Realized NGL prices more than doubled

Cimarex Energy (ticker: XEC) reported first quarter earnings today, announcing net income of $131 million, or $1.38 per share. This result compares favorably to the $38.2 million income in Q4 2016 and the $231.5 million loss the company recorded in Q1 2016.

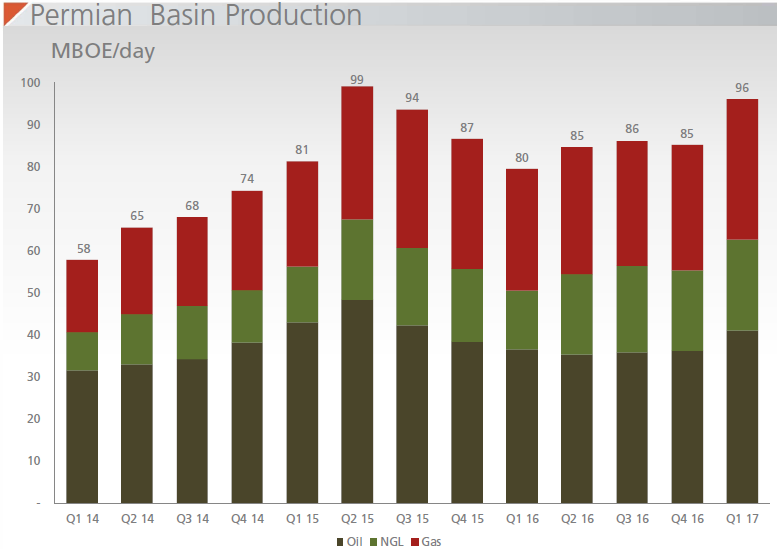

Total production up 11% sequentially

Total company production grew by 11% sequentially, more quickly than expected. Year-over-year realized commodity prices improved across the board, with oil prices increasing by 70% from $28.02. Natural gas prices increased by 57% to average $3.01/Mcf, and NGL prices more than doubled to $20.40/bbl, from $9.84/bbl received in Q1 2016.

Overall, Cimarex expects to produce an average of about 1.11 Bcfe/d in 2017, an increase of 15% beyond 2016 production. After completing 26 wells in Q1, the company plans to complete a total of 73 in the rest of the year, with an additional 44 wells drilling or waiting on completion at the end of the year.

Cimarex is currently running eight rigs in the Permian, where the company owns 225,000 net acres. Several tests of various facets of development are currently in progress in the company’s Delaware basin acreage. In northern Culberson County Cimarex is testing infill drilling in the lower Wolfcamp, evaluating six wells in the formation per section. While most wells are still in initial production, Cimarex reports that wells targeting both upper and lower landings in the zone are yielding good returns. Notably, wells in the upper landing zone currently have a higher oil yield.

Increasing frac intensity has also produced good results, as tests in the upper Wolfcamp in Culberson County and the Avalon Bone Spring in Lea County have each produced significant improvements in returns.

Extensive downspacing tests in Mid-Continent

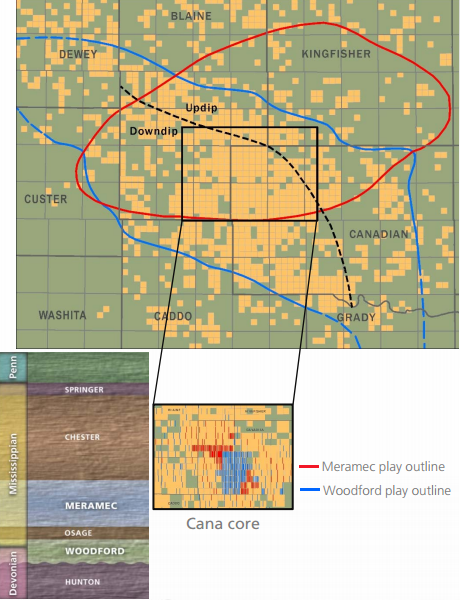

In the Mid-Continent the company owns significant acreage in the stacked plays of the Meramec and Woodford. The company is running six rigs in the area, and brought ten net wells online in Q1 2017.

Cimarex reports that a total of 16 downspacing pilots are underway in the Meramec, and the company has interest or data in all but three. Cimarex itself is currently running the Leon Gundy pilot, where eight total wells are evaluating ten Meramec wells and nine Woodford wells per section. Farther south, where the Woodford dominates, Cimarex is testing 16 and 20 wells per section. The results of these tests will guide the company as it plans infill drilling on its extensive acreage.

Q&A from XEC Q1 2017 conference call

Q: Lea County, it seems like there’s been a lot of activity there lately or a lot, I guess, results coming out between yourselves, EOG had some nice wells. I know Devon’s doing some down-spacing in there. Can you just talk about, is this something different or I know you’ve been up there and you’re testing tighter spacing, but can you just talk a little more general about the area and what you’re seeing?

XEC CEO Thomas E. Jorden: We’ve always loved Lea County. One of the reasons that we haven’t aggressively developed our acreage at the multiple levels is because it’s really quite good and we wanted to make sure that we got our spacing and our science right because you can’t always back up and get a do over. There have been some offset well results. We’ve extended our mapping, and the play has just extended. And we’re quite bullish on the outset, not only for the Wolfcamp, but a number of different zones.

XEC SVP of Exploration John Lambuth: I would just say that you’ll see more of our activity moving into Lea County later this year. We have quite a bit of drilling we want to do up there. It’s not – like Tom said, we’ve always loved Lea County. It’s just over the last few years, with the pull back in our capital, most of our drilling has been to hold acreage that we needed to hold down in Culberson and Reeves. We are very fortunate that almost all of our position in Lea is a well-held HBP acreage, be it a previous drilling we’ve done mostly in the Bone Spring and other targets. So we’re just now starting to focus more energy to get in there and then taking advantage, as Tom said, of the fact that a lot of our competitors are “delineating” our acreage for us. So it looks very, very attractive and thus resulting in the updating we gave on the increase in the acreage there.

Q: The land and seismic CapEx for the first quarter is a little bit higher than we were anticipating. Just wondering did you actually add any acreage or was that just lease retention cost or anything else you can talk about there?

John Lambuth: That was acreage addition in, we leased – we had an opportunity on a new concept and we liked the concept. So, we went out and aggressively acquired acreage on it. So, that was, yes, that was a little bit above and beyond what we planned for the quarter. It’s kind of more of a one-off event. We don’t expect to spend that same amount on a quarter-by-quarter basis, but we saw a very good opportunity for an idea that our team had put together. And so we went out and captured it. Again, I’ll emphasize we don’t expect that same type of expenditure for the remaining quarters this year, unless, of course, they come up with a really good idea.

John Lambuth: And then, we’ll go do it again. But that is what was going on in that first quarter.

Thomas E. Jorden: Just by way of our program, we want to always be making land investments. But what we do is we look very carefully full cycle at the return on our investment, fully burdened with land, corporate overhead, all associated costs, and then we look at our total program and make sure that land is not too high a part of the overall expenditure. And we’ve always managed the company that way. We look at it on an ongoing basis.

You have to make the land investments. Otherwise, you’re essentially liquidating the company. You may be liquidating on a 50-year time horizon, but we always want to be bringing in new things to replace what we drill. And so from time to time, you’re going to see that land investment swing up and down. It’s a part of our ongoing business.

Q: Can you say where that new opportunity is, or is it going to remain kind of in the stealth mode for a while?

John Lambuth: Stealth mode.