Callon reports 73% increase in year-over-year production

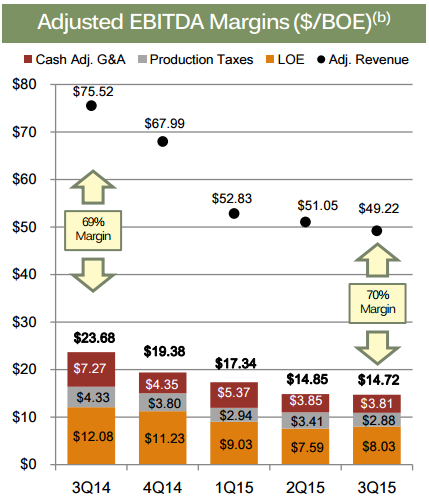

Callon Petroleum (ticker: CPE) announced its third-quarter 2015 results yesterday, showing a year-over-year production increase of 73%, 77% oil-weighted. The company reported an adjusted EBITDA margin of about 70%, compared to 69% a year ago, in large part to lower G&A and LOE costs. The company’s total adjusted EBITDA for the quarter amounted to $30.2 million, an 11% increase from $27.2 million in Q3’14, and a 5% decrease from Q2’15.

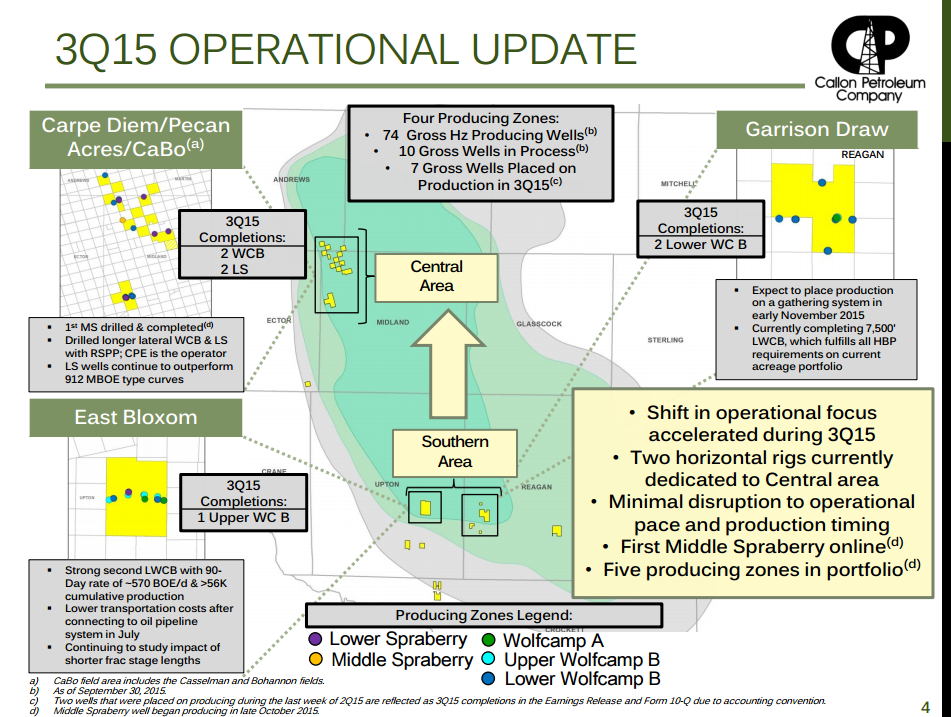

Net daily production reached 9,739 barrels of oil equivalent per day (BOEPD) in the third quarter from 78 gross (67.6 net) horizontal wells located in the Central and Southern Midland Basin, producing from five established zones including a Middle Spraberry well placed on production in late October 2015, according to Callon’s press release.

“We continue to focus on improving our operating cost structure and capital efficiency in the current environment,” commented Fred Callon, Chairman and Chief Executive Officer. “In order to advance our goal of funding our drilling program with internally generated cash flows by mid-2016, we made the decision in August to modify our operational plans and focus our two horizontal drilling rigs on our Central Midland acreage. We will focus on Lower Spraberry shale development through 2016, and will continue to monitor opportunities to develop the Wolfcamp A and Middle Spraberry as those zones are further delineated.”

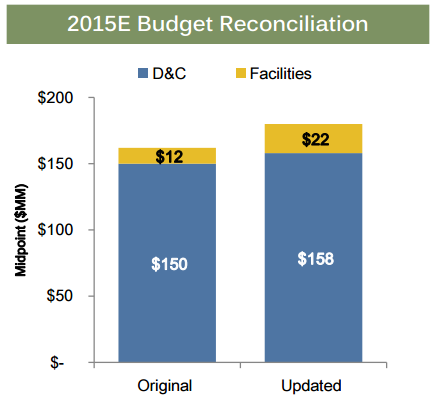

Callon said in its press release that it plans to make a shift in its operations to focus on its Central Midland assets, a move which the company feels it is well positioned to make given that its position is 100% held by production. As part of this shift, Callon decided to increase its capital expenditures budget for 2015 up 10% to $180 million to accommodate the change in drilling schedule.

For the quarter ended September 30, 2015, Callon reported total revenues including cash-settled derivatives of $44.1 million, comprised of oil revenues of $30.6 million, natural gas revenues of $3.7 million and the $9.8 million impact of settled derivative contracts.

About 24% of Callon’s average realized sales price on a per barrel basis was the result of cash-settled derivatives. According to the company’s Q3 financials, the impact of its cash-settled derivatives amounted to $13.64 per barrel, bringing the average sales price of a barrel to $58.03.

Discretionary cash flow for the third quarter of 2015 was $25.1 million, or $0.38 per diluted share, down 47% from the same quarter last year when the company reported discretionary cash flow per diluted share of $0.56.

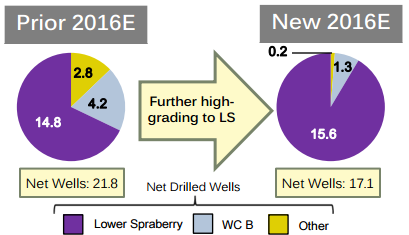

Focused on further high-grading in 2016

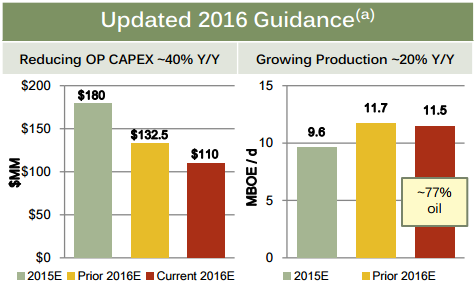

According to Callon’s Q3 press release, the company estimates that its capital budget for 2016 will be $110 million, 39% less than its updated 2015 capex budget. Previously, Callon anticipated a 2016 capex budget of $132.5 million, about 20% more than the new estimate. While the smaller capex budget did dampen the company’s expectations for production growth next year, Callon still expects output to grow by about 20% from 2015.

The focus of the 2016 capital budget will be to continue targeting the Lower Spraberry, where the company plans to approximately 15.6 net horizontal wells, about 91% of its planned wells for next year. The 2016 capital budget assumes a current well cost of $5.9 million for a 7,500’ lateral, Callon said in its press release.

The flexibility the company sees from its 100% held-by-production assets, along with focusing on its highest return assets in the Lower Spraberry, will leave Callon in a position to pursue acquisitions in the future Fred Callon said in the company’s press release.

“Callon was able to quickly pivot in the current environment due to a property base that is entirely held by production, with no drilling commitments that would prevent us from targeting our highest return opportunities,” he said. “We believe this unique flexibility will continue to benefit our operations in a volatile commodity price environment, and also create optionality to pursue acquisition and partnership opportunities that require near-term drilling to hold acreage.”