Cheniere signs five-year contract with France’s Engie

Cheniere Energy (ticker: LNG) made an agreement this week to provide up to 12 cargoes of liquefied natural gas (LNG) to France’s Engie (ticker: ENGI) as part of a five-year contract starting in 2018. The cargoes will be delivered by ship at the Montoir-de-Bretagne regasification terminal in France from Cheniere’s Sabine Pas and Corpus Christi LNG terminals, according to a press release.

According to Cheniere, the 12 cargoes will equate to approximately 222 million MMBtus in total. The price of the contract will be linked to Northern European indices, according to the company.

“This [sales and purchase agreement] with ENGIE furthers our strategy of supplying LNG to European markets and diversifies our marketing portfolio with sales tied to Northern European price indices. Deliveries are expected to be made to the Montoir de Bretagne LNG terminal or to alternative delivery points as determined by our customer,” said Charif Souki, Chairman and CEO of Cheniere.

U.S. LNG will help diversify the origin of gas consumed in Europe, according to Engie. A third of European gas demand is met by Russian gas delivered by pipeline from Siberian fields. Norway, domestic production and LNG from existing suppliers such as Qatar and Algeria account for the rest.

“Importing U.S. LNG will participate to strengthen the security of supply of Europe,” Pierre Chareyre, Engie executive vice president in charge of global gas and LNG, said in the statement.

The primary source of LNG for the contract will be Cheniere’s Corpus Christi terminal, which is slated to start production in 2018. The company’s other project at Sabine Pass is expected to start production in January of 2016, according to Souki. Export production volumes at its Sabine Pass export terminal are expected at 27 million metric tons per annum (mmtpa), a number set to rise to 60 mmtpa by 2025.

Despite plans to further diversify the sources of Europe’s natural gas, Souki believes that Russia will remain the main supplier of natural gas to Europe even after the start-up of Cheniere’s LNG shipments.

“Russian gas will still be the dominant player in Europe,” Souki said at the Singapore International Energy Week. “Cheniere’s entry into Europe won’t dent [LNG] prices there…I don’t see us as price makers.”

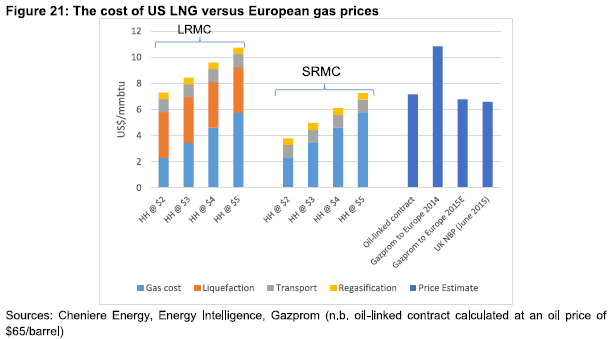

Source: Dr. James Henderson and Dr. Tatiana Mitrova. LRMC: Long-run marginal cost, SRMC: Short-run marginal cost

Despite the probability that Cheniere will not unseat Russia as Europe’s largest supplier, European nations are already courting Cheniere in an attempt to wean themselves off Russian supply. Earlier this month, Lithuania’s Energy Minister Rokas Masiulis announced the country was in talks with Cheniere regarding potential imports.

“We would love to have U.S. cargo in our region to have competition with Gazprom. But of course negotiations will depend on price terms,” Masiulis said.

Demand for LNG expected to rise

U.K.-based BG Group (ticker: BG) believes the demand for LNG will continue to rise through 2020. BG CEO Helge Lund said BG sees demand for LNG growing by 6% by the end of the decade while at the Singapore energy conference.

“There should be no doubt LNG will have an increasingly influential role in the changing landscape of global energy supply,” he said.