Analyst say numbers out of China indicate that growth is slowing

After posting annual GDP growth of 7.4%, the Chinese economy seems to be continuing its impressive year-on-year growth, but analysts say the rise is slowing. 2014 marks the first time in 15 years that China has not reached its annual growth target of 7.5%, but growth figures still came in higher than market expectations of 7.2%, reports the BBC.

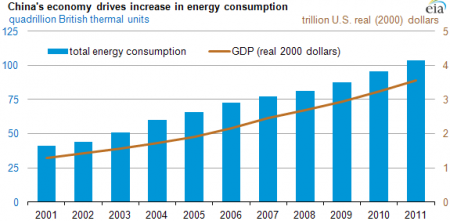

In the energy sector, China’s power consumption rose 10.5% in December from November, reports the Wall Street Journal. Last month, China used 511.7 billion kilowatt-hours, the highest volume since August of 2013. China’s December electricity consumption rose 4.7% year-on-year. That is still higher than every preceding month since June, but only brings consumption in line with levels from the first half of 2014. Consumption for the full year, which was 5.52 trillion kWh, rose just 3.8% from 2013, or half the rate from the previous year.

The International Monetary Fund (IMF) also downgraded its growth forecast for China to below 7%, saying that growth has slowed and will likely moderate further. Some feel that even the IMF’s outlook is too kind. In an interview today with BNN, Patrick Chovanec, Chief Strategist for Silvercrest Asset Management, said he believes the IMF forecast is still overly optimistic. When referring to the economic growth numbers being released by China, Chovanec said: “These are fragile numbers not based on fundamentals. Even the slightest push could send them toppling over.”

Chovanec said that slowing growth could be a sign of an investment boom wearing off in China, and that it could hurt those invested in operations like oil and mining but not damage the world economy. “If you’re pumping for oil or mining for ore and China isn’t demanding as much as the investment boom levels off, obviously you’re going to take a hit,” he said. Chovanec believes a healthier world economy will emerge if China, which has been rapidly growing since the 1990s, reaches an economic plateau.

“Output is going to level out and maybe even fall, but they’ve accumulated $4 trillion of reserves, which is global buying power,” he said. “It won’t stop slowing GDP growth, but it may become a driver for growth around the world.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.