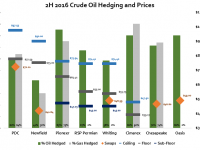

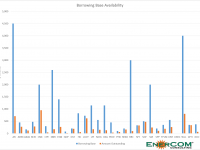

E&Ps Implementing Variety of Hedging Strategies

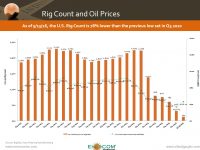

Hedging programs that E&Ps have in place in 2016 vary considerably. The chart below shows the range of oil and gas production for several E&Ps covered by hedging contracts.

Pioneer Natural Resources (ticker: PXD) and Cimarex Energy (ticker: XEC) have …