Cabot Oil & Gas (ticker: COG), a large-cap E&P with operations in the Marcellus and Eagle Ford shales, reported company records for production and net income excluding selected items in its year-end 2014 earnings release. Full-year production in 2014 was 531.8 Bcfe – an increase of 29% compared to 2013, including liquids production of 3,961 MBO – 23% higher than 2013.

2014 operating revenues climbed to $2,173 million and net cash from operations reached $1,236 million, representing year-over-year increases of 24% and 21%, respectively. Fiscal 2014 net income was $104.4 million ($0.25 per share), but was higher than $325.0 million for the first nine months of 2014 before the commodity downturn. If considering the Net Income Excluding Selected Items table issued in the news release, COG’s 2014 income was $404.5 million, which is 36% above 2013’s total of $298.1 million.

Source: COG Nov. 2014 Presentation

The company reported total debt of $1,731 million, equaling a debt to market cap ratio of 44%. In EnerCom’s E&P Weekly Database for the period ended February 13, the median ratio for 89 covered companies is 58%, meaning COG is still on the low end of the debt spectrum. Its drilling efficiencies have supported its balance sheet: COG has the third lowest three-year finding and development costs of all companies listed on the Weekly.

Its asset base also provides additional room for cash flow, as evidenced by its asset intensity (defined as the percentage of EBITDA necessary to maintain production) of 32%, meaning $0.68 on every dollar can be reinvested into growth or paying off debt. The median asset intensity in EnerCom’s Weekly is 56%. Discretionary cash flow in 2014 increased by 16% year-over-year to reach $1,271 million, and the company committed $139 million to repurchase 4.3 million shares throughout 2014.

Dan O. Dinges, Chairman, President and Chief Executive Officer of Cabot, did not rule out potential acquisitions in the near-term. “A lot of opportunity occurs to those that have a strong balance sheet and optionality in a down market,” he said in a conference call following the release. “We’re certainly one of those companies.”

Cabot’s Stakehold: The Marcellus

Operations in the Appalachia attributed for 93% of all volumes in fiscal 2014 and produced an average of 1,491 MMcf/d in Q4’14. New wells are also coming online, as the company drilled 75 of its 200 gross wells in the quarter. Its 2014 drilling program completed 19 more gross wells than it did in 2013, and 100% of the operations were successful. COG’s efficiency in the region is well documented: Pennsylvania’s top 16 producing wells (cumulatively) for 2H’14 all belonged to Cabot, according to data from the state’s Department of Environmental Protection.

COG’s proved reserves also increased for the fifth straight year primarily through its ongoing Marcellus operations. The company reported 7.4 Tcfe of proved reserves at year-end 2014 – an increase of 36% compared to the prior year. 96% are natural gas, while 61% are classified as proved developed producing assets.

Source: COG Nov. 2014 Presentation

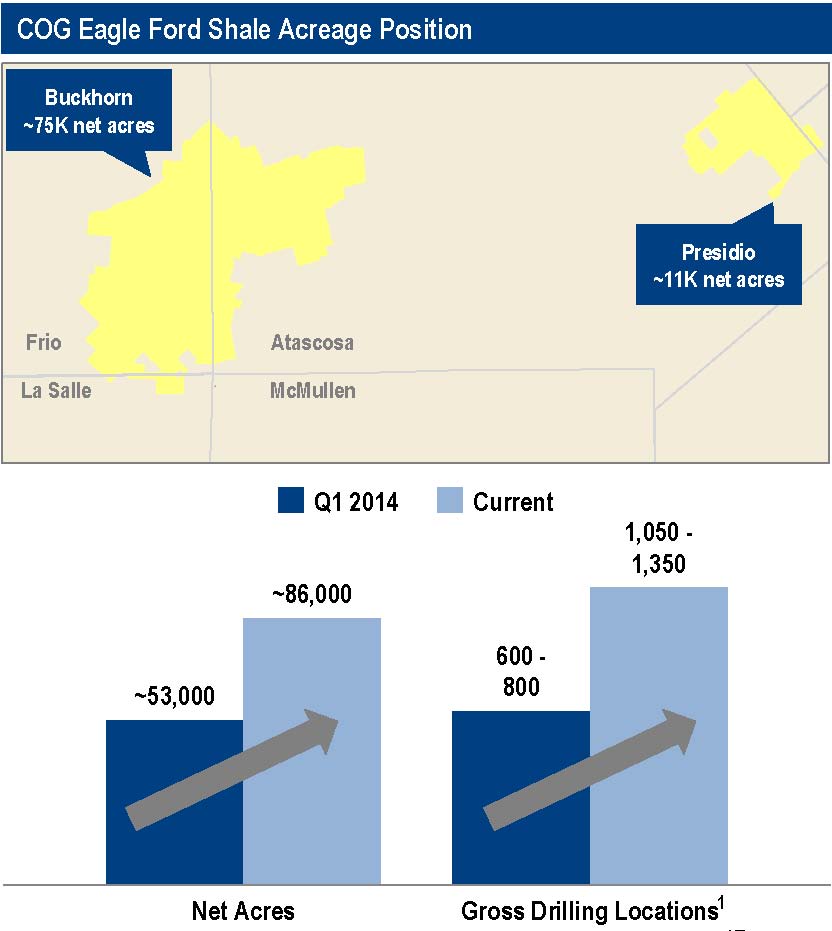

The Eagle Ford is Up-and-Coming

COG doubled its Eagle Ford production on a year-over-year basis, reaching average volumes of 14.8 MBOEPD (96% liquids) in Q4’14. Contributing to the volumes were 20 wells placed online in the quarter, with four of the wells (downspaced to 300 feet between laterals) combining for 210 MBO in their first 60 days of production. Plans for 2015 include drilling approximately 45 wells, placing 40 to 45 online and have 20 total wells waiting on completion by year-end.

“A More Measured Approach”

Cabot plans on dialing down its drilling operations in 2015, reducing its Marcellus rig count to three from its current level of five by the end of Q2’15. COG plans on running one rig in the Eagle Ford, down from its current count of three. In the call, Dinges said the reduction is “a more measured approach” to the commodity environment. “However, given the low-capital intensity of our operations, we can remain flexible to accelerate our pace of operations if market conditions and new takeaway capacity warrant,” he added.

Average well costs in the Marcellus and Eagle Ford range from $6.0 to $6.5 million, and the company plans on drilling and placing online 110 to 115 wells in fiscal 2015 (70 in the Marcellus). When asked about Eagle Ford activity, Dinges said: “We’re not impressed with the returns at $50 [per barrel]. At $60, $65, certainly, it has a return profile that starts getting attractive again.”

In relation to the drilling program, COG’s total 2015 expenditures will consist of $900 million (down from October’s guidance of $1.53 to $1.60 billion), with 80% directed for drilling and completions. The Marcellus will receive the lion’s share of the capital, with a $432 million budget (60%) for D&C. Despite the tightened purse strings, Cabot still believes it can achieve production growth of 10% to 18%, which would place full-year midpoint production at greater than 600 Bcfe. Approximately 28% of its natural gas production is hedged.

Source: COG Nov. 2014 Presentation

Constitution Pipeline

The Constitution Pipeline was a popular topic in COG’s conference call. The pipeline, which management believes will take as much as 0.5 Bcf/d of Cabot’s production to new markets and price points, is awaiting the final permits needed to move forward. Public commentary will end on February 27, 2015, and COG and its partners will immediately move forward by applying to the Federal Energy Regulatory Commission for a construction permit. Williams (ticker: WMB) will be the operator of the pipeline.

Dinges said COG’s backlog of wells, which is expected to be in the range of 40 to 45, is by design. Regarding the impending pipeline, he said: “Those wells that we’ll have by the end of 2015 will be able to build our volumes into the expected commissioning date of 2015… We expect continued efficiency gains in our 2015 program, which I think is going to translate into maybe higher IPs and higher EURs which would allow for a more rapid increase in the amount of deliverability leading up to Constitution.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Capital One Securities (2.20.15)

Neutral. 4Q results in line and we think 2015 guidance is neutral as CAPEX is ~35% below the Street expectation with production only ~6% below the Street forecast. We think the resulting combo of lower cash flow estimates will be largely offset by lower projected net debt (and thus EV) levels, which should leave COG’s 2015 - 2016 EV/EBITDA multiples directionally unchanged at ~9.5x and ~8.5x, respectively. We do think, however, that the Street’s expectations for COG’s gas price realizations this year are too high, so we expect that could continue to pressure estimates. In October, COG provided 2015 CAPEX/production guidance of $1.53B - $1.60B with 20% - 30% growth. Today COG reduced the 2015 capital budget to $900MM (-40% y/y) and is now calling for 10% - 18% production growth. The new budget is 36% below the Street’s $1.41B expectation and 35% below our $1.39B expectation. The new implied production guidance range is 1,603 – 1,719 MMcfe/d. The 1,660 MMcfe/d midpoint of the range is 6% below the Street’s 1,774 MMcfe/d estimate and 6% below our 1,759 MMcfe/d estimate. Even though COG expects 10% - 18% growth in average volumes in FY15, guidance implies that COG’s volumes will be flat throughout the year vs the 4Q14 rate of ~1,650 MMcfe/d. The updated budget assumes $2.45/Mcf gas realizations in 2015 vs mgmt’s original expectation $2.80/Mcf. 4Q EPS was 23c vs 22c both Street/COS. 4Q CFPS was 78c vs 80c/76c Street/COS. While production vols beat our model, the impact was offset by lower-than-expected oil and gas realizations. The slight CFPS beat vs our model was driven by cash costs that came in 3% below our est. Production was +15% q/q at 1.65 Bcfe/d, which matched the Street’s estimate and was 2% above our 1.62 Bcfe/d est. COG’s avg 4Q pre-hedge gas differential was ~$1.16/Mcf, which slightly widened from ~$1.15/Mcfe in 3Q and was above our $1.11/Mcfe est. COG announced YE14 proved reserves of ~7.4 Tcfe (+36% y/y), reserve replacement ratio of 466%, and total company F&D cost (excluding purchases of reserves in place) of 65c/Mcfe. YE14 pre-tax proved PV-10 was $8.6B, a 38% y/y increase. On the call, we will be looking for progress on NY State approval of Constitution. The end of the public comment period was recently extended from Jan 30 to Feb 27.