How Much Borrowing Base will be Left after Redeterminations?

Bankruptcy and restructuring have become prevalent words in the oil and gas industry during the present price downturn. With spring borrowing base redeterminations already under way or quickly approaching, speculation is rampant as to the extent of cuts and who will suffer the consequences when cuts are made.

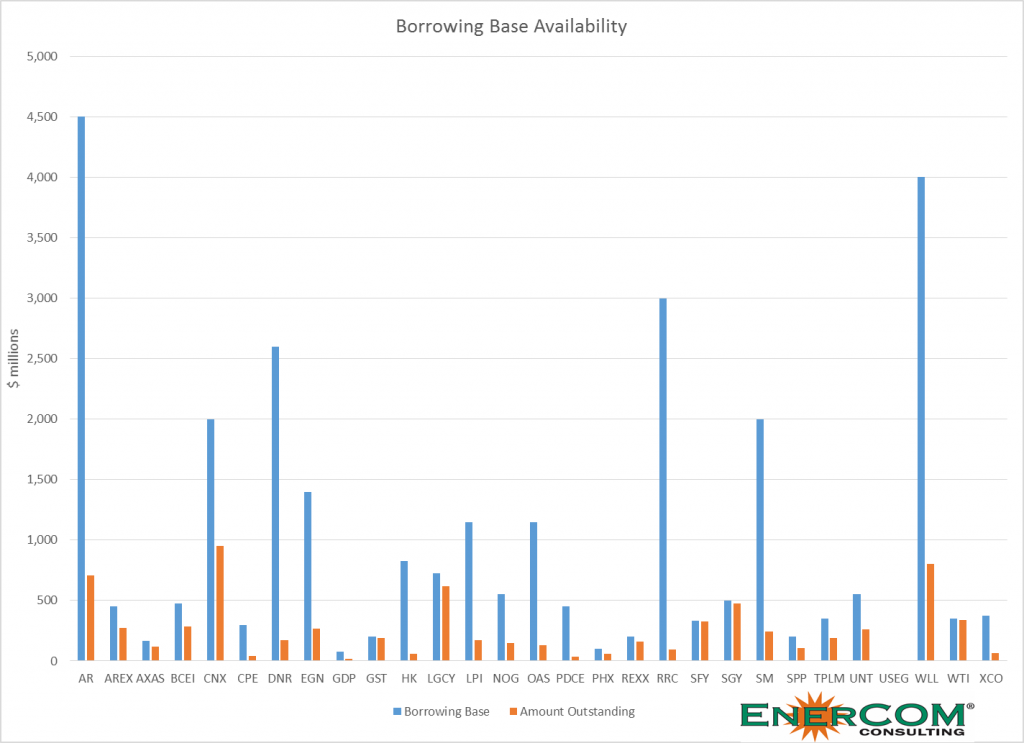

Oil & Gas 360® compiled a list of companies that have reported their existing borrowing base and the amount that has been drawn down on it (according to data from Bloomberg). This chart shows the total amount in the borrowing base as well as the amount reported as outstanding. Companies with a large difference between the two can withstand a cut, or even a big cut in some cases. Companies that have drawn down the majority of their borrowing base show on the chart as the blue and orange bars being very close. These companies will need to seek capital alternatives should their borrowing bases suffer reductions.

This data is limited to those with fully disclosed data.