Cabot Oil & Gas (ticker: COG) is the second-largest producer by volume in the Marcellus Shale, but the E&P continues to dial up operations in another prolific shale play: the Eagle Ford.

On September 24, 2014, Cabot announced the acquisition of 30,000 net acres in the Eagle Ford – 17,000 of which are near the company’s Buckhorn operating area. The properties were purchased from an undisclosed seller and include current production of 1,600 BOEPD (92% liquids). Pro forma for the acquisition, Cabot now has 83,000 net Eagle Ford acres with 60,000 net acres in the Buckhorn. A total of 191 net locations have been identified based on an average lateral length of 6,500 feet.

A Tenth Rig Joins Cabot’s Fleet

Cabot has added a fourth rig to its Eagle Ford position, resulting in the expected drilling of 55 total wells in 2014. An investor presentation on September 2, 2014, forecasted total Eagle Ford wells at 40 to 50 for the fiscal year.

Cabot has added a fourth rig to its Eagle Ford position, resulting in the expected drilling of 55 total wells in 2014. An investor presentation on September 2, 2014, forecasted total Eagle Ford wells at 40 to 50 for the fiscal year.

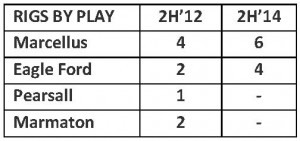

Six rigs are currently running in the Marcellus, and, as indicated by the table on the right, Cabot has simplified its portfolio to operations in the Marcellus and Eagle Ford.

Eagle Ford Accumulation

Cabot’s operations in south Texas were focused on the Pearsall Shale as recent as two years ago, but its results in the Eagle Ford have represented a game change in the company’s direction. During EnerCom’s The Oil & Gas Conference® in 2011, Cabot had 36,830 net acres in the Buckhorn with 11 producing horizontal wells. Lateral lengths averaged roughly 5,000 feet and 30-day IP rates hovered around 500 BOEPD. By TOGC 2012, the company had boosted its position to 72,267 net acres and began testing treated laterals and increased the number of hydraulic fracturing stages.

As indicated by the chart above, Cabot was in the learning curve in 2012. Today, its wells average the return of Wells A and D – the best of its four-well test in 2012. The numbers began to accelerate in Q3’13, around the time COG divested its Marmaton assets. One of its jewels, the Pickens well, was drilled by one of two Eagle Ford-based rigs and produced 125 MBOE in 200 days on production. The well was still producing 600 BOEPD at the 200-day mark.

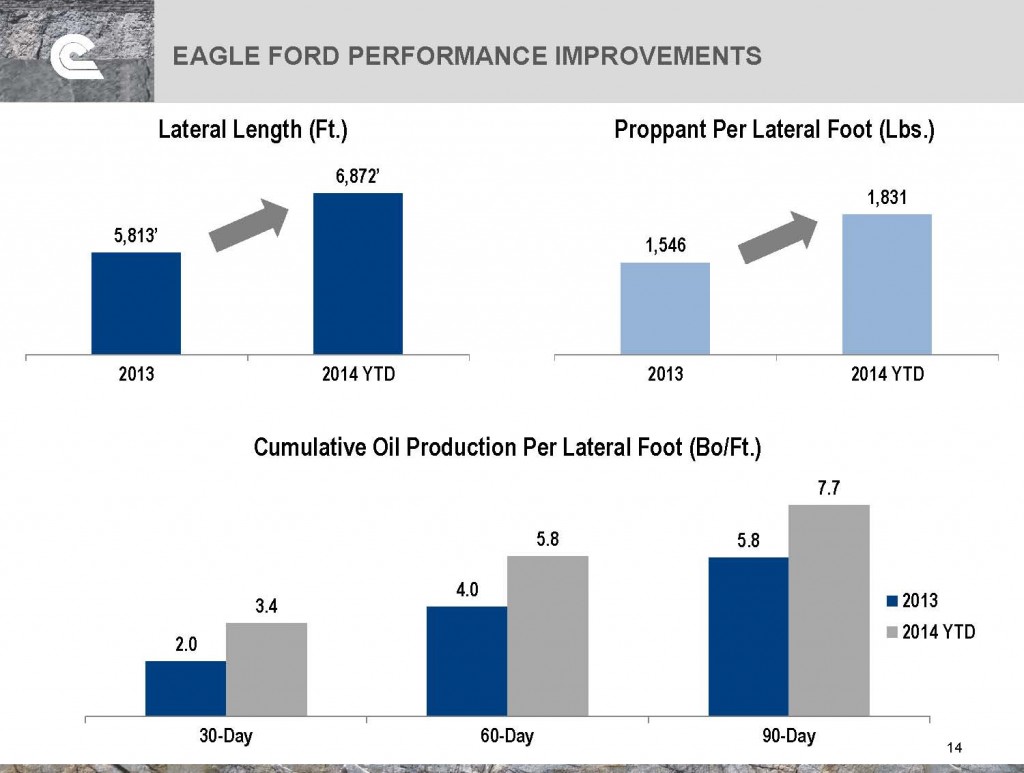

Cabot’s Completion Efficiency

COG’s Marcellus efficiency is evident by completing nine of the top ten producing wells in the first half of 2014. Its return per foot is also among the best of its peers, according to COG’s most recent presentation. The Eagle Ford is also a beneficiary of COG’s drilling techniques, and the company is testing lateral downspacing at 300 feet as opposed to its regular distance of 400 feet. If the downspacing test is successful, management believes its potential drilling locations will increase by 25% to 30%.

“We have further reduced our stage spacing in the Eagle Ford and modified the profit size we use in our frac jobs both of which have resulted in a significant increase in fracture conductivity,” said Dan Dinges, President and Chief Executive Officer of Cabot Oil & Gas, in the company’s Q2’14 conference call. “In the second quarter, our average stage spacing decreased 15% compared to the average spacing for our 2013 program. This equates to more stages per well and more profit per lateral foot. In 2014 we have also increased our profit per foot by 15% to 20% over our 2013 levels.”

Source: COG September 2014 Presentation

Recent results from Q2’14 included an average of 840 BOEPD (92% oil) from 10 wells averaging a lateral length of 6,700 feet, which is 25% longer than those used in 2013. The results were enough for Dinges to publicly declare COG’s intention to boost its position in the Eagle Ford.

“The ten wells are trending above this type curve for the Eagle Ford economics that we have presented and certainly our realized price is higher than the $90 that we’ve represented to get over that 60% return,” Dinges said. “So we are looking at additional opportunities with economic improvements that we’ve seen and the efficiency improvements that we’ve seen to take advantage of any additional acreage we can find.”

COG management also spoke of adding another rig to its Eagle Ford acreage in 2015, dependent on the timing of new acquisitions. With its new acreage, COG will now enter the next fiscal year with its additional rig already in the midst of operations in South Texas.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

KLR Group - (9.24.14)

COG ($31.59, A, $42) – Reasonable Northern Tier Oil Window Eagle Ford Acquisition, Gross Marcellus Production Tracking 3Q/14 Exit Rate, ’14 Production/Capex Refinements – Cabot announced the acquisition of additional acreage in the Eagle Ford and an update on its guidance/share repurchase program. The company acquired ~30,000 net acres in the Eagle Ford for ~$210 million including ~17,000 net acres near COG’s Buckhorn area in Atacosa, Frio and LaSalle Counties, TX. Current production from the properties is ~1,600 Boepd (~92% liquids) and assuming ~$70k per flowing Boe, the acquisition equates to a reasonable ~$3,300 per acre net of production. Additionally, Cabot added a fourth rig in the Eagle Ford. The company increased its ’14 capital plan ~$75 million to $1.45-$1.55 billion and increased its ’14 drilling activity guidance to 165-175 net wells (~55 net Eagle Ford wells) from 150-170 net wells (40-50 net Eagle Ford wells). Cabot anticipates production to grow ~2% q/q, below our growth expectation of ~8% q/q, due to infrastructure constraints. Exiting 3Q/14, gross Marcellus production reached ~1.68 Bcfpd, tracking our expectation. Additionally, the company downwardly revised the top end of its ’14 production guide to 530-555 Bcfe from 530-585 Bcfe. Preliminarily, we expect to remain at the lower half of company guidance. Further, COG reaffirmed its ’15 production growth guidance of 20%-30%. Currently, we are at the mid-point of ’15 growth guidance. In 3Q/14, the company purchased ~2.7 million shares, ~0.7% of total shares outstanding. This announcement should have a minor positive value impact due to the Eagle Ford acquisition/additional rig as gross Marcellus production is tracking our 4Q/14 expectation.