Luxury electric car maker goes to the trough for another billion dollars, sells 5% of company to Chinese Internet giant

“We are planning to produce 500,000 total vehicles in 2018, which is approximately double our prior growth plan”

Shares of Tesla Inc. (ticker: TSLA) pierced the $300 threshold in morning trading today, trading midday at about $303. Tesla’s perceived value is tightly tied to its outspoken founder Elon Musk —the guy with the great big, industry-disrupting ideas. Today’s trading range puts Tesla at a market cap of about $50 billion, while rival Ford Motor Company (ticker: F) tallies in at $45 billion, its stock trading at $11 and change.

Last year Tesla announced a very aggressive ramp up for the Tesla Model 3—Musk’s product idea for an affordable $35,000 luxury plug-in EV for everyman.

As soon as Tesla unveiled a Model 3 prototype and announced it had opened pre-sales for the Model 3, it was flooded by deposit checks—more than $700,000,000 worth of $1,000 deposits from buyers had arrived during the first six months, by the end of September 2016.

Receiving strong pre-orders with deposits is one thing. It’s another thing to ramp up logistics, personnel, supply chain and manufacturing systems to actually crank out thousands of high-tech vehicles that are so high-tech that Musk said last year that there was a supercomputer in every car, referencing the company’s announcement that it would include 100% autonomous driving hardware in every vehicle it manufactures, including the Model 3.

“So when we place parts orders with our suppliers, we’ve told them 1000 a week in July, 2000 a week in August, and 4000 a week in September. These are parts orders. Then the parts need to arrive, and they need to be turned into a car and the car needs to be delivered to customers,” Musk said in a conference call.

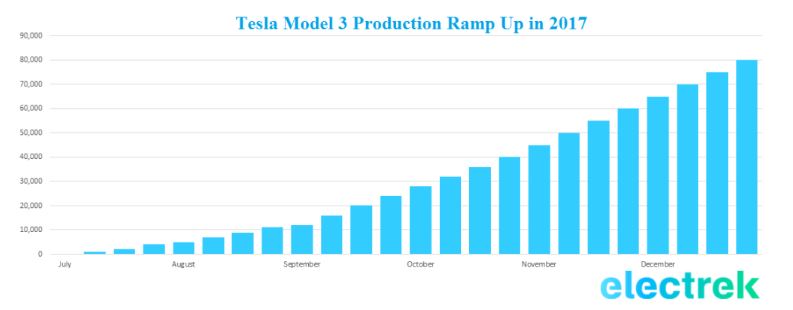

Based on Tesla’s parts orders and using a 10-day delay, “a perfect execution of a Model 3 production ramp climbs to about 80,000 units in 2017,” ElecTrek reported.

“That would barely make a dent in Tesla’s backlog of over 400,000 reservations and again, that’s assuming a perfect execution, which is near impossible,” according to ElecTrek.

Building 500,000 rolling supercomputers is going to require a lot of cash, not to mention brand new infrastructure to keep them rolling.

Heading back to the capital markets

“We plan to build 500,000 vehicles in 2018. Given this plan, we continue to invest heavily in capital expenditures,” Tesla declared in its 2016 10K SEC filing. “Our capital expenditure needs include expenditures for the tooling, production equipment and construction of the Model 3 production lines, equipment to support cell production at the Gigafactory 1, as well as new retail locations, service centers and Supercharger locations. We expect to invest between $2.0 billion and $2.5 billion in capital expenditures ahead of the start of Model 3 production in 2017.”

In March, Tesla filed an amended prospectus with the SEC to sell $250 million in common stock and another $750 million to $862 million in convertible senior notes due in 2022.

In its prospectus the company said it plans to use the proceeds of the $1.1 billion in new equity and debt “to strengthen our balance sheet and further reduce any risks associated with the rapid scaling of our business due to the launch of Model 3, as well as for general corporate purposes.”

Musk has recently sold chunks of the company to raise cash. In an SEC filing on March 24, Tesla reported it had sold 8.2 million shares to China’s Tencent Holdings (ticker: TCEHY), delivering a 5% stake in Tesla for $1.8 billion.

Tencent is a provider of Internet value added services in China, including China’s dominant chat app WeChat. Reports from BBC, TechCrunch and others believe Tesla is looking for more than cash. It’s looking for a bigger diving board into Asia, which could be where its best market for the Model 3 lies. Already, Chinese sales accounted for 15 percent of Tesla’s $7 billion revenue last year, says TechCrunch.

So here is the question: Can Musk’s Tesla Inc. successfully pull all the pieces together to triumph with the Model 3?

There are a lot of ifs:

- Can Tesla raise the needed ramp-up capital and not be eaten alive by debt or overdilute its shareholders?

- Can Musk’s team logistically succeed at getting the Model 3’s production to the point where the company can deliver hundreds of thousands of affordable luxury plug-in electric sedans with fully autonomous driving technology?

- Can Tesla’s engineers and technology team ensure that the vehicles’ onboard computer technology, something beyond imagination when engineers got man walking on the moon with sliderules, actually do cooperate in blissful unison to make operation of the car smooth?

- What about a large, highly qualified service network, even in the middle of nowhere?

- Will Tesla be able to hold its price point so that hundreds of thousands of car buyers will choose to purchase the Model 3 over comparable gasoline powered sedans—after all gasoline is selling for $2.00-$3.00 per gallon and gas stations/convenience stores are just about as plentiful as anything out there on the road, whereas official Tesla charging stations can take a bit of planning to get to. Tesla’s shows a global grid of official charging stations, chiefly in the U.S.—there are more than a hundred in California three in South Dakota and zero in North Dakota.

- Main question: will there be one actually close to where you are when your remaining charge runs down to 1% and you’re on I-80 between Cheyenne and Rock Springs in a March snowstorm?

Tesla discusses charging on its website

“For daily charging, most owners charge their vehicle at home or at their place of work. If you are installing your own equipment, we recommend a 240 volt NEMA 14-50 outlet or a wall connector on a 100 amp circuit. Learn how charging works, how to use a CHAdeMO adapter and how to install home charging equipment on our website. Adapters are also available for purchase to connect your Tesla vehicle to existing outlets.

“Your Tesla vehicle can charge at any Supercharger, Tesla wall connector, public charging station, or anywhere there’s an electrical outlet. Superchargers are conveniently located along the most popular routes and offer the fastest rate of charge. Hotels and restaurants often install Tesla wall connectors for their customers’ use.

“Charge up to 52 miles of range per hour at home.”

UBS estimates the average drive time to the nearest Tesla supercharger is still 31 minutes, compared to a 4 minute average drive time to the nearest gas station in the U.S. “Based on that data, Tesla would need to add about 30,000 new electric-vehicle chargers to compete with the network of gas stations across the U.S., UBS analyst Colin Langan said in a report,” according to the Silicon Valley Business Journal.

Actual time required to charge a Tesla (according to Tesla)

The company says that to charge the Tesla Model X in a 240 volt wall outlet, you’ll need 9 hours, 52 minutes to obtain 300 miles worth of distance (a full tank). If you can charge it in a Tesla Supercharger (120kW), you’ll be able to obtain 300 miles of distance in 1 hour, 25 minutes.

This switch to non-instantaneous fueling requires a different mindset than pulling off the highway on a whim for a five-minute fill up of your gasoline powered vehicle, hitting the rest room, grabbing a Ding-Dong and jumping back in the car to face the next 250 miles with a full tank.

Thirty minutes at Tesla’s Supercharger charges the vehicle enough to go 170 miles. Tesla reports it has 828 Supercharger stations with 5,339 Superchargers in North America. Source: Tesla

What else will change—will people slow their pace, reduce their expectation of getting exactly what they want right now? Will Tesla Roadside Internet Diners pop up on the highways with 20-30 Superchargers out front, where Tesla drivers can go surf the net and have a healthy lunch while they wait? Will people stop going everywhere at the last minute? Does a slower-paced electric charge suit the Asian way of life more closely than the hectic pace of life in America?

Is the market-disrupting CEO facing too big of an uphill battle in these changing times that have thrust his fast-moving, affordable luxury EV dream up against a newly re-energized, fossil fuel-friendly business and political environment, not to mention a highly productive shale boom that may help keep global oil (and gasoline) prices low for the foreseeable future?

Tesla’s sales are growing

In a press release on Sunday, April 2, Tesla said it delivered just over 25,000 vehicles in Q1 of 2017, of which approximately 13,450 were Model S and approximately 11,550 were Model X.

“This was a new quarterly record for us and represents a 69% increase over Q1 2016. Our delivery count should be viewed as slightly conservative, as we only count a car as delivered if it is transferred to the customer and all paperwork is correct. Final numbers could vary by up to 0.5%,” the company said.

Tesla said Q1 production totaled 25,418 vehicles, another record. No Model 3s have been mass-produced but Musk is still predicting they will be in 2017.

Government tax incentives: still here—for now

In the U.S., success for EVs may very well live or die depending on the existence of state and federal tax incentives for plug-in EV buyers, as well as punitive incentives like carbon penalties, state renewable energy standards and similar climate-related government policies. But are those renewables-favoring policies on hold in the Trump administration?

The new administration is rebranding U.S. energy policy. New Secretary of the Interior Ryan Zinke said upon issuing a new coal lease on federal lands (something the Obama administration had all but stopped): “The interior department is in the energy business.” The missing word was “back” but the meaning is clear.

The IRS still gives tax credits to buyers of new plug-ins as of now.

If the U.S. taxpayer continues to hand over the plug-in EV tax credit at $7,500 per Tesla, that essentially reduces the targeted purchase price of the $35,000 Model 3 (for tax-paying buyers) to $27,500. According to automobile pricing comparisons at MotorTrend.com, Uncle Sam’s continued handout would put the Model 3 in play with cars like the Subaru CrossTrek Hybrid at $27,500, the Chevy Impala at $26,395 and the Dodge Charger at $27,995.

Big thinking leads to big projects

There is no doubt that Elon Musk is a big thinker.

- Musk is the guy who is behind a new design for a hundred-year-old idea—vacuum tube transport. Musk designed a freight (and eventually passenger) delivery system called Hyperloop that, if it is successful, will be able to suck boxes and packages, even containers, across the landscape and eventually across the oceans inside an 11-foot diameter vacuum tube at estimated speeds that range from a few hundred miles per hour up to 4,000 miles per hour, depending on what account you read. “A Hyperloop involves using magnets to levitate pods inside an airless tube, creating conditions in which the floating pods could shuttle people and cargo at speeds of up to 750 mph,” is how Reuters reported the idea. Musk conceived of Hyperloop One in 2013. DP World Group, which invested $50 million in the project and is involved in building a test version, wants to use the proposed system to move containers from ships docked at its flagship Port of Jebel Ali to a new inland container depot in Dubai, according to Reuters. A full scale version of Hyperloop One is under development in the Nevada desert.

- Musk’s SpaceX announced in March that it’s going to launch space tourism flights around the moon in 2018. Musk said the company has two paying passengers who are committed to the boarding queue for the world’s first lunar sightseeing flight. SpaceX has developed three space delivery vehicles and has contracts with the U.S. government and private companies to deliver satellites into orbit and supplies to the International Space Station. SpaceX reports it has more than $70 billion in future launch contracts, including $1.2 billion with NASA.

- And Tesla Motors which changed its name to Tesla Inc. to better reflect its expanded business interests which now include:

- Luxury electric automobiles—plug-in EVs and the infrastructure to manufacture them, their batteries, and the charging network;

- Electric solar storage batteries for the average solar powered home—the Tesla Powerwall—in addition to commercial battery systems and grid-scale battery technologies currently in development;

- Solar energy systems manufacturer and marketer, a business it acquired when Tesla merged with Solar City last November in a $2 billion transaction. Products include the launch of rooftop solar collector shingles—Musk is in the ramp-up stage now for this product group.

No shortage of risks: who would take on such a venture?

Tesla includes the following risk factors related to the Model 3 ramp-up in its 2016 10K:

Our future business depends in large part on our ability to execute on our plans to develop, manufacture, market and sell the Model 3 vehicle, which we intend to offer at a lower price point and to produce at significantly higher volumes than our present production capabilities for the Model S or Model X vehicles.

We unveiled a prototype of Model 3 in March 2016 and have announced our goal to achieve volume production and deliveries of this vehicle in the second half of 2017.

We have no experience to date in manufacturing vehicles at the high volumes that we anticipate for Model 3, and to be successful, we will need to implement efficient, automated and low-cost manufacturing capabilities, processes and supply chains necessary to support such volumes.

We will also need to do extensive testing to ensure that Model 3 is in compliance with our quality standards and applicable regulations prior to beginning mass production and delivery of the vehicles.

Moreover, our Model 3 production plan will also require significant investments of cash and management resources. Our production plan for Model 3 is based on many key assumptions, including:

- that we will be able to build and equip a new dedicated final assembly line for high volume production of Model 3 at the Tesla Factory without exceeding our projected costs and on our projected timeline;

- that we will be able to continue to expand Gigafactory 1 in a timely manner to produce high volumes of quality lithiumion cells and integrate such cells into finished battery packs for Model 3, all at costs that allow us to sell Model 3 at our target gross margins;

- that the equipment and processes which we install for Model 3 production will be able to accurately manufacture high volumes of Model 3 vehicles within specified design tolerances and with high quality;

- that we will be able to continue to engage suppliers for the necessary components on terms and conditions that are acceptable to us and that we will be able to obtain components on a timely basis and in the necessary quantities to support high volume production;

- that we will be able to complete our final tooling, production planning and validation for Model 3 and the delivery of final component designs to our suppliers in a timely manner; and

- that we will be able to attract, recruit, hire and train skilled employees, including employees on the production line, to operate our planned high volume production facilities to support Model 3, including at the Tesla Factory and Gigafactory 1.

If one or more of the foregoing assumptions turns out to be incorrect, our ability to successfully launch Model 3 on time and at volumes and prices that are profitable, as well as our business, prospects, operating results and financial condition, may be materially and adversely impacted. We may be unable to meet our growing vehicle production and delivery plans, both of which could harm our business and prospects.

Our plans call for significant increases in vehicle production and deliveries to high volumes in a short amount of time.

Our ability to achieve these plans will depend upon a number of factors, including our ability to add production lines and capacity as planned while maintaining our desired quality levels and optimize design and production changes, and our suppliers’ ability to support our needs.

In addition, we have used and may use in the future a number of new manufacturing technologies, techniques and processes for our vehicles, which we must successfully introduce and scale for high volume production. For example, we have introduced aluminum spot welding systems and high-speed blow forming of certain difficult to stamp vehicle parts.

We have also introduced unique design features in our vehicles with different manufacturing challenges, such as a 17 inch display screen, dual motor drivetrain, autopilot hardware and falcon-wing doors.

We have limited experience developing, manufacturing, selling and servicing, and allocating our available resources among, multiple products simultaneously. If we are unable to realize our plans, our brand, business, prospects, financial condition and operating results could be materially damaged.

Concurrent with the significant planned increase in our vehicle production levels, we will also need to continue to significantly increase deliveries of our vehicles. We have limited experience in delivering a high volume of vehicles, and no experience in delivering vehicles at the significantly higher volumes we anticipate for Model 3, and we may face difficulties meeting our delivery and growth plans into both existing markets as well as new markets into which we expand. If we are unable to ramp up to meet our delivery goals globally, this could have a material adverse effect on our business, prospects, financial condition and operating results. We are dependent on our suppliers, the majority of which are single source suppliers, and the inability of these suppliers to deliver necessary components of our products in a timely manner at prices, quality levels, and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

Our current products contain numerous purchased parts which we source globally from hundreds of direct suppliers, the majority of whom are currently single source suppliers despite efforts to qualify and obtain components from multiple sources whenever feasible.

Any significant unanticipated demand would require us to procure additional components in a short amount of time, and in the past we have also replaced certain suppliers because of their failure to provide components that met our quality control standards. While we believe that we will be able to secure additional or alternate sources of supply for most of our components in a relatively short time frame, there is no assurance that we will be able to do so or develop our own replacements for certain highly customized components of our products.

Moreover, we have signed long-term agreements with Panasonic to be our manufacturing partner and supplier for lithium-ion cells at Gigafactory 1 in Nevada and PV cells and panels at Gigafactory 2 in Buffalo, New York.

If we encounter unexpected difficulties with key suppliers such as Panasonic, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products.

This limited supply chain exposes us to multiple potential sources of delivery failure or component shortages for the production of our products, such as those which we experienced in 2012 and 2016 in connection with our slower-than-planned Model S and Model X ramps.

Furthermore, unexpected changes in business conditions, materials pricing, labor issues, wars, governmental changes, natural disasters such as the March 2011 earthquakes in Japan and other factors beyond our and our suppliers’ control, could also affect our suppliers’ ability to deliver components to us on a timely basis.

The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to product design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results. Changes in our supply chain have also resulted in the past, and may result in the future, in increased cost.

We have also experienced cost increases from certain of our suppliers in order to meet our quality targets and development timelines as well as due to design changes that we made, and we may experience similar cost increases in the future. Certain suppliers, including for Model X, have sought to renegotiate the terms of the supply arrangements.

Additionally, we are negotiating with existing suppliers for cost reductions, seeking new and less expensive suppliers for certain parts, and attempting to redesign certain parts to make them less expensive to produce. If we are unsuccessful in our efforts to control and reduce supplier costs, our operating results will suffer.

We expect the foregoing discussion to apply generally to Model 3. However, because we plan to produce Model 3 at significantly higher volumes than Model S or Model X, the negative impact of any delays or other constraints with respect to our suppliers for Model 3 could be substantially greater than any such issues experienced with respect to our products to date.

As some of our suppliers for our current production vehicles do not have the resources, equipment or capability to provide components for the Model 3 in line with our requirements, we have engaged a significant number of new suppliers, and such suppliers will also have to ramp to achieve our needs in a short period of time. There is no assurance that these suppliers will ultimately be able to meet our cost, quality and volume needs.

Furthermore, as the scale of our vehicle production increases, we will need to accurately forecast, purchase, warehouse and transport to our manufacturing facilities components at much higher volumes than we have experience with. If we are unable to accurately match the timing and quantities of component purchases to our actual production plans or capabilities, or successfully implement automation, inventory management and other systems to accommodate the increased complexity in our supply chain, we may have to incur unexpected storage, transportation and write-off costs, which could have a material adverse effect on our financial condition and operating results. Our future growth and success is dependent upon consumers’ willingness to adopt electric vehicles and specifically our vehicles, especially in the mass market demographic which we are targeting with Model 3.

Our growth is highly dependent upon the adoption by consumers of alternative fuel vehicles in general and electric vehicles in particular. Although we have successfully grown demand for Model S and Model X to date and have seen very strong initial demand for Model 3, and we believe that we will be able to continue to grow demand separately for each of these vehicles and their variants, there is no guarantee of such future demand or that our vehicles will not compete with one another in the market.

Moreover, the mass market demographic which we are targeting with Model 3 is larger, but more competitive, than for Model S and Model X. If the market for electric vehicles in general and Tesla vehicles in particular does not develop as we expect, or develops more slowly than we expect, our business, prospects, financial condition and operating results could be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, and could be affected by numerous external factors, such as:

- perceptions about electric vehicle features, quality, safety, performance and cost;

- perceptions about the limited range over which electric vehicles may be driven on a single battery charge;

- competition, including from other types of alternative fuel vehicles, plug-in hybrid electric vehicles, and high fuel economy internal combustion engine vehicles;

- volatility in the cost of oil and gasoline;

- government regulations and economic incentives; and

- access to charging facilities.

Future problems or delays in expanding Gigafactory 1 and operating it in line with our expectations could negatively affect the production and profitability of our battery-based products, such as Model 3 or our energy storage products. To lower the cost of cell production and produce cells in high volume, we intend to integrate the production of lithium-ion cells and finished battery packs for our vehicles including Model 3 and energy storage products at Gigafactory 1.

While Gigafactory 1 began producing lithium-ion cells for energy storage products in January 2017, we have no other direct experience in the production of lithium-ion cells, including those intended for use in vehicles. Although we continue to remain on track with our progress at Gigafactory 1, given the size and complexity of this undertaking, it is possible that future events could result in the cost of expanding and operating Gigafactory 1 exceeding our current expectations and Gigafactory 1 taking longer to expand than we currently anticipate.

In order to build our Model 3 vehicles at our planned volume and target gross margin, we must have significant battery cell production from Gigafactory 1. If we are unable to expand Gigafactory 1 in a timely manner, and attract, hire and retain a substantial number of highly skilled personnel to work there in order to produce high volumes of quality lithium-ion cells at reasonable prices, our ability to supply battery packs to our vehicles, especially Model 3, and other battery-based products according to our schedule and/or at a price that allows us to sell them at our target gross margins and in the quantities we estimate could be negatively impacted. Any such future problems or delays with Gigafactory 1 could negatively affect our brand and harm our business, prospects, financial condition and operating results.

If our vehicles or other products that contain our vehicle powertrains or battery packs fail to perform as expected, our ability to develop, market and sell our electric vehicles could be harmed. If our vehicles, other OEMs’ vehicles that contain our powertrains or our energy storage products were to contain defects in design and manufacture that cause them not to perform as expected or that require repair, our ability to develop, market and sell our products could be harmed. For example, the operation of our vehicles is highly dependent on software, which is inherently complex and could conceivably contain defects and errors.

Issues experienced by customers have included those related to the software for the 17 inch display screen, the panoramic roof and the 12 volt battery in the Model S and the seats and doors in the Model X. Although we attempt to remedy any issues we observe in our vehicles as effectively and rapidly as possible, such efforts may not be timely, may hamper production or may not be up to the satisfaction of our customers.

While we have performed extensive internal testing, we currently have a limited frame of reference by which to evaluate detailed long-term quality, reliability, durability and performance characteristics of our battery packs, powertrains, vehicles and energy storage products. There can be no assurance that we will be able to detect and fix any defects in our products prior to their sale to consumers. Any product defects or any other failure of our products to perform as expected could harm our reputation and result in delivery delays, product recalls, product liability claims, significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results and prospects.

Our Model X vehicles have not yet been evaluated by NHTSA for a star rating under the New Car Assessment Program, and while based on our internal testing we expect to obtain comparable ratings to those achieved by Model S, there is no assurance this will occur. If we fail to scale our business operations and otherwise manage future growth effectively as we rapidly grow our company, especially internationally, we may not be able to produce, market, sell and service our products successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We continue to expand our operations significantly, especially internationally, including by a planned transition to high volume vehicle production and the worldwide sales and servicing of a significantly higher number of vehicles than our current vehicle fleet in the coming years, with the launch and ramp of Model 3.

Furthermore, we are developing and growing our energy storage product and solar business worldwide, including in countries where we have limited or no previous operating experience in connection with our vehicle business.

Our future operating results depend to a large extent on our ability to manage our expansion and growth successfully. We may not be successful in undertaking this global expansion if we are unable to control expenses and avoid cost overruns and other unexpected operating costs; establish sufficient worldwide sales, service and Supercharger facilities in a timely manner; adapt our products to meet local requirements; implement the required infrastructure, systems and processes; and find and hire a significant number of additional manufacturing, engineering, service, electrical installation, construction and administrative personnel.

If we are unable to continue to reduce the manufacturing costs of Model S and Model X or control manufacturing costs for Model 3, our financial condition and operating results will suffer. As we have gradually ramped production of Model S and Model X, manufacturing costs per vehicle have decreased. While we expect ongoing cost reductions to be realized by both us and our suppliers, there is no guarantee we will be able to achieve sufficient cost savings to reach our gross margin and profitability goals. We incur significant costs related to procuring the materials required to manufacture our vehicles, assembling vehicles and compensating our personnel. We may also incur substantial costs or cost overruns in increasing the production capability of our vehicle manufacturing facilities, such as for Model 3.

Furthermore, if we are unable to achieve production cost targets on our Model X and Model 3 vehicles pursuant to our plans, we may not be able to meet our gross margin and other financial targets. Furthermore, many of the factors that impact our manufacturing costs are beyond our control, such as potential increases in the costs of our materials and components, such as lithium-ion battery cells or aluminum used to produce body panels.

If we are unable to continue to control and reduce our manufacturing costs, our operating results, business and prospects will be harmed.

We are significantly dependent upon revenue generated from the sale of a limited fleet of electric vehicles, which currently includes the Model S and Model X and which will also include Model 3 in the near term.

We currently generate a significant percentage of our revenues from the sale of two products: Model S and Model X vehicles.

Model 3, for which we are planning to achieve volume production and deliveries in second half of 2017, requires significant investment prior to commercial introduction, and there is no guarantee that it will be commercially successful. Historically, automobile customers have come to expect a variety of vehicles offered in a manufacturer’s fleet and new and improved vehicle models to be introduced frequently. In order to meet these expectations, we may in the future be required to introduce on a regular basis new vehicle models as well as enhanced versions of existing vehicle models.

To the extent our product variety and cycles do not meet consumer expectations, our future sales may be adversely affected. Our vehicles and energy storage products make use of lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame, and such events have raised concerns, and future events may lead to additional concerns, about the batteries used in automotive applications.

Tesla Gigafactory 1. Source: ElecTrek

The battery packs that we produce make use of lithium-ion cells. On rare occasions, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials as well as other lithium-ion cells. While we have designed the battery pack to passively contain any single cell’s release of energy without spreading to neighboring cells, there can be no assurance that a field or testing failure of our vehicles or other battery packs that we produce will not occur, which could subject us to lawsuits, product recalls, or redesign efforts, all of which would be time consuming and expensive.

Also, negative public perceptions regarding the suitability of lithium-ion cells for automotive applications or any future incident involving lithium-ion cells such as a vehicle or other fire, even if such incident does not involve our vehicles, could seriously harm our business. In addition, we store a significant number of lithium-ion cells at the Tesla Factory and plan to produce high volumes of cells and battery modules and packs at Gigafactory 1. Any mishandling of battery cells may cause disruption to the operation of our facilities. While we have implemented safety procedures related to the handling of the cells, there can be no assurance that a safety issue or fire related to the cells would not disrupt our operations. Such damage or injury could lead to adverse publicity and potentially a safety recall.

Moreover, any failure of a competitor’s electric vehicle or energy storage product may cause indirect adverse publicity for us and our products. Such adverse publicity could negatively affect our brand and harm our business, prospects, financial condition and operating results. Increases in costs, disruption of supply or shortage of materials, in particular for lithium-ion cells, could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of materials. Any such increase, supply interruption or shortage could materially and negatively impact our business, prospects, financial condition and operating results.

We use various materials in our business including aluminum, steel, lithium, cobalt, nickel and copper, as well as lithium-ion cells from suppliers. The prices for these materials fluctuate, and their available supply may be unstable, depending on market conditions and global demand for these materials, including as a result of increased production of electric vehicles and energy storage products by our competitors, and could adversely affect our business and operating results.

For instance, we are exposed to multiple risks relating to lithium-ion cells.

These risks include:

- the inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers of lithium-ion cells we require;

- disruption in the supply of cells due to quality issues or recalls by battery cell manufacturers or any issues that may arise with respect to cells manufactured at our own facilities;

- an increase in the cost, or decrease in the available supply, of materials used in the cells; and

- fluctuations in the value of the Japanese yen against the U.S. dollar as our battery cell purchases for Model S and Model X are currently denominated in Japanese yen.

Our business is dependent on the continued supply of battery cells for the battery packs used in our vehicles and energy storage products.

While we believe several sources of the battery cells are available for such battery packs, and expect to eventually rely substantially on battery cells manufactured at our own facilities, we have to date fully qualified only a very limited number of suppliers for the cells used in such battery packs and have very limited flexibility in changing cell suppliers.

In particular, we have fully qualified only one supplier for the cells used in battery packs for our current production vehicles. Any disruption in the supply of battery cells from such suppliers could disrupt production of our vehicles and of the battery packs we produce for other automobile manufacturers until such time as a different supplier is fully qualified.

Furthermore, fluctuations or shortages in petroleum and other economic conditions may cause us to experience significant increases in freight charges and material costs. Substantial increases in the prices for our materials or prices charged to us, such as those charged by battery cell suppliers, would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices.

Any attempts to increase vehicle prices in response to increased material costs could result in cancellations of vehicle orders and reservations and therefore materially and adversely affect our brand, image, business, prospects and operating results.

Risky or not, some of the largest financial institutions hold Tesla’s shares

(Currency in USD – Source: Yahoo Finance)

Breakdown

| 22.28% | Shares Held by All Insider and 5% Owners |

| 62.00% | % of Shares Held by Institutional & Mutual Fund Owners |

| 79.78% | % of Float Held by Institutional & Mutual Fund Owners |

| 572 | Number of Institutions Holding Shares |

Top Institutional Holders

| Holder | Shares | Date Reported | % Out | Value |

| FMR, LLC | 22,050,401 | Dec 30, 2016 | 13.65% | 4,711,950,233 |

| Baillie Gifford and Company | 13,289,548 | Dec 30, 2016 | 8.23% | 2,839,843,538 |

| Price (T.Rowe) Associates Inc. | 11,899,343 | Dec 30, 2016 | 7.37% | 2,542,770,629 |

| Vanguard Group, Inc. (The) | 5,653,858 | Dec 30, 2016 | 3.50% | 1,208,172,927 |

| Morgan Stanley | 3,792,206 | Dec 30, 2016 | 2.35% | 810,356,507 |

| Bank of Montreal/Can/ | 3,342,207 | Dec 30, 2016 | 2.07% | 714,196,220 |

| BlackRock Institutional Trust Company, N.A. | 3,124,644 | Dec 30, 2016 | 1.93% | 667,705,182 |

| Jennison Associates LLC | 2,666,446 | Dec 30, 2016 | 1.65% | 569,792,851 |

| State Street Corporation | 2,271,484 | Dec 30, 2016 | 1.41% | 485,393,420 |

| Capital World Investors | 2,068,377 | Dec 30, 2016 | 1.28% | 441,991,485 |

Top Mutual Fund Holders

| Holder | Shares | Date Reported | % Out | Value |

| Fidelity Contrafund Inc | 5,707,382 | Dec 30, 2016 | 3.53% | 1,219,610,470 |

| Fidelity OTC Portfolio | 4,820,901 | Dec 30, 2016 | 2.98% | 1,030,178,344 |

| Vanguard Total Stock Market Index Fund | 2,287,231 | Sep 29, 2016 | 1.42% | 466,663,738 |

| Price (T.Rowe) Growth Stock Fund Inc. | 2,275,673 | Sep 29, 2016 | 1.41% | 464,305,559 |

| Fidelity Blue Chip Growth Fund | 2,211,033 | Dec 30, 2016 | 1.37% | 472,475,646 |

| Fidelity Growth Company Fund | 1,396,600 | Dec 30, 2016 | 0.86% | 298,439,456 |

| Vanguard Extended Market Index Fund | 1,305,506 | Sep 29, 2016 | 0.81% | 266,362,387 |

| Vanguard International Growth Fund | 1,178,679 | Aug 30, 2016 | 0.73% | 249,891,728 |

| Powershares Exhg Traded Fd Tr-Powershares QQQ Tr, Series 1 | 1,110,681 | Dec 30, 2016 | 0.69% | 237,341,425 |

| Baron Partners Fund | 1,110,000 | Sep 29, 2016 | 0.69% | 226,473,298 |

Down to Earth: comparing enterprise value

If you look at the enterprise values of Tesla and Ford, Tesla comes in at $53 billion. Ford tallies up at $161 billion. Tencent, which could conceivably capture a bigger piece of Tesla over time, has a market cap of $273 billion and an enterprise value of $269 billion, making it more than five times bigger than Tesla. Tencent shares traded today at $29 and change.

Today’s reality: it’s a very gasoline friendly marketplace

The EIA calculated what fueled the USA’s transportation needs in 2015: 56% of U.S. transportation was powered by gasoline, 21% by diesel fuel and 11% by jet fuel—the balance of about 11% included 3% fueled by natural gas, 5% by biofuels and 3% other.

Within the “other” category the EIA lumps electricity, LPG, lubricants, residual fuel oil and other fuels associated with transportation.

Even Tesla’s excessive slathering of “cool factor”—driven by the Model 3’s dash-mounted 17-inch monitor, dual motor drivetrain, autopilot hardware and falcon-wing doors—may be insufficient to power the company through the looming uphill climb it is facing in competing with the 100-year entrenched gasoline and diesel transportation mass market in the U.S. (Notwithstanding a sustained period of extremely high petroleum prices that drive up fuel costs and make plug-in EVs more economically attractive to operate than traditional gas and diesel vehicles.)

No shortage of confidence

Tesla founder and CEO Elon Musk has said he is “fairly confident” that Model 3 deliveries will begin by the end of 2017. He is also confident in the rapid growth of SpaceX, his rocket company with its eye on taking humans to Mars. SpaceX has recently posted almost 500 open positions on its career website—everything from engineer to shipping clerk.

The wildcard

Even with many hundreds, even thousands of risks associated with launching what feels like a manufacturing miracle to get the Tesla Model 3 scaled up to penetrate the U.S. and global mass market—designing a completely new kind of car from scratch, using newly invented processes, new suppliers, never before seen parts designs, relying on massive amounts of technology, having the life or death of your car tethered to the success or failure of two “gigafactories,” and going up against massive mass market competition from the U.S., Europe and Asia, many of whom have been entrenched in consumer buying patterns for a century–even with all that going against Tesla’s ability to produce 500,000 Model 3 vehicles next year, Tesla has one asset going for it that could trump all of the unknowns: Elon Musk.