Chesapeake Energy Corporation (ticker: CHK) reported net income available to common stockholders of $268 million, or $0.29 per share for Q1 of 2018. Chesapeake’s average daily production for the first quarter of 2018 was approximately 554,000 BOE, compared to approximately 528,000 BOE in Q1 2017.

Chesapeake reported an average rig count of 15 in Q1 2018, with 77 gross wells spud and 76 gross wells completed. As for the number of gross wells connected in the quarter, Chesapeake recorded 57.

Production expenses during Q1 2018 were $2.94 per BOE, while general and administrative expenses, including stock-based compensation, were $1.44 per BOE. Capital expenditures, including accruals, were $611 million for the quarter.

Chesapeake CEO Doug Lawler said, “The strength of our operations and improved cost structure, coupled with higher realized prices, resulted in our best quarterly financial performance in over three years. The net cash flow provided by operating and investing activities, including net proceeds from asset sales, was $609 million for the quarter and was the highest in more than three years, allowing us to reduce our long-term debt by $581 million.”

Lawler also said that strong oil production, coupled with a lower cost structure, drove margin improvement.

PRB

In the Powder River Basin (PRB) in Wyoming, Chesapeake is currently utilizing four rigs, all of which are drilling in the Turner formation. Chesapeake placed six wells on production during Q1 2018 in the PRB, and expects to place 12 wells on production in Q2 and up to 35 wells for the full year of 2018.

Mid-Continent

In the company’s Mid-Continent operating area in Oklahoma, Chesapeake is currently utilizing two drilling rigs and placed eight wells on production during Q1 2018.

The company expects to place nine wells on production during Q2 2018 and up to 35 wells for the full year of 2018.

Chesapeake drilled its first horizontal well targeting the Chester formation in Woods County in April 2018 and expects to place this well on production later this quarter. The company said that one rig will continue to drill appraisal opportunities on the 800,000-net acre position during 2018, and the second rig will continue developing the Oswego oil play.

Eagle Ford

In the Eagle Ford Shale, Chesapeake is currently utilizing five drilling rigs and placed 23 wells on production during Q1 2018.

The company expects to place approximately 50 wells on production during the Q2 2018 and up to 150 wells for the full year of 2018.

Marcellus

In the Marcellus Shale, Chesapeake is currently utilizing one drilling rig and placed six wells on production during the quarter.

The company expects to place 17 wells on production during the 2018 second quarter and up to 50 wells for the full year of 2018.

Haynesville

In the Haynesville Shale in Louisiana, Chesapeake is currently utilizing three drilling rigs and placed four wells on production during Q1 2018. Chesapeake said it expects to place eight wells on production during the second quarter and up to 25 wells for the full year of 2018.

Utica rolls out new program

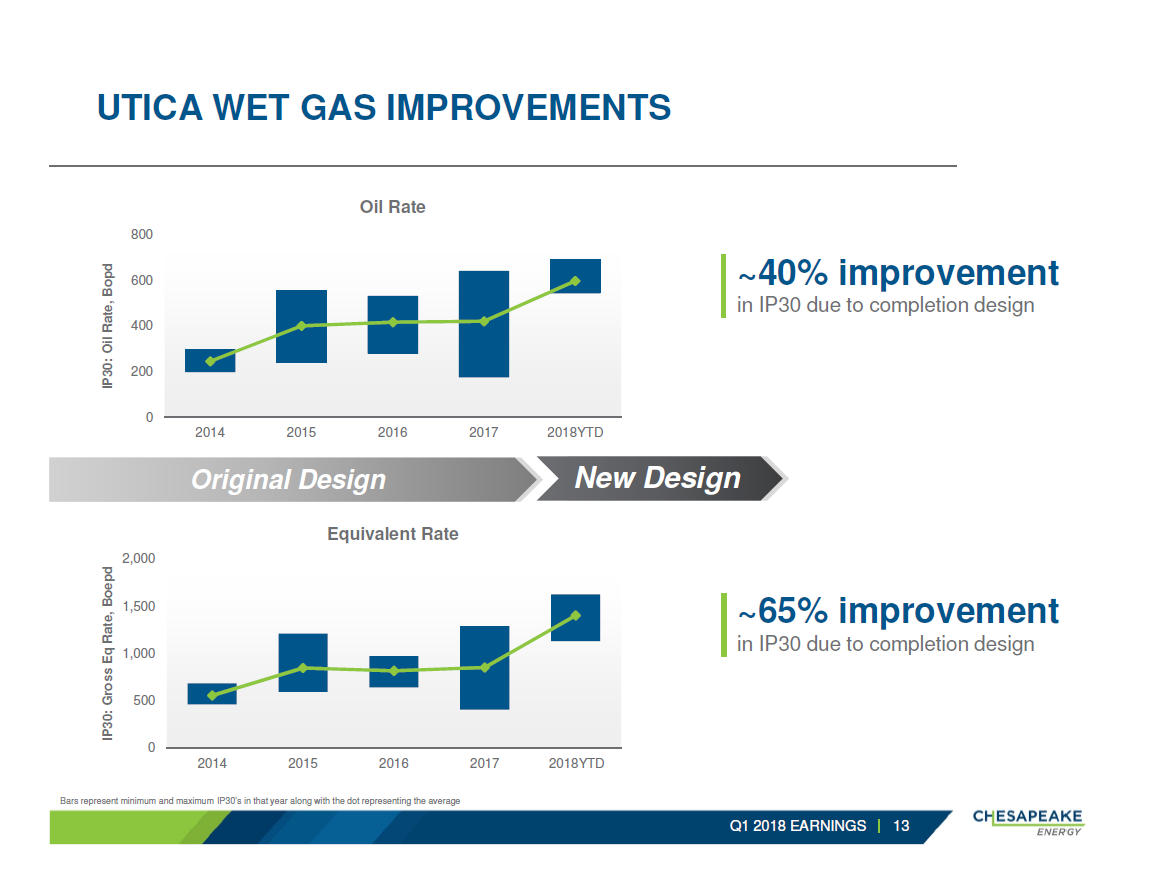

In the Utica Shale in Ohio, Chesapeake is currently utilizing two drilling rigs and placed ten wells on production during the quarter. The company has recently changed its completion methodologies, resulting in 30-day average daily production rates that have increased by approximately 65% for its first six wells in 2018 under this new program.

Chesapeake expects to place seven wells on production during 2018’s second quarter and up to 35 wells for the full year of 2018.

Conference call Q&A

Q: You talk about some of the improvements that you’re seeing in the Utica… Can you give some additional color? Is that all on the completion side or is there some component where you’re landing the lateral, and how far west do you think you can take this new design to?

EVP of E&P Frank Patterson: We’ve gone back and basically reinvented the Utica.

I mean, we were well into this program. Everything we’ve learned in Eagle Ford, Haynesville and the other plays, we’re moving all that knowledge to all of our plays as fast as we possibly can.

We are looking and we have changed some of the landing within the Utica. We are drilling longer laterals in the Utica. We have up spaced in the Utica, because we believe that we are effectively stimulating more rock and don’t need the tight spacing.

So it’s all the above, and yes, you’re right. It is moving over towards the oilier portion of the field and we think that is a real positive for acreage position that expands our available well count, and then, we are changing some of the completion styles and I’ll let Jason talk about that.

But we’re really excited about what it’s doing. It’s a substantial uptick to what we’ve seen historically and I think it’s going to bode well for the future.

EVP of Operations and Technical Services Jason Pigott: We’re really excited on the completion side of what we’re able to accomplish out there and it’s actually a good combination effort between our drilling and completion teams.

We had to completely redesign the wells from the casing string onwards, but we started changing the fluids that we pump and we’ve also increased the sand concentration like it was successful in other plays like the Haynesville. So, sand is up 33%… So that’s something, again, it’s easy for us to do across the board going forward, but took some operational adjustments to get us there to be able to make these high producing well(s).

So we’re really excited about the future in Utica as well.

Patterson: And basically, one other thing that we’re looking at — this could be a refrac opportunity as well – if you go back into all the older portion(s) of the field and maybe re-stimulate.

So there is expandable opportunity with technology.

Q (continued): You talked about 790 or so locations in the wet gas window. Any thoughts based on some of the new data points that you’re seeing, where that could move to?

Patterson: We are still in the process reevaluating how the wet and the dry windows should behave.

So it’s a little premature to say, we’ve up-space, but that up-space — with that up-spacing comes also an increased EURs per given wellbore. So we’re not working necessarily locations in any of our field. That’s not our driver.

Our driver in every field is how do we maximize the value of every well we put in the ground. So our well count could go down, it could go up in a given field depending on spacing, but what we’re trying to do is get the economics on every single well that we drill to the highest it can be.

CEO Robert Douglas Lawler: And just on top of Frank’s comments there, keep in mind that one of the competitive positions at Chesapeake has today is that and essentially all of our yields, we still remain about 30% developed.

So when you start asking about specific well locations in the technical improvements in this company, the answer is, we’ve got a bunch of them. We’ve got a bunch of opportunity and significant number of locations in every asset that only gets better with the improvement for recognizing.

Q: You had a pretty significant drop in the Haynesville production from Q4 than Q1. Do you have any color on that?

Patterson: What we’ve done is basically in all the fields — one of the lessons learned is that trying to align the drilling rigs with the completion crew is to create the most efficient logistic stream we can possibly create.

So that’s just a situation where we’re running three rigs. We are running basically a completion crew to — two completion crews right now following those rigs. We’ve also try to align in most of our gas fields, because the price of gas is dropped as you’re very aware with our firm transportation and so we’re just lining that out.

We will see the asset basically running at about our firm transportation rate and that’s an asset where if gas price reacts, that’s where we can react and drive more gas into the system as needed.

CFO Domenic Dell’Osso: Just to add on to that. We only turned to line four wells in the Haynesville in the quarter as we align those operational efforts and get our logistics revised to reduce cost as much as possible and be efficient as possible.

So as we work through our capital allocation process, as I noted in my notes, in my prepared notes for the call this morning, we are driving for an optimal allocation to gas, which in today’s commodity price environment is not terribly high and we are going to be as efficient with our capital as possible.

And so, again that’s a bit of lumpiness there in the turn-in-line schedule. There will be more wells turn-in-line in the Haynesville as we move throughout the year, but it’s about capital efficiency and it’s about allocating capital across the portfolio where we frankly don’t have a need to invest as much in gas with the gas strip where it is today.