The Energy Information Administration (EIA) released its monthly Drilling Productivity Report today, complete with production projections through year-end 2014.

In review, the rig count of the four major oil basins (Bakken, Eagle Ford, Niobrara and Permian) increased by 113 from December 2013 to October 2014. The Permian accounted for a whopping 86 rigs, while the remaining three plays added a total of 27 rigs.

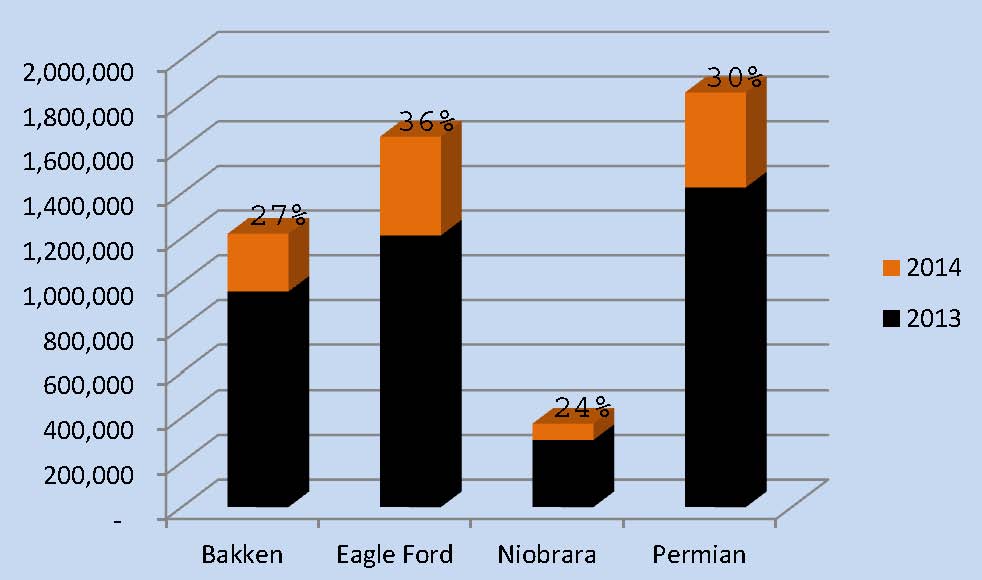

Although the Permian added more than 20 times the amount of rigs of Texas’ “other” basin, the Eagle Ford, it did not match up to the production increase of its interstate rival. Projected Eagle Ford production for December 2014 is expected to reach 1,653 MBOPD – a 36% increase compared to numbers from December 2013. Its production per rig ratio also leads all of its peers.

The Permian is still the leading U.S. oil producer at rates of 1,851 MBOPD (for Dec. 2014), but the Eagle Ford is closing in. If considering oil volumes solely between the Eagle Ford and Permian, the Permian’s share has lessened to 52.8% for projected year-end 2014 from 54.1% at year-end 2013. This comes even after the Permian’s projected rates for December 2014 are expected to be 30% higher on a year-over-year basis.

The Bakken and Niobrara regions also enjoyed considerable oil growth, increasing by 27% and 24%, respectively.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.