Cabot Oil & Gas (NYSE: COG) announced Q2 results, showing net income of $42.4 million, or $0.09 per share.

Highlights

- Daily equivalent production of 1,895 MMcfe/d

- Adjusted net income of $57.9 million

- Net cash provided by operating activities of $273.9 million

- Discretionary cash flow of $196.5 million

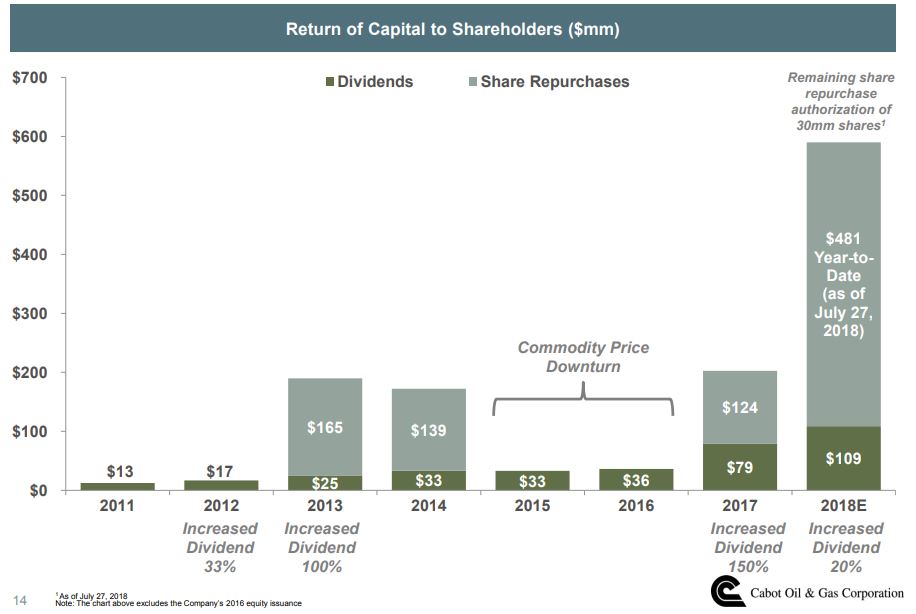

- Returned $239.6 million of capital to shareholders through dividends and share repurchases

- Improved operating expenses per unit by eight percent YOY

Current operations and outlook

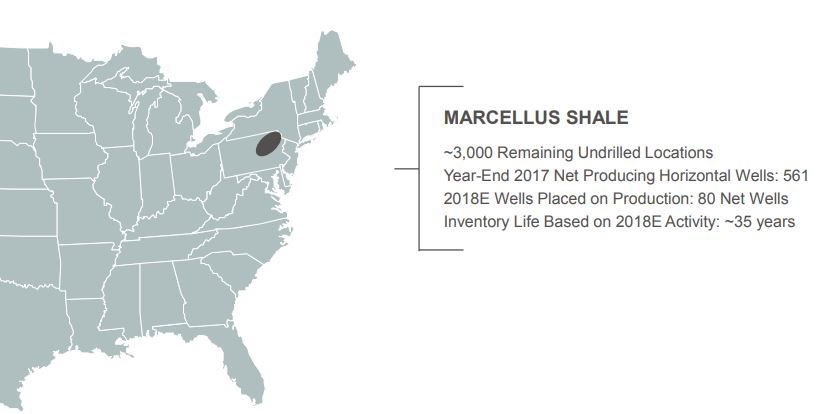

Cabot is currently operating three rigs and two completion crews in the Marcellus Shale and plans to place 37.0 net wells on production in conjunction with the anticipated in-service of the Atlantic Sunrise pipeline project during the second-half of August 2018.

Cabot in Q2 closed on the sale of its oil and gas properties in the Haynesville Shale for net proceeds of $29.2 million, which included a $5.0 million deposit that was received in the fourth-quarter of 2017 making Cabot a pure play E&P focused on the Marcellus.

The company has also updated its 2018 daily production growth guidance range from 10 – 15 percent to 10 – 12 percent and increased its full-year capital budget by $10 million to $960 million to reflect additional spending associated with its equity ownership in the Atlantic Sunrise pipeline project.

Share repurchase program expanded

Cabot repurchased 11.6 million shares at a weighted-average share price of $23.54, including 1.6 million shares that were previously reported in the first-quarter 2018 earnings release. Over the past year the company has repurchased 20.0 million shares at a weighted-average share price of $24.09 and since reactivating the share repurchase program in Q2 2017, Cabot has reduced its shares outstanding by over five percent to 441.2 million shares.

Additionally, the board of directors has authorized an increase of 20.0 million shares to the share repurchase program, bringing the current remaining authorization to 30.1 million shares. Based on the closing share price on July 26, 2018, the program implies approximately $745 million of additional share repurchases.

Q & A

Selected Q & A from Cabot Oil & Gas’ Q2 earnings call included below:

Q: Dan, in your prepared remarks, you’d talked about the Upper Marcellus tests that you’ve drilled in the past. I know it’s not been the focus of yours right now. Can you just talk about what assumptions you’ve made in that? You guys have laid out before like a 20-year production forecast. What assumptions are made in that forecast for the Upper Marcellus?

Chairman, President, and CEO of Cabot Oil & Gas, Dan O. Dinges: The 20-year forecast that you’re talking about, we’ve assumed the – where we are today and what we’ve seen, Drew, with the 30 completions that have been completed in our old technique. We’ve assumed the 2.9 Bcf in that forecast.

Q: Okay. And I guess just looking at share repurchases, obviously, you guys came out and increased the program here. But I guess if I just sort of look at that high level, we have kind of seen some weakness in NYMEX gas prices. I know you guys also had this debt repayment that you had to recently make here over the last couple of weeks. Irrespective of that stuff, I mean, do you guys still plan on being pretty aggressive here in H2 with the buyback program?

Chairman, President, and CEO of Cabot Oil & Gas, Dan O. Dinges: Yeah, Leo, the conversation again at our board meeting this week was specifically along the lines that I have mentioned in the past. And that was that our authorization is not optics, it is for action. And that is our intent to execute on the authorization that the board has granted. So, the takeaway would be that we fully intend to continue our program that we’ve implemented.

Q: I know in the past you said all of the Atlantic Sunrise, when it comes online, are going to be taking volumes that go from – that are in the local market on to Atlantic Summers. But is it possible that you’re not actually going be delivering your Bcf a day on within a couple of weeks of startup, that you’re going to ramp to that?

Chairman, President, and CEO of Cabot Oil & Gas, Dan O. Dinges: On Atlantic Sunrise?

Q: Right.

Chairman, President, and CEO of Cabot Oil & Gas, Dan O. Dinges: Charles, we’re planning on utilizing the capacity available in Atlantic Sunrise as soon as it is available. The connection to our gathering system of the upstream portion of Atlantic Sunrise is designed to take the volume of gas that we committed to, and it is our full intent to deliver the gas as soon as Atlantic Sunrise will take it.

One of the things on our conservatism, I wasn’t trying to be cute on the comment on conservatism, Charles, but one of the things that, I think, is relevant, the ramp-up and shifting in a small area, a Bcf of gas and coordinating two power units that are coming on at the same time and moving gas around in a small geographic area is done with the switch of the valves, I guess, but it’s multiple valves, it’s multiple coordination, to get it done and get it all smoothed out.

So in light of the time of year, which the shoulder month time of the year, when you get a little bit of the early cooler weather, it ramps up the pressure in the pipes, the pipes that are within the basin and the amount and volumes that the pipelines will accept at the higher pressure starts creating some reduction in the volumes that you’re going to be able to put into the pipe. That has happened every year back-to-back, back-to-back without exception.

Q: Okay. And then, I guess, the other side is just kind of following up a little bit on the exploratory programs, but in the context of the dividend – I’m sorry, the buyback. You talked about one thing that has been a kind of gating item for the buyback has been getting the infrastructure up and running and commissioned, as expected. Just wondering to what extent has – or have the exploration programs also been kind of governors on committing even more in a way of buybacks? And to the extent you did see or you did move on, let’s say, from the second program, would it be fair then to assume you’d see another big step-up in buybacks, or any commentary along those lines?

Chairman, President, and CEO of Cabot Oil & Gas, Dan O. Dinges: Well, the exploratory portion of our available cash has not influenced our decisions on the level of buybacks. We anticipate our buyback program to be, as we’ve laid out, opportunistic. And it dovetails now – along with the comment I made on dividends, it dovetails now with our anticipation of both in-basin power demand and our commissioning of Atlantic Sunrise. So, the amount of money compared to Cabot’s available capital and cash that’s being allocated to the exploratory effort is de minimis. And it does not impact our decision on buybacks.

The Oil and Gas Conference®

Cabot Oil & Gas is presenting at EnerCom’s The Oil & Gas Conference® at the Denver Downtown Westin Hotel, Denver, Colo. Aug. 19-22, 2018. EnerCom expects to have more than 80 presenting oil and gas companies and more than 2000 financial professionals attending this year’s conference.

To learn more about the conference and presenter schedule please visit the conference website here.