Cabot Oil and Gas (ticker: COG) is building steadily within its core Marcellus and Eagle Ford assets, through cost reduction in drilling and completions and through the addition of wells in both areas.

In its Marcellus play, Cabot expects to drill 60 wells and complete 51 over the course of 2017. This development is on top of an existing 517 net horizontal wells, as of the end of 2016.

Similar growth is mirrored in Cabot’s Eagle Ford assets, with an expected 30 wells drilled and 39 completed in 2017, on top of an existing 207 net producing horizontal wells as of the end of 2016.

In both fields, gains in efficiency have made it possible for Cabot to accelerate growth. A 12% decrease in cost per foot for Marcellus wells, and a 13% decrease in Eagle Ford drilling costs have helped fuel Cabot’s addition of new wells in both areas. Efficiency gains were measured sequentially from the end of 2016 to the end of Q1 2017.

Achieving 30% higher production per foot in the Eagle Ford

In its Eagle Ford assets, Cabot has also reported a 30% increase in oil production per foot since early 2016, due to advancements in its completion design. The new completions program features the use of larger amounts of proppant, at 2,000 lbs./ft. versus the previous 1,600 lbs./ft.; smaller cluster spacing, at 25 ft. versus the previous 60 ft.; and the use of intra-stage diversion, which the previous design lacked.

A similar increase in productivity was visible in the Marcellus between the Q1, 2017 and the 2016 type curves with an increase of 14%. While Cabot did not institute a new completions design for the newer Marcellus wells, Dan Dinges—CEO and President of Cabot Oil and Gas—in the May 2017 earnings call, attributed the rise in production to “enhanced cluster spacing,” and adjustments in “pump pressures and pump rates,” which culminated in gains in near wellbore conductivity.

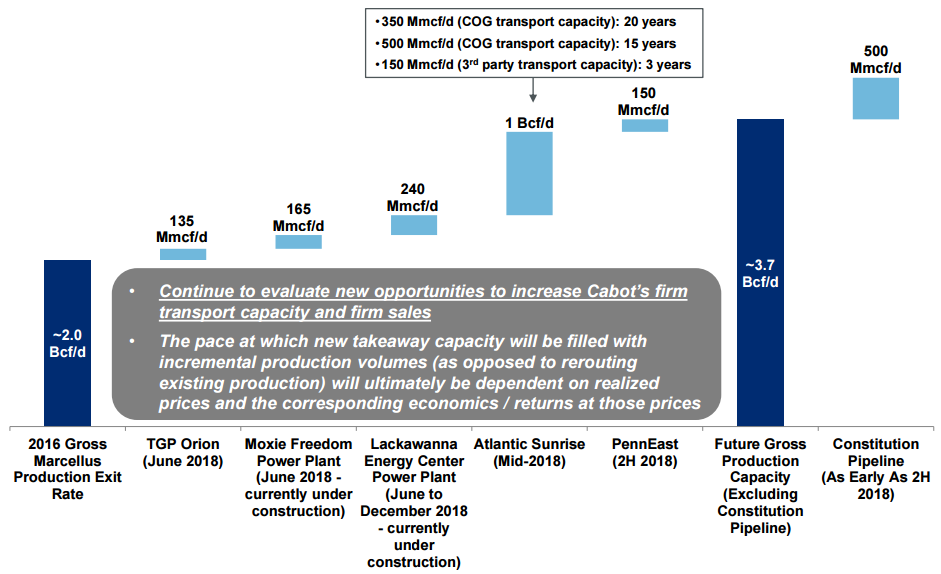

Scheduled 2018 Marcellus takeaway additions could be Cabot’s platform to almost double production

Cabot is enthusiastic about its ability to increase production in line with growing takeaway potential in the Marcellus area. Cabot’s 2016 gross Marcellus production exit rate was approximately 2.0 Bcf per day. Cabot believes that the TGP Orion, Atlantic Sunrise, and PennEast pipelines will create a cumulative takeaway potential of 1.285 Bcf per day, and that the Moxie Freedom and Lackawanna Energy Center power plants currently under construction will create a cumulative takeaway potential of 405 Mcf per day.

Cabot believes that the above increases in takeaway potential, if they come online in 2018 as projected, could allow it to increase gross production exit to approximately 3.7 Bcf per day in the Marcellus in 2018.

Cabot presenting at EnerCom

Cabot Oil and Gas will be presenting at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.