A detailed look into the drilling of the industry’s longest onshore lateral – an exclusive interview with Eclipse Resources’ COO Tom Liberatore, Halliburton VP Tony Angelle, and Deep Well Services’ Matt Tourigny

As oil and natural gas producers search for ways to create profitability in today’s market, drillers are looking to make each well they drill more economic than the previous well.

In the pursuit of enhancing well economics in the Utica, Eclipse Resources (ticker: ECR) decided to drill the industry’s longest onshore lateral to date, and it appears the company has started a trend.

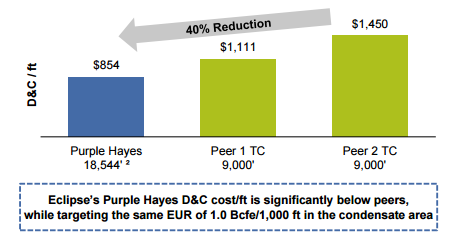

Eclipse’s Purple Hayes well, which was drilled to a total measured depth of 27,048 feet with a completed lateral extension of approximately 18,500 feet set the record with 124 stages, but the company did not set out to drill the three and a half mile lateral just for the sake of bragging rights. By drilling such a long horizontal, Eclipse was able to reduce its per-lateral-foot costs to $854 compared to peer rates that exceed $1,100 per lateral foot with the same EUR of 1.0 Bcfe per 1,000 feet.

The well cost approximately $15.8 million, but it makes sense for the Appalachian Basin, especially when you consider the cost of a single pad in the Utica can run between one and two million dollars.

“The superlateral is cost effective here in the Appalachian basin where we have high location costs and pretty expensive vertical costs, so you try to spread that out over as long a lateral as you can,” Eclipse COO Tom Liberatore told Oil & Gas 360®.

“That may not be the case out in the Southwest where it may cost $100,000 to build a pad, versus our million to two million. The economic impact probably wouldn’t be the same in other basins.”

Even though Purple Hayes was drilled to an impressive 3.5 miles, Liberatore and his team believe they could have gone past 20,000 feet. This superlateral well, as Eclipse’s COO put it, will serve as a first step in a growing program of long-lateral wells, and it has been outperforming the company’s expectations.

“We modeled a 100 pound per week pressure decline in this well, and we’re seeing less than a 50 pound per week decline, and it continues to hold steady,” said Liberatore. “We could probably turn the well on, but we’re not going to. We’re going to stick to the plan and keep monitoring this well. Right now we believe the well is going to be in the mid- to high-end of our forecast.”

Drilled with one drill bit in one run: technical challenges of the Purple Hayes

“The thing that was really exceptional about that well is that it was drilled with one drill bit, in one run,” said Liberatore. “Technically, everything went perfectly. While there’s always room for improvement, there’s always the chance that on the next run, you won’t get a full 18,000 foot lateral on one run. But it does show that if you do all your homework, it’s possible. The success we had on Purple Hayes is repeatable.”

Planning was the key to executing this feat, Halliburton (ticker: HAL) Vice President, North East Tony Angelle told Oil & Gas 360®. His team took their time in designing the frac for the well, and that made it possible for Halliburton to complete Purple Hayes without issues.

“It goes back to the planning. With the types of pumps that we’re using, and the horsepower that we had on location, getting the placement really wasn’t a big challenge,” said Angelle. “I think the bigger challenge was making sure that the guns were pumped down to the proper depth.

“I believe that Eclipse drilled a very good well, which made it very easy for us to get the frac put away,” he explained. “A lot of customers chase zones, and when you do that, you put these hills and valleys in your wellbore. That can make it a challenge to pump your guns down, and it can cause sand to build up in those low parts of the well and cause a lot of friction.”

There were a number of technical challenges that had to be overcome to ensure the success of the Purple Hayes well. Aside from making pad costs higher by a factor of ten, the challenging geography of the basin also makes it difficult to get the amount of water and sand that you need on location to complete the 124 stages of a well like Purple Hayes.

“The roads weren’t designed for the amount of 18-wheeler traffic that needs to get up there,” said Angelle.

The importance of a nicely drilled wellbore was echoed by Matt Tourigny, technical sales manager with Deep Well Services (DWS), which also worked on completing the Purple Hayes superlateral.

“The Purple Hayes well is pretty unique in terms of how it was drilled. I refer to it as a rifle barrel well. It was smooth, it was consistent, and it was very well drilled. One of the best I’ve ever seen,” Tourigny said.

Off the shelf equipment being utilized to its full potential

In order to complete Purple Hayes, Halliburton used its Q10 frac pumps, while DWS decided to upgrade its rotor systems to help keep inertia moving on the pipe and use a 285-K drilling rig, which can lift 285,000 pounds off the bottom of the wellbore. But Eclipse used equipment that was already available to complete the longest onshore lateral to date.

“We used all off-the-shelf equipment and technology,” said Liberatore. “We didn’t really create anything. We just worked on the combination, particularly of the completion fluid, of what works best in terms of what allows us to place the most sand in slickwater, using the least amount of water and recovering the most amount of water.”

The well did present challenges.

“There’s a lot of heat issues,” Tourigny explained. “When you’re running to that length, your snubbing unit is a hydraulic system, and that creates a lot of heat. So one thing we learned half way through the job was to efficiently cool our hydraulic and rotary systems. We were able to cool down the hydraulic fluids and reduce wear and tear on the equipment.

“One nice thing about this well was that we had what’s called an XT-27 drill string in the lateral,” he explained. “It’s a tapered string that’s good for higher torque, so we were able to use that drill string, which was procured from the Gulf of Mexico. We’ll be taking that idea of having your drill string in the vertical with a tapered string of lesser OD and friction and torque value into the toe. And the reason for that is the XT-27 drill string is really too rigid to get past the kick out point. It creates friction issues and drag issues.”

Limitless laterals? Probably not.

While the team behind the Purple Hayes superlateral believes it’s possible to go even further, that doesn’t mean that it’s possible to go out as far as you can dream.

One of the major obstacles facing operators like Eclipse is the mineral leases. Before E&P companies can even start to think about the next largest onshore lateral, they need to have the contiguous mineral leases to make such a long lateral possible.

From the technical side, a few limitations exist as well, said Angelle. “One is going to be the rig, and the other is the weight of the casing,” he said. “In other words, the rig can only have so much hook load, and then getting your casing to run down to the bottom. You have to be able to rotate your casing. Your surface pressure at some point would exceed the pipe’s limitations as well.”

“The limitations of coil are coming up in the basin,” added Tourigny. “You’ve got short TBDs and long laterals, and they just can’t get coil out to those depths, so stick pipe really is the way of the future for these long laterals.”

Superlaterals are “revolutionizing the cost structure”

Even if leasehold limitations and technical issues stop operators from drilling out past the horizon, Eclipse believes that wells like Purple Hayes are going to create real change in the cost of doing business in the Utica and Marcellus.

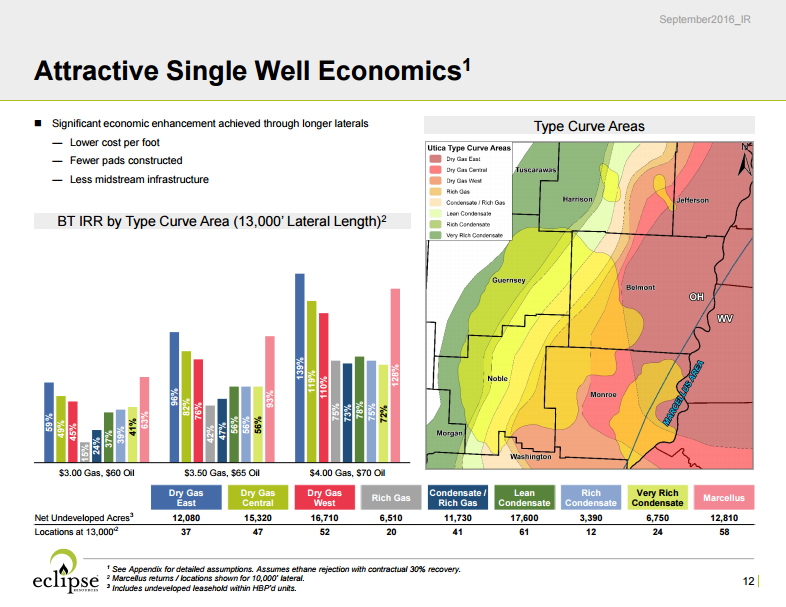

“It’s revolutionizing the cost structure of the play,” said Liberatore. “Long term, we’ll be able to, theoretically, drill fewer wells with greater efficiencies. We’ll see F&D costs drop 20% to 30%, particularly in the condensate areas, improving returns by as much to 35% to 70% over shorter lateral type wells.

“We do think there is some continued room for improvement. We learned a lot of lessons. One of the interesting things about Purple Hayes is that it was a one-off well, so it absorbed a lot of costs that would get shared across multiple wells on a pad. Aside from that, we believe there are still some cost savings we can reap from efficiencies.”

Eclipse plans to drill a number of 19,000 foot laterals in the future, and a number of other operators have started to contact DWS about similar work.

“Operators were almost waiting for this well to get completed to see if it was possible to do with a snubbing unit and stiff pipe,” said Tourigny. “I think a lot of well-design programs were on hold to see if this would be a success. Now they’re starting to fire up those programs again.”