Sinopec offers major stake in international unit to Chinese investment firms

China Petrochemical Corp., or Sinopec Group as it is commonly referred to, is selling more than half of a unit which holds its overseas assets to two state investment vehicles. No value for the transaction was provided, but the deal will split ownership into two 30% stakes and one 40% stake between Sinopec Group, China Chengtong Holdings Group Ltd. and China Reform Holdings Corp. No further detail on who will retain which stakes was provided, reports Bloomberg.

Sinopec Group’s international unit, Sinopec International Petroleum Exploration & Production Corp., produced 49.86 MMBO of crude oil in 2014, or about 14% of the group’s total 360.7 MMBO output. The value of the assets in the group’s portfolio have been severely affected by the downturn in commodity prices, making it difficult to run them profitably or sell them without taking a loss.

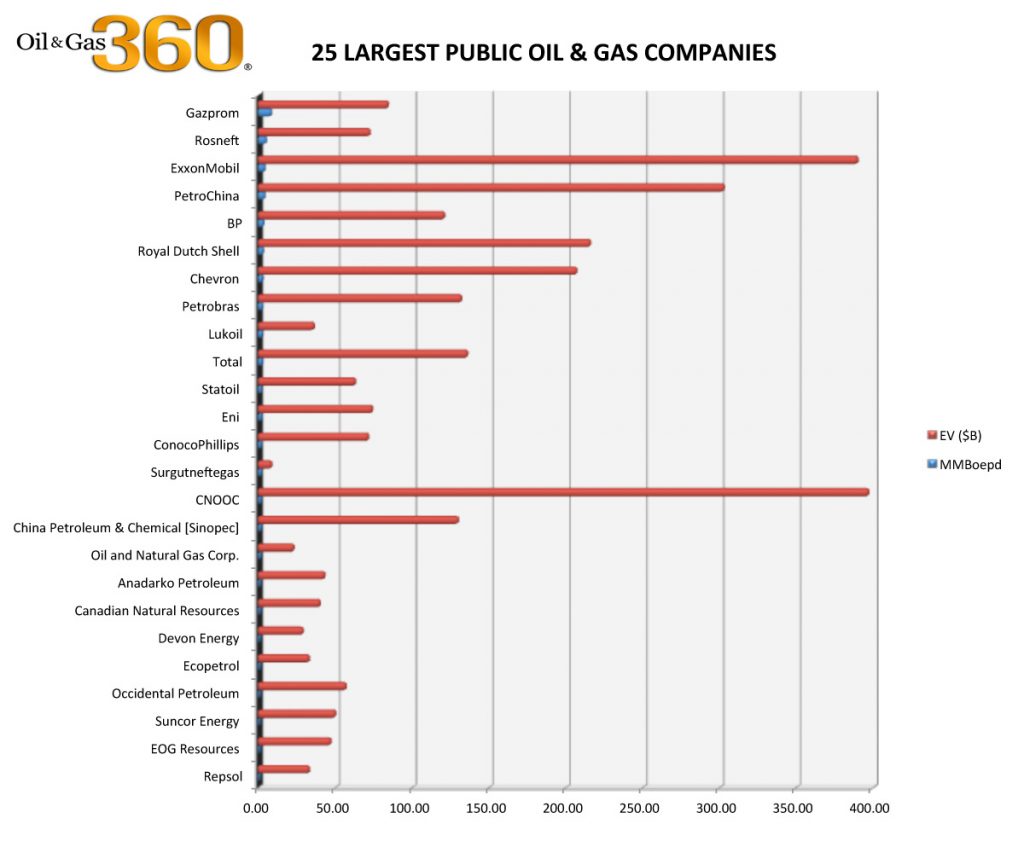

Chinese energy companies prominent in Forbes global list of 25 public oil & gas companies

4th – PetroChina (ticker: PTR, com) – China – 4.07 MMBoepd – EV $303 billion

15th – CNOOC (ticker: CEO; com) – China – 1.36 MMBoepd – EV $397 billion

16th – China Petroleum & Chemical [Sinopec] (ticker: SNP; com) – China – 1.32 MMBoepd – EV $130 billion

Forbes’ 25 Largest Public Oil & Gas Companies – ranked by production (blue bars) largest to smallest. Red bars represent enterprise value.

China’s biggest oil and gas companies, which include Sinopec Group as well as China National Petroleum Corp., spent nearly $119 billion on energy deals from 2009 through 2013, accounting for 13% of global transactions in the industry, according to data from Bloomberg. The assets held by Sinopec Group include projects in areas as diverse as Canada, Kurdistan, Brazil, Russia, Egypt and in Africa.

Handing assets back to the government becoming increasingly prevalent amidst reform

The trend of selling stakes to state-run firms is on the rise in China, where the country is in the process of trying to reform its cumbersome government-owned industries.

“Only the state-owned asset companies have the capacity and money to merge and reorganize them,” said Tian Miao, an analyst at North Square Blue Oak Ltd., a China policy research company. “Those overseas projects bought at high oil prices years ago may have lost massive value in this low oil price environment.”

“No company would buy those assets at anything but a small fraction of what Sinopec Group paid for them,” said James Hubbard, a Hong Kong-based analyst. These assets “have book values that are far in excess of anything Sinopec’s listed company would pay without destroying vast amounts of shareholder value.”