BP has completed the $10.5 billion acquisition of BHP’s U.S. unconventional assets in a landmark deal that will significantly upgrade BP’s U.S. onshore oil and gas portfolio.

The acquisition – which was announced in July and closed October 31– adds oil and gas production of 190,000 barrels of oil equivalent per day (boe/d) and 4.6 billion oil equivalent barrels (boe) of discovered resources in the liquids-rich regions of the Permian and Eagle Ford basins in Texas and in the Haynesville natural gas basin in East Texas and Louisiana.

Following integration, the transaction will be accretive to earnings, is estimated to generate more than $350 million of annual pre-tax synergies and is expected to boost upstream pre-tax free cash flow by $1 billion, to $14-15 billion in 2021.

“By every measure, this is a transformational deal for our Lower 48 business. It is an important step in our strategy of growing value in Upstream and a world-class addition to BP’s global portfolio,” said Bernard Looney, BP’s Upstream chief executive.

“We look forward now to safely integrating these great assets into our business and are excited about the potential they have for delivering growth well into the next decade.”

New company name for BP’s Lower 48 business

BP’s Lower 48 business also announced today that it is changing its name to BPX Energy. The change marks a new era of growth for BP’s U.S. onshore oil and gas unit, which has operated as a separate entity since 2015 and has achieved material improvements in operational and financial performance since then.

The “BP” portion of the business’s new name reflects that it remains wholly-owned by BP and a strategic business within BP’s Upstream organization. The “X” stands for exploration — both the search for new oil and gas resources as well as for new ideas and methods to fundamentally improve the business.

BP has completed the acquisition of assets in three basins, the Permian, Eagle Ford and Haynesville

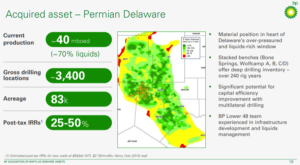

BHP owns about 83,000 acres in the Permian, mostly in Reeves County, TX. This is one of the larger positions in the play, with extensive opportunities for further development. BP estimates there are 3,400 gross drilling locations on the acreage, though it does not mention what benches and densities are included in this assumption. 3,400 wells will take a long time to develop, BP estimates this represents over 240 rig years. Even Concho Resources, which has accumulated over

640,000 acres in the Permian and has the largest drilling program in the play, would take almost nine years of drilling to develop these locations.

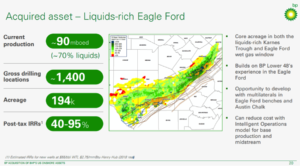

BHP’s Eagle Ford position is likely the most valuable position of the three, as the company holds 194,000 acres in the play. This asset is currently producing 90 MBOEPD, 70% of which is liquids, giving it a large production base. BP already has extensive operations in the Eagle Ford, so this asset should merge well with the company’s existing experience. BP estimates wells in the basin have post tax IRRs of 40% to 95%, making development very attractive.

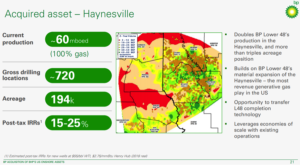

BHP’s Haynesville position is the most mature of the three, with only 720 remaining drilling locations. Like in the Eagle Ford, BP already holds acreage in the Haynesville. BHP’s position is significantly larger, though, and this acquisition doubles BP’s Haynesville production and more than triples its acreage

BHP will return proceeds to shareholders

BP will pay the $10.5 billion in cash, split between several payments. Half, $5.25 billion will be paid immediately upon completion of the transaction, while the remining 50% will be paid in six installments over the next six months. BP will finance the first payment using cash on hand, while the remaining installments will be financed through equity offerings.

BHP reports that its current net debt is at the low end of its target range, so the proceeds from the sale will be returned to shareholders. The precise means for returning $10.5 billion to shareholders will be announced when the transaction closes. BHP will take an impairment of $2.9 billion on the sale.

Bob Dudley, BP CEO, commented “This is a transformational acquisition for our Lower 48 business, a major step in delivering our Upstream strategy and a world-class addition to BP’s distinctive portfolio. Given our confidence in BP’s future – further bolstered by additional earnings and cash flow from this deal – we are increasing the dividend, reflecting our long-standing commitment to growing distributions to shareholders.”