Vermilion energy boosts Saskatchewan presence

During the first quarter of 2018, M&A activity was dominated by U.S. deals, with the largest-ever Permian deal accenting this trend. In terms of total value, Q1 2018 was the third-largest quarter for U.S. M&A since the beginning of the downturn.

Canadian activity, however, was much more muted in Q1 with only minor deals taking place. Canadian transactions came roaring back today, though, with Vermilion (ticker: VET) announcing a major move.

Vermilion will acquire Spartan Energy (ticker: SPE) in an all-stock transaction valued at C$1.23 billion. According to PLS, this is the largest Canadian M&A deal since Cenovus Energy acquired ConocoPhillips’ oil sands properties for $13.3 billion in March 2017.

Spartan Energy holds nearly 500,000 net acres in Saskatchewan and Alberta, with a primary focus on southeast Saskatchewan. The company has 400,000 acres in the area, spread between several different plays.

Vermilion estimates Spartan Energy will produce about 23 MBOEPD in 2018, with 91% of this volume composed of oil. Spartan currently holds 73 MMBOE of reserves, and Vermilion has significant plans for the new acreage.

The company has identified over 1,000 potential drilling locations, targeting multiple formations, the Ratcliffe, Midale, Frobisher/Alida, Bakken, and Three Forks/Torquay. Unlike most U.S. operations, most of the future drilling targets are inexpensive open-hole completions not requiring hydraulic fracturing. Further development may target waterflooding in the Ratcliffe and Midale.

Vermilion will likely spend $105 million on these properties, but the company believes that at current prices the assets will generate enough cash to cover the areas CapEx and incremental dividends, plus further free cash flow. Vermilion reports the acquired assets have high operating netbacks, estimated at $38.42/BOE at current prices.

Premium of 5% based on most recent closing price

Vermilion will pay Spartan Energy shareholders 0.1476 VET shares for each Spartan Shares. This gives a valuation of $6.50 per share, based on Friday’s closing price. This is a small premium, only 5%, but is 13% above the 30-day average price of Spartan shares. Vermilion will also assume C$175 million in debt as a result of the buy, giving a total transaction valuation of C$1.4 billion.

Based on Friday’s closing prices, the payment equates to US$48,260 per flowing BOE, or US$15.21 per BOE of reserves.

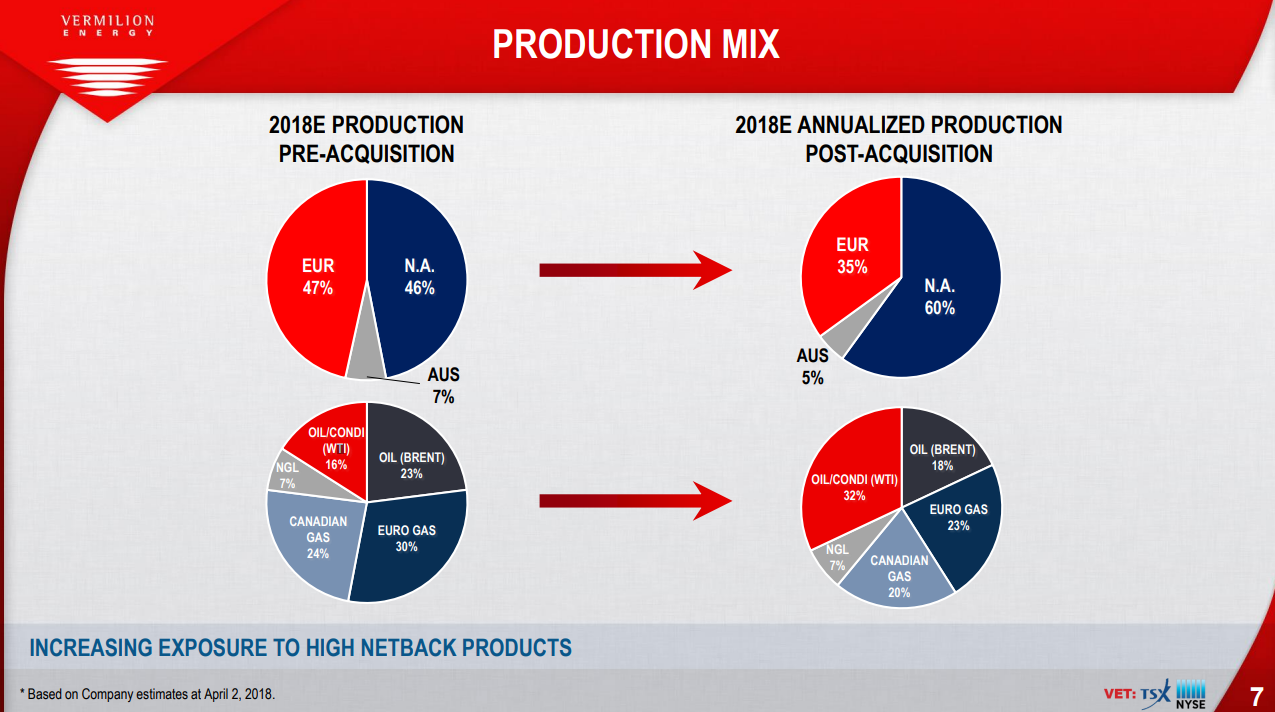

This deal boost’s Vermilion’s Canadian presence, and North America pro forma accounts for 60% of the company’s production. Oil output will rise from under 40% of total production to 50% pro forma, while oil reserves will grow to 55% of total.