Guidance raised on outperformance

Magnolia Oil & Gas (ticker: MGY) announced its first quarterly results since its acquisition of assets from EnerVest, giving an initial view into Steve Chazen’s new company.

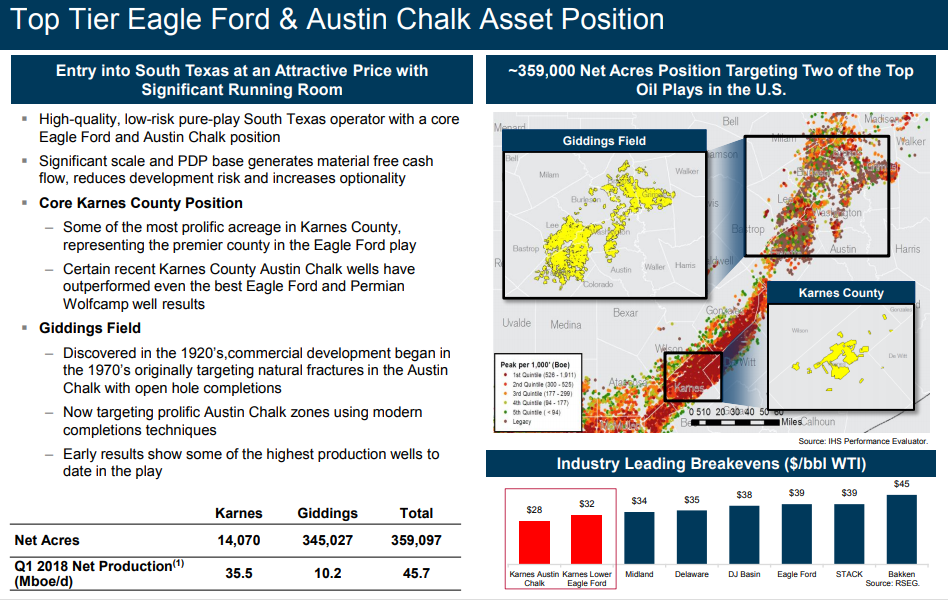

Magnolia was formed from TGP Pace Energy Holding’s $2.66 billion acquisition of EnerVest’s Eagle Ford assets earlier this year. The transaction closed at the end of July, giving Magnolia a major asset base to develop.

The company owns nearly 360,000 net acres in the Karnes Trough and the northern Eagle Ford, a play Magnolia refers to as the Giddings Field. Magnolia reports these assets produced 49.6 MBOEPD in Q2, up from 46.4 MBOEPD in Q1. This production is exceeding expectations, and Magnolia has increased its 2018 production guidance to 50 MBOEPD, up from 45.6 MBOEPD. The company predicts it will spend about 50% to 55% of 2018 EBITDA, a level that is in line with previous forecasts.

Magnolia is currently running three rigs on its acreage, two in Karnes and one in Giddings. The company plans to add a second rig to Giddings in 2019, allowing it to appraise its acreage more extensively. Magnolia is only running one completions crew, however, meaning it can only bring wells online from one basin at a time. The crew recently shifted from Karnes to Giddings, so the second half of the year should show increased production from that play.

No transport constraints: Magnolia received a $2.61 premium to WTI in Q2

The company’s Eagle Ford assets have a welcomed benefit over Permian operators, minimal transportation constraints. In fact, instead of dealing with the punishing Midland differential, Magnolia realized $70.50/bbl in Q2, a premium over WTI.

Magnolia Chairman and CEO Steve Chazen commented, “Our business plan is on track and we have already made significant progress by delivering better than 50 percent pretax margins and generating moderate volume growth while spending within 60 percent of our anticipated cash flow. Our 2018 development program is ahead of plan as demonstrated by the better than expected production results during the first half of the year. We expect the business to continue to generate significant cash flow after capital, and we are on track to exceed our previously announced financial and operating objectives for the year.”

“Looking ahead to the third quarter, we expect to bring on line multiple wells in both Karnes and Giddings that should further highlight our strong presence in these areas. We are also evaluating a few small-to-medium size bolt-on acquisition opportunities that fit our business plan and have similar financial and operating characteristics to Magnolia’s existing assets.”