IHS Markit has released a new study called, “A New Look: Extracting Value from the Canadian Oil Sands.” The report presents a post-oil price collapse update to a 2013 analysis on the economics of processing heavy oil in Alberta and other select jurisdictions.

Bitumen-related problems: too heavy for pipelines

Bitumen is the extra-heavy oil found in the oil sands. Making it marketable requires capital-intensive heavy oil conversion units to transform it into refined products such as gasoline or diesel. Bitumen is also too heavy and viscous for pipeline transport, HIS pointed out.

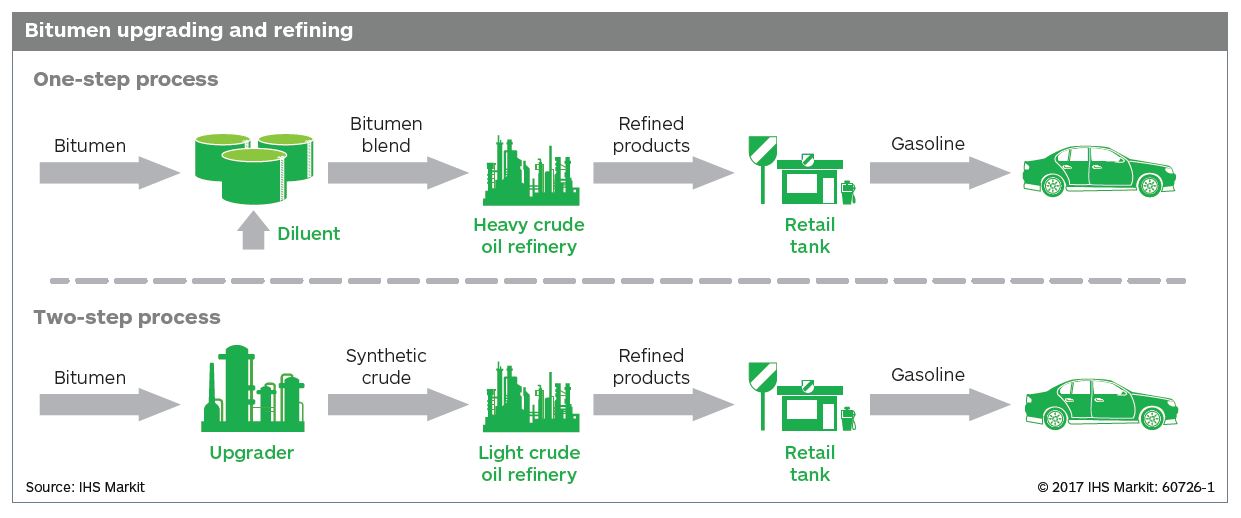

Oil sands producers historically faced two options to deliver their product to market:

- Blend bitumen with lighter hydrocarbons to reduce its viscosity, allowing it to be moved via pipeline to refiners that have made specific investments in heavy oil processing capacity;

- Invest in heavy processing units near or at producing facilities that convert the extra-heavy oil into lighter crudes before shipping to markets.

Bitumen 101

Bitumen blend and dilbit: To meet pipeline requirements, bitumen is diluted with lighter hydrocarbons. A refinery may need modifications to process large amounts of bitumen blends because they result in more heavy oil products than most crude oils. Bitumen blends typically have a gravity of 22°API (similar to other heavy crude oils such as Mexican Maya). The most common bitumen blend involves diluting bitumen with a natural gas condensate (pentane plus material) to make diluted bitumen, or dilbit. A typical blend is about 72% bitumen and 28% condensate.

Synthetic crude oil: SCO is produced from bitumen via refinery conversion units called upgraders that turn heavy hydrocarbons into lighter, more valuable components from which gasoline and diesel are manufactured. SCO resembles light, sweet crude oil, with API gravity typically greater than 30 degrees (°).

“In 2016, more than two-fifths of every barrel produced in the oil sands underwent some form of upgrading in western Canada,” said IHS Markit. “In the early years of oil sands development, upgrading bitumen into SCO was the most common strategy used by upstream operators. Limited access to refineries capable of processing extra-heavy oil and technical requirements related to the extraction process contributed to the historical dominance of the two-step process.”

Recent oil sands growth has been dominated by projects opting to market heavier bitumen blends

In 2012, the supply of heavy bitumen blends overtook SCO as the dominant form of oil sands supply output. However, upgrading retains a significant share of output, according to the study.

Three investment options

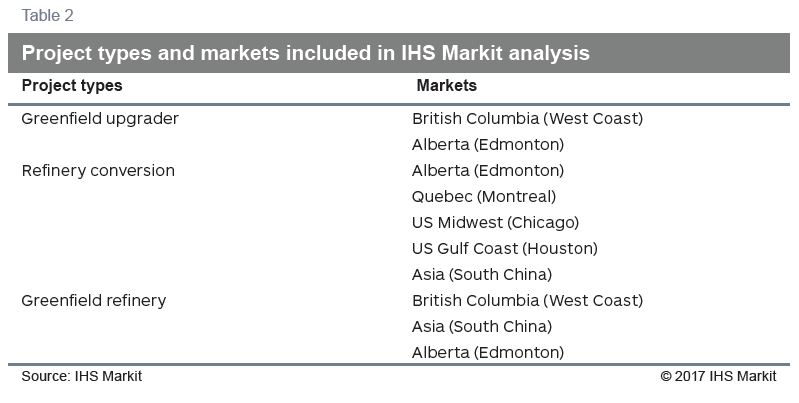

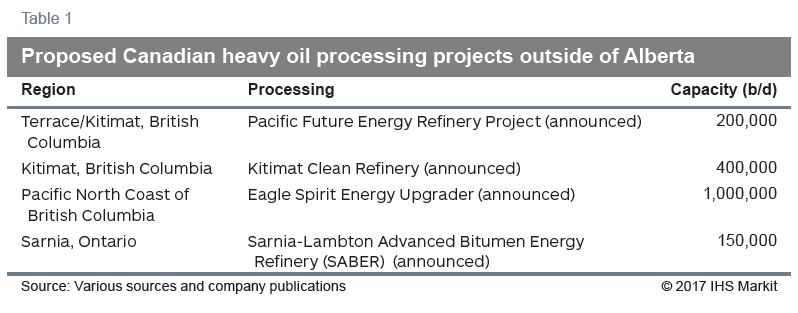

The study examines three investment options to process heavy oil.

- Option one suggests upgrading facilities to convert oil sands bitumen into light, synthetic crude oil that competes for refinery space with light sweet crude from the growing U.S. tight oil supply.

- The other two options, refinery conversions and new refineries, involve either adapting an existing refinery to process heavier crude oil or building an entirely new heavy oil refinery.

“Public interest remains for heavy oil refining and processing capacity in Western Canada,” said Kevin Birn, an IHS Markit executive director who heads the Oil Sands Dialogue. “Though the economic outlook has improved, upgrading continues to look challenged. New refineries could work under the right circumstances, but are not without risk.”

Refined product demand in North America will gradually decline

According to the IHS Markit study, refined product demand in North America is expected to gradually decline. New investments in refining capacity in western Canada would likely displace incumbents or would be exported offshore. Finding a party willing to commit to a mutually agreeable, long-term contract—a likely necessity for obtaining financing for a new export-oriented refining project—may be a stumbling block, according to the new study.

Gulf Coast will continue to take the heavy sour bitumen blends

“The most attractive option for growing oil sands production continues to look like the export of heavy sour bitumen blends to U.S. Gulf Coast region, which imported over 1.8 million b/d of crude oil of similar quality to the oil sands from offshore places like Venezuela, Mexico, and others in 2016,” said Patrick Smith, the study’s co-author and research associate at IHS Markit.

Reducing need for diluent through partial upgrading

“But present conditions have oil sands producers searching for new options as well. A key area of interest is what is being called partial upgrading, which seeks to improve the mobility of bitumen—reducing the need for diluent used in the creation of bitumen blends—a significant cost for the industry today.”

Exporting to U.S. refineries likely to continue as best option

The report concluded that with continued expected growth (albeit at a slower pace), the preferred option may be to continue exporting bitumen, rather than investing in heavy oil processing.