Yes, the world of oil is changing and has been in an evolution for the last several years. The US has moved into a position as a major global oil supplier, and even price leader, as OPEC and its production partners struggle to defend a price level while continually giving up market share to US producers. It is always difficult to forecast where oil prices are heading for the next year or so. However, that said the world of oil continues to evolve into a world where the price is still being driven by over-supply, even with many geopolitical events evolving around the world.

Furthermore, 2018 has been a year with an above-normal level of uncertainty coming from the global financial markets, adding another variable to the global oil balance. Will the global economy slow along with global oil demand growth? A looming trade war between the US and China and an uncertain UK exit from the EU are just a few of the major events unfolding as we approach 2019. Even if oil supply and demand balances improve in the short term, the uncertainties could dampen an oil price recovery.

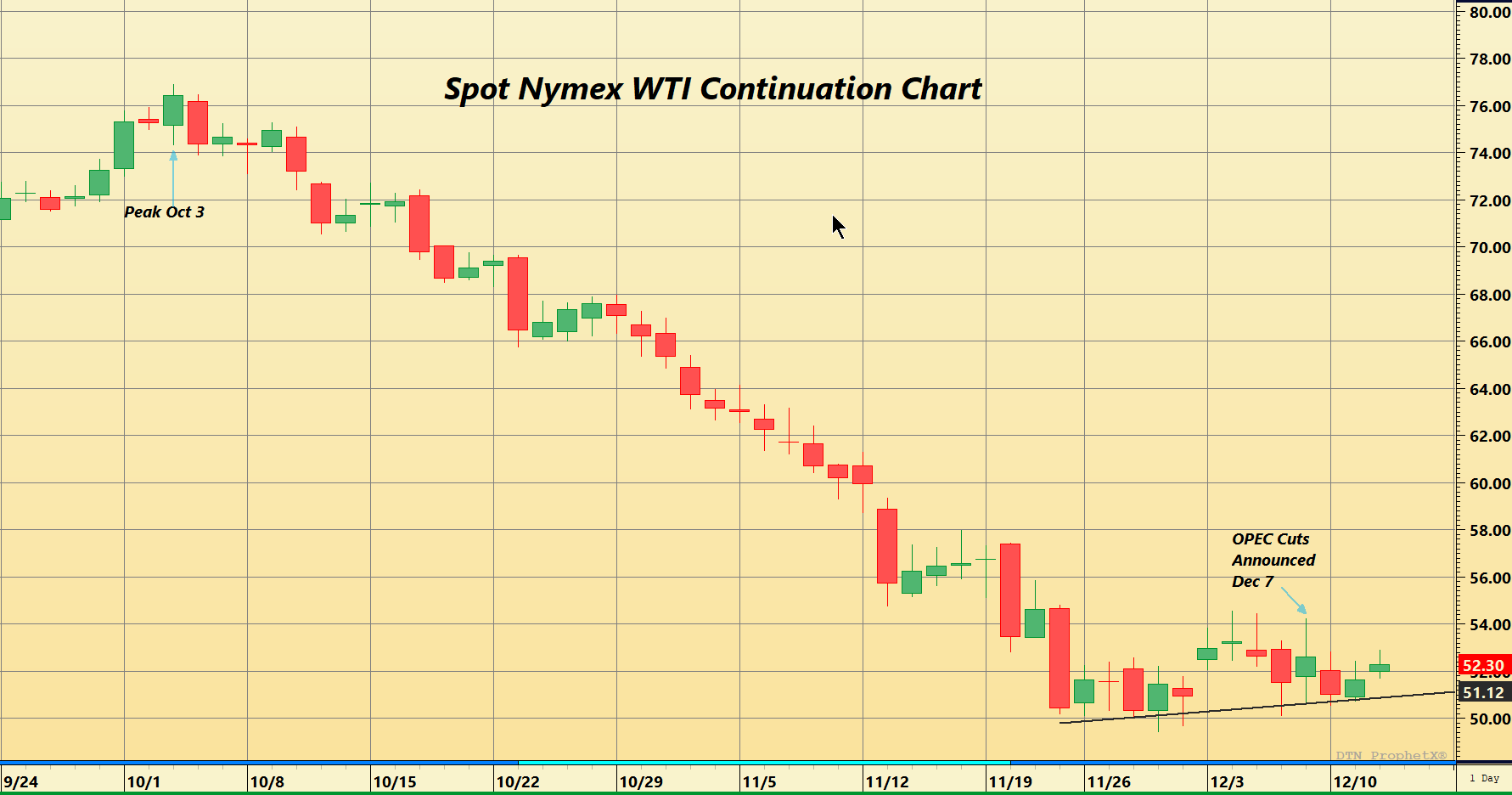

In the first week in December OPEC and its non-OPEC partners, including Russia agreed to cut production by around 1.2 million bpd beginning in January of 2019. This was in response to the spot WTI crude oil futures contract declining by around 35 percent after peaking in early October, and the spot Brent contract declining 33 percent over the same timeframe. In technical trading terms oil is in a bear market (a bear market is defined as a market that has declined 20 percent or more from its high). In addition, in Canada the Alberta province ordered oil producers to reduce production by 8.7 percent or about 325,000 bpd in 2019 to shore up prices while reducing the inventory overhang.

Total announced cuts are now over 1.5 million bpd, plus the shorter-term cuts coming from issues in places like Libya (declared force majeure recently impacting over 300,000 bpd). The main question is will the cuts be enough and will OPEC and its partners comply to the accord even as US production continues to ramp up.

In fact, for the week ending November 26, the EIA reported in their weekly fundamental snapshot that total US net import/exports of crude oil and refined products showed the US net exported 211,000 bbls of oil. This has not gone un-noticed by OPEC. It’s a trend that is only going to grow as infrastructure bottlenecks in the US are resolved in 2019 and beyond and more and more shale oil hits the export ports in the US Gulf Coast. Simply put the US oil sector is a major player in the international markets - but not as in the past as a net importer rather as a net exporter of oil.

The market responded favorably to the OPEC agreement sending prices higher by a tad over 2 percent on the day the deal was announced. Market participants are approaching the latest supply news with a high level of caution (and they should) as global oil demand growth may be slowing and the cuts may not be enough to move global inventories into a sustained destocking pattern. The EIA in their December Short Term Energy Outlook released on December 11 are still forecasting the inventory trend to remain in a slight building pattern throughout the majority of 2019.

In the chart below of the spot NYMEX WTI, the continuation contract shows that although the market has not yet surged after the supply cuts prices are starting to appear to be in the early stages of a bottoming pattern. Market participants are still in a wait-and-see mentality and are not yet ready to jump into the pool with both feet. One major reason stems from the EIA projecting US crude oil production is expected to increase by 1.2 million bpd in 2019 (over 2018) offsetting the entire OPEC/non-OPEC pledged production cuts.

Aside from the small impact of the Canadian cuts, the supply side of the equation is still likely to outstrip global demand for most of 2019, assuming there is not a strong downturn in the global economy, with global oil inventories possibly moving into a small destocking pattern toward the end of 2019.

Oil prices have a long road to recover the losses since October 3. Barring any new unplanned supply interruptions, the road to price recovery in the first half of 2019 is going to be a difficult road - one that may push OPEC into another corner when they meet again in April of 2019 when they may have to decide to cut even deeper and shed additional market share to US producers.

Overall, I believe the supply cuts were a positive outcome for OPEC and its partners. Coupled with the 325,000-bpd cut in Canadian production beginning in January, OPEC and its partners may have dodged a bullet insofar as another massive decline in prices. With a tad bit of patience, prices may slowly work their way higher in the coming months. I believe they set the stage for oil prices to slowly claw their way out of the bear market trend that has been in play since prices peaked in very early October, but demand must continue to grow and compliance to the production cuts will have to be very high. A rocky road at best ahead for oil producers.

If you would like to learn more directly from Dominick and other industry experts, see DTN’s current course schedule or take one of our courses online. DTN also offers Advisory Services for companies from all levels of the energy infrastructure in the area of risk management.