Callon Petroleum Company (ticker: CPE) reported results of operations for the three months and full-year ended December 31, 2017.

Financial and operational highlights

- Full-year 2017 production of 22.9 MBOE/d (78% oil), an increase of 50% over 2016 volumes

- Fourth quarter 2017 production of 26.5 MBOE/d (79% oil), a sequential quarterly increase of 18%

- Year-end proved reserves of 137.0 MMBOE (78% oil), a year-over-year increase of 50%

- Organic reserve replacement(i) of 566% of 2017 production at a “Drill-Bit” finding and development cost concept(i) of $8.21 per BOE on a two-stream basis

- Reduced lease operating expense to $4.84 per BOE in the fourth quarter of 2017, a sequential quarterly decrease of 5%, contributing to a total reduction of 27% since the first quarter of 2017

- Generated a fourth quarter operating margin of $40.51 per BOE

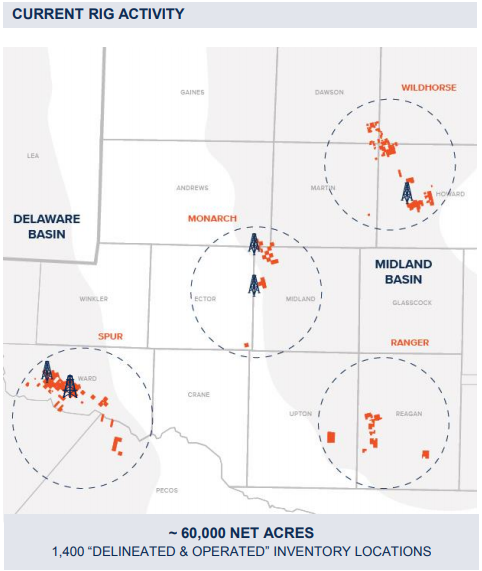

- Currently operating five horizontal rigs and two completion crews

According to the company’s press release, by December 31, 2017, Callon Petroleum was producing from 232 (171.8 net) horizontal wells from eight established flow units in the Permian Basin. Compared to the same period in 2016, Callon increased its net daily production by approximate 44% to 26.5 MBOEPD (approximately 79 percent oil). The total full year average production for 2017 was 22,940 BOEPD (approximately 78 percent oil), reflecting a 50 percent growth compared to 2016 volumes.

Midland Basin

In Q4 2017 over 50 percent of well put on production were form the WildHorse area, averaging completed lateral lengths of approximately 7,300 feet. The Wildhorse area is a key component of production growth for Callon, and is projected to comprise of 30 percent of total gross drilling activity in 2018. The Wolfcamp A bench will be a primary focus for development in the Wildhorse area in 2018, and average completed lateral lengths are projected to increase to over 8,000 feet.

In addition to the Wildhorse Area, six wells were put on production in the Monarch Area. The Lower Spraberry will be a key focus, due to the consistency of high returns. The three-well Kendra pad, with average completed lateral lengths of approximately 10,350, has produced over 236,000 BOE (87% oil) over the first 90 days online. Callon also initiated production from the first multi-well pad that utilized recycled flowback water, and plans to increase recycling activity in Monarch for upcoming wells.

Mega-Pad concept

In 2018 Callon plans to incorporate two separate “mega-pad” concepts incorporating simultaneous development of two contiguous three-well pads. Each bad will be drilled concurrently and all six wells will be placed on production at the same time. The pads are expected to be put on production during the second half of 2018.

In the Reagan County at the Ranger area, Callon completed its first Wolfcamp C well, along with two Lower Wolfcamp B wells. The wells began flowback in January 2018. The Wolfcamp C well is producing over 1000 BOEPD (85-90 percent oil) on natural flow, and is still in the process of establishing a peak rate. In 2018 Callon plans to drill four gross additional wells in Wolfcamp C with an average working interest of approximately 55 percent.

Delaware Basin

Callon recently completed its first two-well pad and added a second rig to its Spur development program in February. To accommodate the increased activity, Callon plans to enhance existing saltwater disposal capacity to overall 100,00 bpd with a connection to a pipeline system operated by Goodnight Midstream. Callon is in the final stages of establishing a recycling program in the area, and is projected to use up to 50 percent recycled volumes for completions by the end of 2018. In Q4 2017, the Saratoga 7La well came online and has produced an average daily rate of 1,015 BOEPD (83 percent oil) for its first 56 days of production.

CAPEX, financial results, and proved reserves

Operational capital expenditures for the Q4 2017 was $115.8 million, compared to $113.4 million for Q3 2017. Callon also divested certain infrastructure during Q4 for proceeds of just over $20 million.

Callon reported total revenue of $118.2 million for Q4 2017 and total revenue including cash-settled derivatives of $113.7 million. Lease operating expenses for Q4 2017 was $5.41 per BOE, compared to $5.60 per BOE for Q3 2017. Production taxes were $2.55 per BOE, and DD&A was 14.98 per BOE for Q4 2017.

AS of December 31, 2017, Callon estimated total proved reserves at 137 MMBOE, which represents a 50 percent increase over the previous year-end. Callon added a total of 47.4 MMBOE in 2017 from horizontal development properties, replacing 566% of 2017 production as calculated by the sum of reserve extensions and discoveries, divided by annual production.

Conference Call Q&A

Q: So, I had a question on well interference, we’ve heard a number of your peers talk about parent-child relationships and two-type spacing. How do you see these risks for Callon – or the industry and what steps have you kind of taken to mitigate these?

Senior Vice President and COO Gary A Newberry: That’s something that we’re all learning about together as we go forward. We’ve been stepping into this in a way that, I think, has been very educational and learning. Frankly, part of the reason we’ve actually gone to pad development from the very beginning was to minimize that impact early on throughout the entire lifecycle of our drilling program. Since early time, we’ve been doing mostly pad wells.

But as we get into infill drilling, just similar to what we did in CASM, and really some parts of Ranger, we have the majority of our experience with parent-child relationship, de-watering or deferred – or watering out and deferred production and ultimately, the ability to effectively fracture stimulate the offset wells based on depletion.

So, there’s a lot of things that are impacting this entire relationship. But in total, as we’ve down-spaced in both the Wolfcamp B in Reagan County and as we’ve down-spaced the Lower Spraberry in Midland County primarily around all the things that we’ve actually published data on over the last several quarters, we think we’ve mitigated that impact quite well.

Now, the next step for us is to move to this larger pad development, which is what we’re moving through now and Monarch this year to further minimize and mitigate the impact of deferred production from de-watering existing wells as well as more effectively and efficiently propagating effective fracture stimulations into this shale development in a larger way.

So, we think it’s going well. I think it’s something as we continue to mature in each area that it’ll be different. But I think the data that we’ve shown you is that it seems to be working well and there will clearly be an impact. We’ve mentioned it before, there’s clearly an impact to that next well over, but it can be mitigated if planned properly.

Q: You guys have been early on in infrastructure build out. How much kind of headroom do you guys have over your production guidance in 2018, first, your current infrastructure or what you’ll have midyear?

Senior Vice President and COO Gary A Newberry: We’re well ahead of what our needs are, but our production growth both in water and oil is that we’re expecting that to be substantial. So, at the end of the day, we’ll never be finished. What we’ve done ourselves, frankly, in getting to pipeline infrastructure for water management, getting to our own deep disposal wells for water management, high-capacity deep disposal wells to avoid shallow hazards. We are now partnering with third-party companies to help actually manage some of that peak loading that we expect on some of these larger pad developments.

We’ve already announced actually in the Delaware Basin a long-term relationship with Goodnight Midstream and we’re anxious to talk about another relationship on water sourcing and disposal with another company that we’re working on right now, both in the Delaware as well as the Midland Basin. We’re just not quite ready to do that yet. We’re still working on a few other items with this other company, but they’re being very proactive in doing all the right things in our mind.

And the focus on recycle that we’ve had for a number of years is going to be very impactful in managing all of our needs throughout the area. So, I would say that we’re ahead of where we need to be, but we’re not quite done. That’s why we’re spending primarily money in the Delaware Basin yet to further enhance our ability to move water around to our own disposal wells and then ultimately to delivering into the Goodnight system.

Q: I was hoping we can maybe just start a little bit on the Saratoga well and the Delaware Basin. I was curious if this was one of the operating completions in which you intended on reining in proppant intensity and just overall completion intensity in an effort to get the well cost down. So, maybe if you can just talk a little bit more about the completion design and the cost?

Senior Vice President and COO Gary A Newberry: We pulled back sand loading a little bit on that well, just like we had intended to actually get another learning step on how we effectively stimulate a single well, as well as ultimately moving to multiple well pads in that area. This well is performing quite well based on what we see today. We’re happy with the performance. But there’s still more to learn as to how we go forward in the Delaware. But yeah, we pulled back on sand loading just like we said we would.

Q: I guess the Wolfcamp C, a nice result there. Curious about any updated thoughts on the Wolfcamp D? I know at one point, you did plan on testing the zone at Ranger in 2015. Just given some recent competitor results, do you think about testing that at any point this year?

Senior Vice President and COO Gary A Newberry: There’s a lot in that question, but, again, I want to emphasize we’re very focused on efficient development throughout the year, but we are encouraged with the Wolfcamp C in the Reagan County. It’s very early time. You guys know I don’t like talking about single well results. I’d never have, never will. It is a single well. We’re encouraged with it. It’s a well that is encouraging enough that we’re going to drill more wells. But I’ll tell you that I have as many questions about the well as I have answers. So, it’s still just a single well result with encouraging information early time.

So, with that, we’re going to do more. We’re encouraged that we’re actually able to participate near-term with another well as an OBO partner, carries on with one of the area wells down there soon. So, we’re anxiously learning about that. And we’re learning as much as we can from all the public results, of course, from the Parsley data that we can get because their Taylor well is an interesting well. This well doesn’t feel like a Taylor well to me, but it’s encouraging. So, I’ll just leave that the way it is with the Wolfcamp C.

Your last question was with the Wolfcamp D. And I think, again, I’m assuming still Reagan County because that’s where we had planned to drill one prior to pivoting at the end of 2014 to the Monarch area. There’s some very good results, very interesting results being delivered by offset operators there today and we’re very encouraged with that opportunity. We’re not prepared to go drill our own this year at all.

President and CEO Joseph C. Gatto: So, I think, overall, we do have some delineation work going on in both Midland and Delaware. But as it relates to our overall program, it is in the single-digits, on a percentage basis, in terms of capital exposed. So, some of that’s having some lower working interest, which helps us get into some more wells with lower capital exposed, but we have those opportunities, like you said, in the Wolfcamp D. They’re on the radar screen. It’s just probably not on this radar screen for 2018, but it’s good to see those results continuing to come in the de-offsetting as in Reagan.

Q: The 2018 plan includes progressing larger pad development concepts that you discussed, the mega pad in Monarch, for example. Other than this development, what’s the average pad size for 2018 versus 2017? And what do you think the optimal pad size is, given your footprint, and whether or not the pad size plays into any execution objectives you have for this year?

Senior Vice President and COO Gary A Newberry: We’re really focused on fully understanding the asset base in its entirety in the Delaware Basin. And even though we’ve just finished a two-well pad, we’re going to focus on single well pads primarily in the Delaware for this year. But in WildHorse, we’ll go to two and three-well pads. And that’s all aligned in some lease obligations as well as trying to mitigate this parent-child relationship that we talked about earlier, as well as deferred production.

So, it all depends generally on what our obligation wells are, how we want to mitigate future development impacts, as well as cycle time and efficient development for what we’re trying to do throughout 2018. Monarch is where we’re going to do the six-well pad. We invested in infrastructure several years ago. We’re well setup with our own disposal as well as third-party disposal, as well as a recycle there to do that very efficiently. And we think that’s the best place to jump right into that.

We’re learning actually about a lot of things in pad size and development going forward. Given the pace that we think is a responsible pace to run and the capital levels to invest, we’re partners in some multi-level, multi-well pad development in Howard County with some of our offset operators and we’re learning a lot from that. So, more to come on it. It’s something as we think about it in a lot of detail in our planning process in order to effectively and efficiently bring value forward. It’s a little different in each area. But over time, we believe we’re headed to bigger and bigger pads.

Q: My question is on Delaware Basin and Ward County. You guys got some of the best acreage that I can think of. And just wondering if there’s any plan to look at the Bone Spring, because there has been activities from your competitors. And then, ultimately, when you look at the Delaware Basin, understanding how well you guys have worked your margins in Midland Basin, do you think you can approach similar cash returns in light of the probably higher water handling costs?

Senior Vice President and COO Gary A Newberry: We’ve got some great acreage in the Delaware. We’re happy to have it. We’re happy to go learn as much as we can about it this year through the planned and dispersed development program that we have. We’re very focused on reducing cycle time, managing costs out of system, as well as, as we’ve already discussed, building the appropriate infrastructure necessary to be very efficient with managing the higher water-loading that is associated with the Delaware. And I think we’re ahead of the curve there. I think that the innovative and creative solution we’ve gotten with Goodnight Midstream, I’ve already referenced it, and I can’t speak too much more about it other than the water sourcing arrangement that we have with a third-party company.

The water recycling system that we’re doing on our own self and do it with ourselves as well as in our own infrastructure is going to be very critical in managing costs. And so, we see plenty of opportunity to further improve the margins in the Delaware, similar to what we’ve done in the Midland Basin.

Q: Maybe I’ll just kind of get your latest thoughts on M&A. Are you looking to continue expanding your footprint? And if so, which area do you see the greatest opportunity to continue adding acreage?

President and CEO Joseph C. Gatto: I think, simply put, yes, we are continuing to look at expanding the footprint. The focus has largely been on continuing to bolt-on around our footprint in the four core operating areas and we’ve made progress in all four of them over the last several quarters. So, that’ll continue to be the priority.

There are some potentially larger transactions we look at, but the way we think about that is we want them to be in and around our existing footprint. We’re not looking to add a fifth core operating area at this point and grow our opportunities out there. There’s a lot of transactions that didn’t clear the market last year that are probably swinging back around, and we’ll watch. But the good thing is we have a very deep inventory right now to work on these smaller types of opportunities that are very value added. They fit into the drilling program near-term and bring forward the PV proposition.

Q: Throughout earnings to-date, gas evacuation has become a topical discussion point for Permian producers in light of growth plans within the region. While you guys are quite a bit older than your peers, could you comment on your thoughts on gas macro in the basin and how you position the firm to mitigate risk?

Senior Vice President and COO Gary A Newberry: I think you started off right, and would remind everybody that about 77% of our equivalent net production is oil. Of the remaining 23%, roughly one half is natural gas that is sold into the Waha market. We’re not seeing any flow concern issues to date. We have gas gathering contracts in place and our gatherers are incentivized to flow 100%. So, we’re not seeing those issues to date.

We are actively considering some basis trades to mitigate differential risk. I know that this is an issue throughout the basin for some, but I just want to highlight on a revenue basis, a $0.25 per MCF movement in Waha differentials will impact our total revenues by less than 0.5% or 1%. It’s really – for us, we have the flow capacity and it’s just not meaningful when you add it all up.

President and CEO Joseph C. Gatto: So, for us, there’s a financial element there that Jim had talked about. But when we started talking about this topic several quarters ago, it was really a focus on how do we move the gas volumes because we want the oil, right. I mean, we’re close to 80% oil in Delaware. It’s not like we’re differentiated between Midland and Delaware. So, the focus of the team was let’s make sure we can move the gas.

And I think going through that analysis, looking at the pipes and the takeaway, feel pretty comfortable that there is physical takeaway there. It might mean that you’re getting into gas on gas competitions in markets that are going hurt the Waha basis. But in terms of evacuating and moving the methane volumes, we feel pretty comfortable. There’s a pass out of the basin that just becomes a price aspect and we need to continue to work on how we mitigate some of those price impacts. Although, as Jim pointed out, even with some of that adverse movement, it’s pretty negligible in terms of the grand scheme of our revenue picture.