Everyone’s heard the story about the government’s promise to spend $1 trillion on fixing America’s aging critical infrastructure. But there’s another big money story that few investors know of…

Trump’s trillion-dollar pledge won’t come close to fixing our infrastructure. It’ll take $3.6 trillion to make this happen. And in the midst of this infrastructure crisis, one little-known company has launched an artificial intelligence coup that could save us billions.

Consider the dire straits of a massive network of critical infrastructure that industries, the environment and human lives all count on, every minute of every day:

- U.S. dams are failing from coast to coast: 15,500 of our 90,500 dams now a high-hazard potential for public safety and the economy and it will take $60 billion to fix them.

- 180,000 people were recently evacuated in California because of fears that the largest dam in the U.S. would collapse.

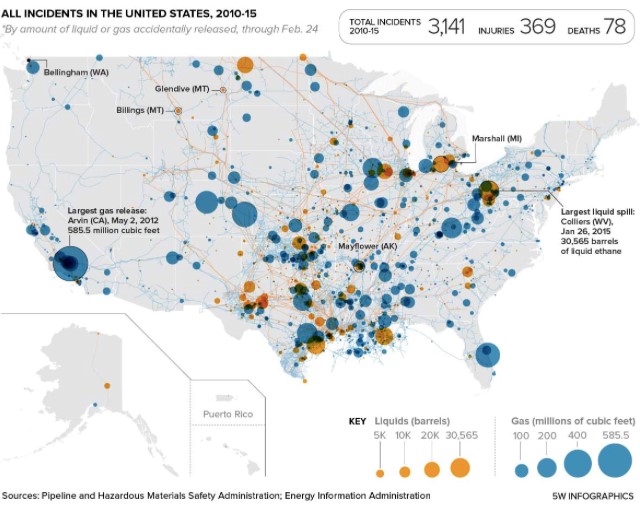

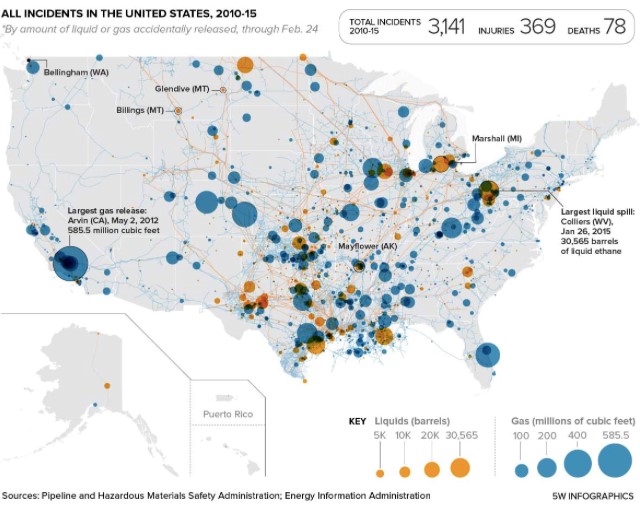

- Pipelines have caused almost 9,000 significant accidents in only 30 years, hitting us with $8.5 billion in damages, killing hundreds and injuring thousands.

- The U.S. spends almost $3 billion every year just cleaning up spills in our waterways.

- The over 140 oil refineries in the U.S. are potential disasters waiting to happen, with more than 500 accidents since 1994, and explosions killing and threatening millions with fatal toxins.

We’ve spent billions on remote sensing equipment to monitor our 2.5 million miles of pipeline, our over 90,000 dams, and our 7.2 million miles of electric power lines. The amount of data collected isn’t just big, it’s incomprehensible.

What it’s NOT is actionable. It’s intelligence that gets sucked into a black hole and does nothing to help us get ahead of the next environmental or human tragedy caused by a failure of critical infrastructure. It does nothing to help industries across three massive verticals to avoid spending billions in damages and clean-up costs.

One little-known company has stepped in to turn critical infrastructure big data on its head.

The company is Carl Data Solutions (CSE:CRL; OTC:CDTAF), and its proprietary new internet remote monitoring technology could be the difference between a 7-day advance warning of a major disaster and a billion-dollar catastrophe.

In a remote monitoring market that will be worth over $27 billion by 2023, Carl Data is leading the next phase of the revolution. By 2020, more than 50 billion devices will be connected to this network, and Carl Data plans to turn the massive amounts of data they collect into an actionable—and profitable—early-warning system.

Here are 5 reasons to keep a close eye on Carl Data Solutions (CSE:CRL; OTC:CDTAF)

#1 Protecting a $153-Billion Market

The critical infrastructure protection market should be worth over $153 billion by 2022. And the remote sensing services market, which makes much of the data-collection possible, is expected to more than double from $10.68 billion this year to $21.62 billion in just three years.

Not only is Carl Data positioning itself to disrupt these two huge markets, but it’s also throwing a lifeline to multi-billion-dollar industry verticals:

- The oil pipeline industry brings in $11 billion in revenue

- Water supply and irrigation systems in the US generate $77 billion in revenue

- US gas pipeline transportation boasts $24 billion in revenue

- The electric power transmission system in the US brings in a whopping $380 billion in revenue.

The pipeline monitoring systems market alone is expected to double from US$4.13 billion in 2015 to US$8.72 billion in 2026. And this is just one market segment within the overall critical infrastructure monitoring sector.

From Toronto to LA and Dallas; and from municipalities, engineering firms and massive infrastructure operators at every vertical, Carl Data has the potential of turning the big data industry upside down.

Why? Because while everyone was getting excited about remote sensing equipment, no one was thinking about what to do with all the data collected.

Carl Data was, and it’s conquered the black hole, intercepting all the data and making it actionable.

And according to its creators, there are few systems out there that can handle the sheer volume Carl Data can and then identify problems in near-real time.

Carl Data’s AI system can predict events that may lead to critical infrastructure failures up to seven days into the future.

It can use AI to compare past storm events to weather predictions to forecast whether a future storm might cause a major incident at one of America’s many aging and high-hazard potential dams—before they fail.

#2 Taking North America by … Cloud

For major cities with aging infrastructure, it’s not enough to have a bunch of sensors collecting data. You have to know what the data is telling you, and in order to do that, you have to have ultra sophisticated analytics capabilities.

That’s exactly what Carl Data (CSE:CRL; OTC:CDTAF) is doing for a host of North American cities where critical infrastructure is crippled by age. And its client list is big and getting bigger.

This is a massive data platform that is built to service absolutely any and every industry vertical.

For oil and gas stream crossings, and major pipeline operators like Kinder Morgan, Enbridge, Husky and Trans Canada, Carl Data would be essential as it uses flow and stability sensors to monitor where the pipeline crosses the stream in real-time, alerting engineers via cell phone immediately if thresholds are threatening breach. For Kinder Morgan’s 1,300 LNG stream crossings in British Columbia alone, monitoring is critical.

For companies like Teck, Gold Corp., Imperial Metals and BC Hydro and thousands of hydro-electric dams and toxic trailing ponds around the world, Carl Data could be the difference between safety and a billion-dollar clean-up.

#3 American Critical Infrastructure is Dangerously Failing

More cities, and more industries should be lining up soon because this predictive data solution comes at a desperate time for American infrastructure, which earns a woeful D+ on its report card.

The country’s more than 90,000 dams represent a major threat to public safety and the economy, with nearly 15,500 already considered high-hazard potential in 2016.

In October 2015, 18 dams were breached in South Carolina flooding, closing down 300 roads and 166 bridges, and killing 19 people. Just a year later, Hurricane Matthew ripped through the same state, causing 25 dams to fail—again.

In February this year, 200,000 were urgently evacuated in northern California over fear that the Oroville Dam—America’s tallest--would collapse.

In the past two years alone, there have been 21 dam failures.

And that’s just one part of our massive critical infrastructure.

From the Deepwater Horizon immolation that killed 11 workers and released 5 million barrels of crude oil into the Gulf of Mexico to the Anacortes Tesoro oil refinery explosion and the collapse of West Virginia coal mine that killed 29 miners, public safety has been comprised.

And that was only in 2010—and all in a single month, April.

Just a few weeks ago, the Keystone Pipeline in South Dakota leaked over 200,000 gallons of oil, forcing a shutdown.

(Source: Politico)

Bigger and better monitoring measures are critical, and Carl Data Solutions not only uses the latest in artificial intelligence to alert critical infrastructure operators to impending disasters, but it is predictive—enabling a response before situations become life-threatening.

For America’s bursting dams, having a 7-day lead time on a pending disaster might be the difference between life and death, and could save operators tens of millions in catastrophic clean-up fees, lawsuits and damage control.

#4 Multiple-Billion $ Industries Can Avoid Massive Liability

One of the biggest selling points for Carl Data (CSE:CRL; OTC:CDTAF) is the huge savings its predictive solutions could mean for some of our biggest industries.

A major dam failure can cost on average over $700 million in damages and close to $2 billion for clean-up.

Penn West reported 93 pipeline failures in 2013 and 112 pipeline failures in 2012. One of those failures cost it $4.3 million.

- The 2010 Deepwater Horizon spill will cost an estimated $61.6 billion once all lawsuits are over.

- The 1989 Exxon Valdez spill cost $3.8 billion—so far (and counting)

- The 2015 El Capitan State Beach Spill in California cost $62 million.

And those are just the biggest spills.

When a company like Carl Data comes up with a system that can save our biggest and most critical industries billions of dollars, profits are likely to follow. When they can save reputations, it’s even more likely.

But it doesn’t end there: Insurance and risk management is a massive expense for critical infrastructure operators. With toxic Canadian tailing ponds alone we’re looking at billions of dollars in potential unsecured liability.

Insurance companies have risk management consultants on the prowl for tools like Carl Data’s patented system to help manage risk because they insure resource development projects, and want to prevent paying out on insurance claims.

That’s why Carl Data’s revenue could be poised for a major boost.

Carl Data is working its way into multiple verticals because the applications of its SaaS-based technology are potentially boundless. So is the revenue potential.

Clients pay a fee based on the number of data sources coming into their account, along with set-up fees and customization services, which include new algorithms and unique reporting.

And the entire system just got a lot easier and even more cost-effective with Carl Data’s acquisition of ab Embedded Systems Ltd assets. This is where low-power wireless mesh networks are scooping up huge amounts of data from remote locations automatically.

With the potential to tap into most industries that collect data, Carl Data already has a strong pipeline for this year, and increased revenues by over 30% from 2016 to 2017.

And the potential for near-term revenue growth is already visible through proprietary applications and strategic acquisitions.

- Through its acquisition of Flowworks real-time reporting and analytics in 2015, Carl Data has solidified its relationship with major sensor manufacturer Hach, with a new project for the City of Dallas, which has since been expanded, with several more projects expected in the near future.

- Carl Data’s Polish subsidiary, where its core team of data scientists are, was approved for a substantial EU research grant to help the company maintain its lead in tech that monitors aging water infrastructure.

- Carl Data is also working with big-cap miner Teck Resources and has developed and deployed an application for monitoring tailing ponds. The tech system will help Teck manage risk and is expected to result in significant operational savings for Tech.

- The same technology is also being adapted for Dam Safety and other Asset Monitoring uses.

From Toronto and Dallas to LA, major cities are lining up for Carl Data solutions to protect budgets and populations from the devastating disasters caused by aging infrastructure. The mining vertical is already being successfully tapped, and Carl Data anticipates other major verticals to follow suit.

#5 Big Data Visionaries, Big Business Brains

While everyone was blindsided by the remote sensing bonanza, Carl Data (CSE:CRL; OTC:CDTAF) CEO Greg Johnston was looking into the future. What to actually do with all that data to make it work for us. He had a big idea that he’s since turned into a small-cap company with a very large-cap potential.

The real gold mine is the data, not the sensors. And in Johnston’s words: “We’re turning the industry on its head”.

Johnston’s idea was hard-hitting and unique. He set out to create a system that can work with any hardware vendor, giving Carl Data a rare advantage. Once it’s set up, it spoon-feeds critical data to clients—filtered and relevant and in time to fix problems and avert disaster.

Carl Data is about Greg Johnston’s vision, and the high-tech team he put together to disrupt the future.

- Johnston is the former director of ecommerce marketing for Global Hyatt Corporation, where he increased online revenue by 34 percent. He’s also a principal at BDIRECT Online Communications, Director of Database & Loyalty Marketing for Choice Hotels Canada, VP of Antarctica Digital Marketing, and partner at Revenue Automation Incorporated.

- CTO Piotr Stepinski is a high-level software engineer with a major track record in Kainos, Atena and Telzas and he is the tech architect for Carl Data.

- Director Chris Johnston, a professional engineer, is the co-founder of Flowworks.

- VP of Business Development Kevin Marsh led the industry’s first successful efforts to commercialize an IoT-based Data-as-a-Service solution, overseeing its rapid market adoption.

- Director Craig Tennock is a veteran civil and structural engineer who was awarded the Order of Merit by Industry Canada for designing and implementing a new way to measure open channel flow with greater accuracy.

The expert management team and board has major successes behind the in launching award-winning data solutions, start-up ventures and Fortune 500 consumer programs. And they are heavily invested in Carl Data, with over 80 percent insider ownership.

Remote monitoring is already a multi-billion-dollar business, that’s heading to over $27 billion in the next few years, and critical infrastructure protection will top $150 billion.

And the momentum is building as fast as data collection. Even more companies and governments have lined up for this proprietary technology over the past few weeks.

Even better: Carl Data recently announced that its revenue could double next year.

The rapid news flow and the critical timing could make this a prime target for acquisition, and investors who already have Carl Data on their radar will have noticed GE’s recent $207.5-million acquisition of a similar company…

Big Data is Big Money.

Actionable Data is even Bigger Money.

With technology that could save infrastructure companies billions in clean-up costs, even more in liability, and keep reputations intact, Carl Data (CSE:CRL; OTC:CDTAF) is poised for leadership in the critical infrastructure cloud.

Honorable Mentions:

TransCanada (TSX:TRP) owns and operates energy infrastructure throughout North America. It is one of the continent’s largest providers of gas storage, and owns and has interests in approximately 11,800 megawatts of power generations. The technology needed to maintain TransCanada’s huge portfolio of assets is constantly changing, and TransCanada has done an amazing job adopting the most cutting-edge solutions for its infrastructure challenges.

With TransCanada’s massive influence throughout North America, it is no wonder that the company is among one of Canada’s highest valued energy companies. Investors can feel comfortable with the company due to its huge and diverse portfolio, and continuing eye for success.

Blackberry Ltd. (TSX:BB): Many don’t realize that Blackberry is actually providing mobile cybersecurity for government agencies worldwide. It’s also playing security consultant. A major victory for BB came in July when it won the right to sell its secure messaging tools to the U.S. government. That means it was endorsed by the NSA.

Stocks are up over 56% this year, and investors have taken notice. Blackberry has moved well beyond its roots of a simple cell phone manufacturer, and the company is on track to maintain its impressive growth.

Celestica Inc. (TSX:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last year’s.

While many investors thought the stock was overvalued after a stellar run in 2016, the recent correction and volatility in the stock has attracted new buyers and the stock has recovered since.

While telecommunications stocks have been volatile recently, defense, IT and aerospace industries have outperformed and while many see limited upside, these industries continue to surprise both investors and analysts.

Absolute Software Corporation (TSX:ABT): This Vancouver-based company offers endpoint security and data risk-management solutions, and this year has seen a share price jump of over 27%. Revenues are also up, and it looks like it’s on a path of securing strong new customers. The pipeline looks great, and forecasts for next year have been increased.

With strong management and an innovative team, Absolute Software is drawing growing investor attention. Absolute has seen a strong 21% stock growth year to date and is expected to see strong growth as the cyber security market grows at a rampant pace.

EXFO Inc (TSX:EXFO): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking statements in this news release include statements that Carl Data’s data scientists can continue developing breakthrough machine learning abilities into their software, that the custom closed control system can predict events that may lead to critical infrastructure failures up to seven days into the future, that Carl Data can precisely monitor and analyze the vibration of pipelines and predict maintenance of infrastructure which can save millions and prevent possible disasters; that revenues could grow substantially (and double in one year), that sensor anomaly detection will result in a number of new clients and revenue sources, that specific projects are expected in Dallas and elsewhere, that Carl Data’s technology may be able to prevent disasters resulting from infrastructure failure, and that the Company will be able to train some of the most powerful machine learning applications for waste water ever developed.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks with respect to: that Carl Data’s data scientists may not be able to continue developing breakthrough machine learning abilities into their software, that machine learning and Carl Data’s technology in general may not achieve the expected results and its accomplishments may be limited, that the use of past data may not enable accurate predictions as expected, Carl Data may not establish a market for its services as expected; competitive conditions in the industry; general economic conditions in the US, Canada and globally; the inability to secure additional financing; competition for, among other things, capital and skilled personnel; potential delays or changes in plans with respect to deployment of services or capital expenditures; possibility that government policies or laws may change; technological change; risks related to Carl Data’s competition who may offer better or cheaper alternatives; Carl Data not adequately protecting its intellectual property; interruption or failure of information technology systems; and regulatory risks relating to Carl Data’s business, financings and strategic acquisitions. The Company disclaims any intent or obligation to update publicly any forward-looking information other than as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Carl Data ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Carl Data to conduct investor awareness advertising and marketing for (CSE:CRL; OTC:CDTAF). Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.