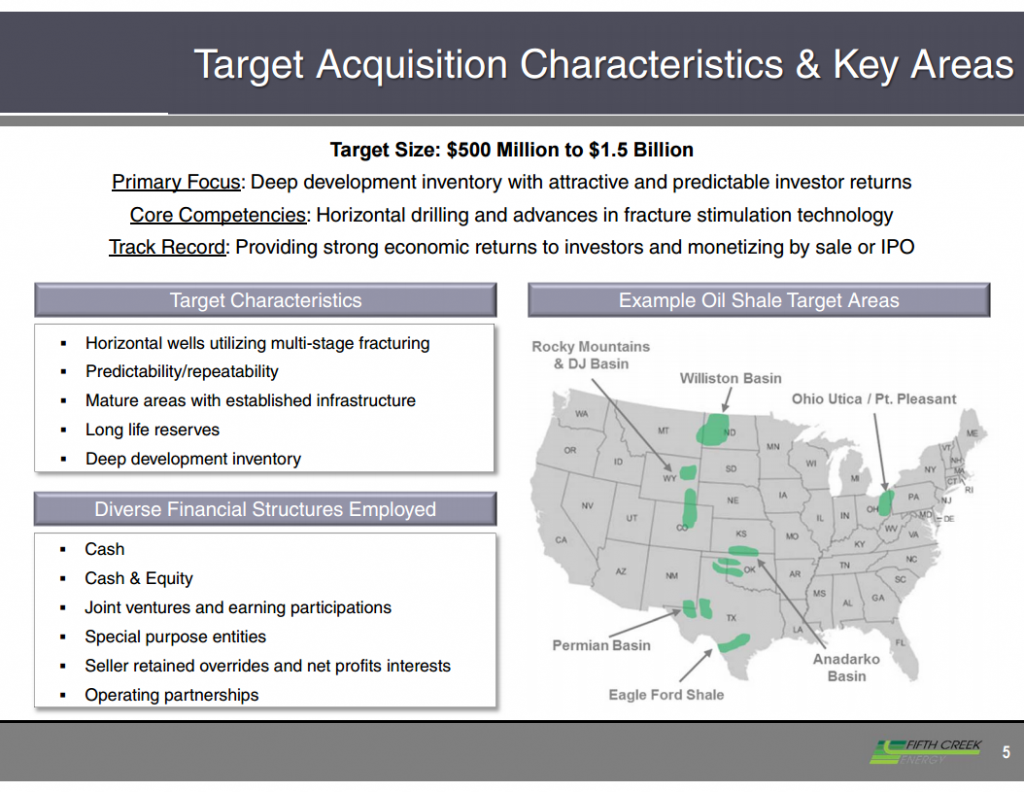

With Michael Starzer, the company’s founder, working as CEO, Bonanza Creek grew production to 16.2 MBOEPD and increased market cap to $1.8 billion, increases of 43% and 39%, respectively, from 2012 to 2013. But after just one full year trading on public markets, Starzer left the company he founded to form Fifth Creek Energy, a privately-owned E&P, with BCEI’s former Vice President of Corporate Development Patrick Graham.

Despite two consecutive years of growth, it appears that West Face became more vocal in how the company should be managed, prompting members of senior management, like Starzer and Graham, to leave in February and March 2014, respectively.

Though it would take ten months, Bonanza’s board of directors would eventually name Richard Carty as Starzer’s replacement. Carty, who served on the board from the company’s formation, was president of West Face Capital (USA) Corp. from 2009 to 2013.

In the months between Starzer’s departure and Carty’s appointment, Bonanza Creek’s stock fell from all-time highs in the mid-$50 to $60 range down below $40 per share. Despite the company reporting another year of production growth in 2014, reaching 23.5 MBOEPD, its market cap shrank to $991 million at year-end 2014, falling below $1 billion for the first time since the company’s IPO on December 15, 2011.

It was around this time that Saudi Arabia and OPEC announced that they would no longer prop up prices, sending the entire oil and gas market into a tailspin. Oil and gas companies began looking for ways to navigate the downturn, including BCEI.

Bonanza Creek initially turned to the equity markets, raising more than $200 million in a secondary offering in February 2015 to investors willing to pay $26 per share. After the equity offering, BCEI then turned to asset sales, though with limited success.

Last November, the company announced it would sell its gathering systems and other infrastructure to Meritage Midstream for $225 million in cash. The deal did not close, and in February 2016, the company announced that it was terminating the deal.

Adding to the financial pressures, Bonanza Creek saw its borrowing base cut 58% in May to $200 million from $475 million. With $288 million outstanding on its revolver prior to the redetermination, the company was left with a credit deficiency, and said in an 8-K filing that its options included:

- within 20 days after the Deficiency Notice Date, deliver to the Administrative Agent written notice of the Company’s election to repay Advances such that the Borrowing Base Deficiency is cured within 30 days after the Deficiency Notice Date;

- (B) pledge, within 30 days after the Deficiency Notice Date, additional Oil and Gas Properties acceptable to the Lenders, which the Lenders deem sufficient in their sole discretion to eliminate the Borrowing Base Deficiency;

- (C) within 20 days after the Deficiency Notice Date, deliver to the Administrative Agent written notice of the Company’s election to repay Advances in six monthly installments equal to one-sixth of the Borrowing Base Deficiency, with the first such installment due 30 days after the Deficiency Notice Date and each following installment due 30 days after the preceding installment; or

- (D) within 20 days after the Deficiency Notice Date, deliver to the Administrative Agent written notice of the Company’s election to combine the options in clause (B) and (C) above, and indicating the amount to be repaid in installments and the amount to be provided as additional Collateral.

While Bonanza Creek certainly wasn’t helped by the oil and gas downturn, the departure of an experienced management team seems to have made the problem even more pronounced. BCEI market cap continued to fall to just $97 million in EnerCom’s E&P weekly for the week ended July 8, 2016, while the company’s debt-to-market cap has ballooned to 1,131%, far exceeding the median 63% for the group.

West Face Capital’s other energy ventures

West Face holds a number of energy investments, including companies like Gran Tierra Energy (ticker: GTE), Mitra Energy, Petromaroc Corp. and Mandalay Resources, as well as an interest in the Port Ambrose regasification plant.

A similar story took place at Gran Tierra, where West Face nominated a total of eight directors to the board in March 2015 before pushing out the company’s CEO in May and replacing him with Gary Guidry as part of an agreement reached between the company and West Face, which held 9.8% of the company’s stock at the time.

Through the remainder of 2015, West Face then sold down its interest in Gran Tierra to 6% by January 29, 2016, and held just 5% of the company’s stock according to the most recent Bloomberg data. Over the last year, West Face has sold down its interest in every energy company it owns, even exiting two, Corridor Resources and Suncoke Energy, completely.

Good management teams march on

While Bonanza Creek struggled through its change in management and the oil price downturn, Starzer wasted no time in moving his next venture forward.

On March 5, 2015, Fifth Creek announced the completion of its private equity financing with funding commitments from NGP Natural Resources XI, L.P. which closed in January 2015, with total commitments of $5.325 billion. Natural Gas Partners holds cumulative committed capital of $16.5 billion since inception, organized to make investments in the oil and gas production, midstream and oilfield services sectors.