Market Showing Resilience at the Moment but Brexit Will Take Years to Unfold

Big changes have happened in the U.K. since the “exit the EU” outcome of the June 23 national referendum, with the aftermath likely taking years to fully understand. And “Brexit” itself hasn’t even happened yet.

David Cameron’s promised resignation brought in Theresa May as Prime Minister, who intends to respect the popular decision and has stated “Brexit means Brexit.” No one is sure what this really means yet for Britain, the E.U., the global economy, or the oil and gas sector.

What we do know regarding oil and gas is that demand, settlement currency (USD) strength, and overall market uncertainty have been negatively affected in recent months. From a fundamentals standpoint, a strong dollar relative to major U.S. trading partners, dimmed global growth outlooks, and heightened market sensitivity have historically placed downward pressure on oil prices.

British Pound Holding Steadily Weaker than Dollar, Stocks Higher

The consensus that Brexit will be a long-term negative for the U.K. is reflected in the pound’s continuing weakness. After the vote, the Bank of England cut interest rates to a record low of 0.25% in the hopes of spurring investment and staving off recession. These measures have supported a weak pound, whose value remains at a 30-year low after falling 13% against the dollar since the vote. The flipside of a weak pound is increased demand for British exports and a boost to the country’s tourist industry.

In the markets, share prices recovered from their drop in value, with both the FTSE 100 and broader FTSE 250 which covers more British-based businesses currently trading higher than before the referendum.

In short, the world didn’t end and markets proved resilient after the referendum, repricing quickly after absorbing the news. Investors hate surprises and so far, Brexit has only been a surprise and not a Black Swan event for the financial markets.

At the same time, financial indicators reflect shifting assumptions about future economic conditions in valuation models. Whether markets remain resilient depends on the direction of global growth.

Major Agencies Predicting Lower Global Growth

Most major macroeconomic forecasting agencies are predicting weakened U.K. growth in the coming years, which will have a significant impact on the world economy. The U.K.’s GDP is currently the fifth largest in the world and the country is one of Europe’s few economic powerhouses.

At a meeting of European lawmakers in Brussels on Monday, European Central Bank President Mario Draghi said that although the Eurozone economy has proved resilient so far, economic risks remain. Mr. Draghi warned of a “substantial weakening” in the prospects for overseas demand since June that could dampen export growth, as well as “widespread feelings of insecurity.”

A weakening global growth outlook translates into less disposable income, less energy-intensive activity, and lower overall fuel consumption, with adverse effects on oil and gas demand, which has already been dampened due to the developing world slowdown.

This trend of slowing global growth was already in the making, so it is difficult to identify what changes are specifically the result of Brexit. In its June 2016 (pre-Brexit) Outlook, the World Bank had already reduced its U.K. growth forecasts from 2.9% to 2.4%, citing “weaker growth among advanced economies and lower commodity prices.”

The IMF’s World Economic Outlook has cut growth by 0.1% to 3.1%, reflecting a similar sentiment. The agency emphasized that there is not enough information available at the moment to make a full assessment and that the real effects of Brexit will play out gradually over time, adding economic and political uncertainty that will take many months to resolve.

“This overlay of extra uncertainty, in turn, may open the door to an amplified response of financial markets to negative shocks,” said Maury Obstfeld, IMF Economic Counsellor and Director of the Research Department.

The long-term effects of a decision like Brexit will not be felt until further down the road. Although the OECD has revised its 2016 GDP growth forecasts for the U.K. slightly upward from 1.7% to 1.8%, it has cut its forecast for 2017 from 2% to 1%, saying that “uncertainty about the future path of policy and the reaction of the economy remains very high and risks remain to the downside.”

Who, What, When, Where, and How?

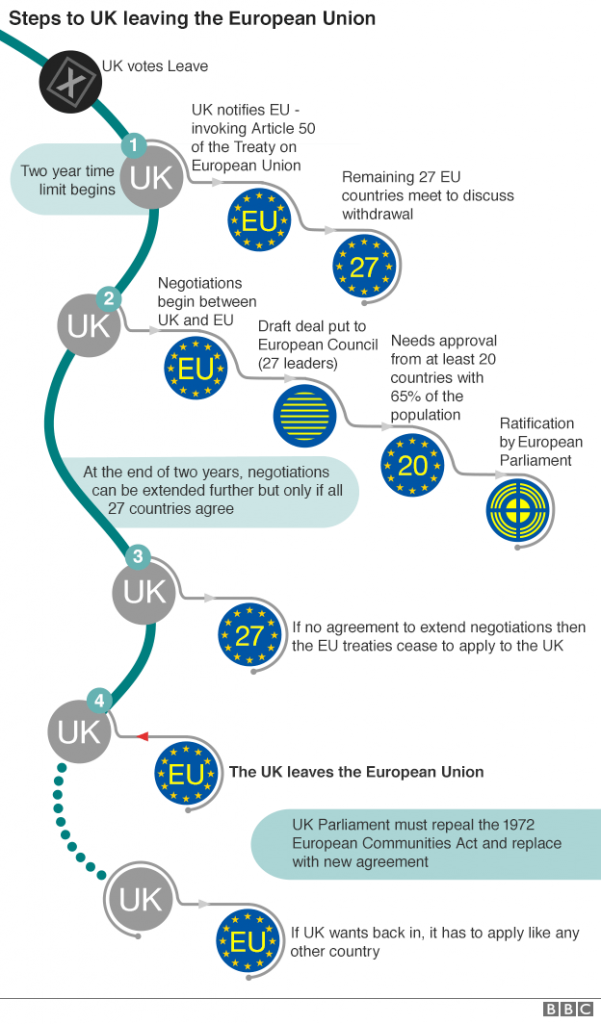

Leaving the E.U. requires that Article 50 of the Lisbon treaty be invoked, giving each side two years to agree to the terms of the split. Prime Minister May has stated that she will not initiate the two-year process to leave before the end of 2016, meaning that we will not know the kind of deal the U.K. will ultimately seek from the E.U. on trade and immigration until next year.

This will only be the start of work for the recently created Brexit Department, which will be responsible for E.U. negotiations and establishing new international agreements. Even this Department is incomplete and the government is rushing to assemble a team of skilled negotiators to manage the entire affair.

Why is a whole new department necessary? Article 50 was only created in late 2009 and has never been actually used. Extricating British law from E.U. law will require 43 years of treaties and agreements covering thousands of subjects to be reworked. The exit’s terms will also have to be agreed upon by 27 national parliaments.

Legal issues aside, the U.K.’s post-Brexit trade deal will be the most complex part of negotiations and have the greatest long-term economic effect. Whatever deal emerges will require unanimous approval by more than 30 European national and regional parliaments, some of which may also want to hold their own referendums.

Brexit Secretary David Davis has optimistically suggested that the whole process could be completed by December 2018. Former Foreign Secretary and current Chancellor of the Exchequer Philip Hammond is pessimistic and suggests the process may take six years.