Coal Woes: Peabody Energy Announces a “Going Concern”

In January 2016, OAG360 published a piece on the coal industry, it began with:

“Government policy can be used as a powerful industry killer. Ask the coal miners in Appalachia.

In a 2008 speech candidate Obama warned that ‘if somebody wants to build a coal power plant it will bankrupt them because they’re going to be charged a huge sum for all that greenhouse gas that’s being emitted’. Many in the business community were shocked that a man who later became president of the United States had essentially declared war on an iconic American industry.”

Through a combination of low natural gas prices, government regulation on emissions, declining steel production, and increasing debt loads, the coal industry has had a rough go of it in the last few years.

The latest news of decline came on March 16, 2016, from Peabody Energy (ticker: BTU). The company announced they delayed an interest payment and may have to seek protection under Chapter 11 bankruptcy. Peabody refinanced debt in March 2015 and was prognosticated by some analysts to run into debt issues come early 2016.

Peabody Energy disclosed the following in its 10-K on March 16, 2016:

“Risks Associated with Our Operations

As a result of operating losses and negative cash flows from operations and our election to exercise a 30-day grace period with respect to certain interest payments, together with other factors, including the possibility that a covenant default or other event of default could cause certain of our indebtedness to become immediately due and payable (after the expiration of any applicable grace period), we may not have sufficient liquidity to sustain operations and to continue as a going concern.”

Should Peabody Energy proceed with a Chapter 11 filing, they would join Arch Coal, the nation’s second largest coal miner, Walter Energy Inc., Alpha Natural Resources, and Patriot Coal in bankruptcy.

How Government Regulation Played a Role

Since taking office, President Obama has targeted coal companies as part of his fight on climate change and environmental initiatives. The Mercury and Air Toxics Standards (MATS) rule, and the Clean Power Plan have been two major pieces of legislation that placed restrictions on emissions, largely targeting the use of coal.

The assault continued on January 15, 2016, the Obama administration ordered a pause on issuing coal-mining leases on federal land as part of the government’s first major review of coal programs in almost 30 years. U.S. Interior Secretary Sally Jewell informed media that the pause could last up to three years as officials assess the implications on global climate change and the role of taxpayer’s stake in coal production from public land.

As part of the pause, the government will review the awarding of leases with the potential for leases on federal land to become more expensive to coal companies. Federal land accounts for just over 40% of U.S. coal production. The government believes that increased expenses on coal leases would help mitigate the production and usage of coal, thus helping the environment, while simultaneously generating more government royalties.

Obama has used executive authority to implement these changes and circumvented Congress, which has angered some. “Congress will continue to fight back against the president’s ruthless pursuit of destroying people’s low-cost energy sources in order to cement his own climate legacy,” said U.S. House Speaker Paul Ryan.

The Substitution Effect

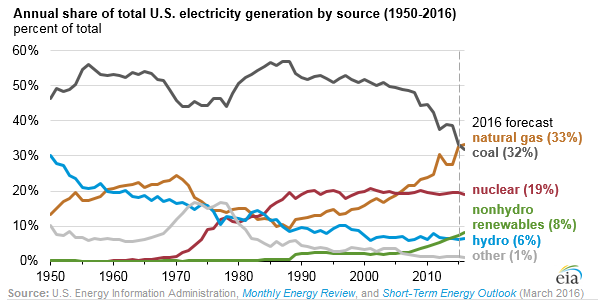

As a result of these policies, there has been a displacement of coal with cleaner burning natural gas for use in power plants. In a March 16, 2016, Today in Energy report issued by the EIA: “For decades, coal has been the dominant energy source for generating electricity in the United States. EIA’s Short-Term Energy Outlook (STEO) is now forecasting that 2016 will be the first year that natural gas-fired generation exceeds coal generation in the United States on an annual basis. Natural gas generation first surpassed coal generation on a monthly basis in April 2015, and the generation shares for coal and natural gas were nearly identical in 2015, each providing about one-third of all electricity generation.”

The rise of the shale revolution has led to an increase in the production of natural gas, and consequently, a fall in price. Add in the increased regulation on emissions, and you have a perfect storm for a decrease in the usage of coal for energy generation in the U.S.

The China Effect

Conventional wisdom would indicate that the decline in coal has been a direct result of the Obama administration’s policies. And to a degree, that is an incredibly valid point, however there is another factor at play.

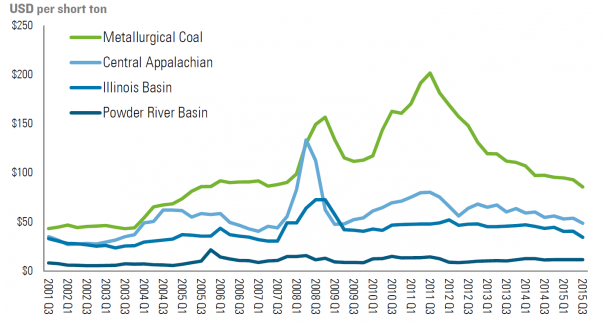

There are several different types of coal, two of the primary forms are known as thermal coal (also called steam coal) and metallurgical coal (also called cooking coal). Thermal coal is mainly used in power generation, and metallurgical coal is widely used in the production of steel.

The Chinese economy was growing at an average rate of 10% from 2001 to 2012, which led to a wealth of new construction and spending. Large quantities of metallurgical coal and thermal coal were needed to produce steel for construction and as a power source.

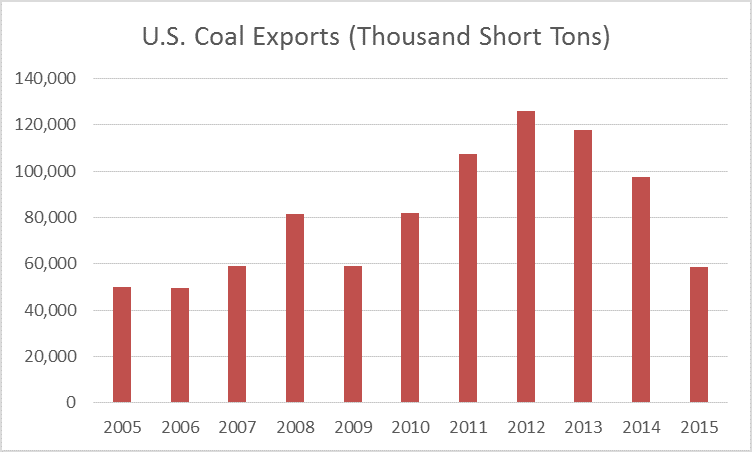

Source: EIA

U.S. coal exports continued to grow through 2012 as China’s economy boomed, and the price of metallurgical coal followed suit. Metallurgical coal prices surged past $200 a ton in 2011, but have come crashing down to around $85 per ton towards the end of 2015. According to a report published by the Rhodium Group, “Between 2011 and 2014, 93% of the decline in US coal producer revenue was due to a drop in met[allurgical] quantities and prices.”

Source: Bloomberg, EIA, Rhodium Group

The World Steel Association had forecasted that global steel demand will decrease by 1.7% in 2015, before growing by 0.7% in 2016. The WSA also projected Chinese demand to fall by 3.5% in 2015 and 2% in 2016, following a demand peak in 2013.

A CNBC story reported that the deputy head of the China Iron and Steel Association warned that demand for the ferrous metal was waning fast. “China’s steel demand evaporated at unprecedented speed as the nation’s economic growth slowed. As demand quickly contracted, steel mills are lowering prices in competition to get contracts,” Zhu Jimin, deputy head of the China Iron & Steel Association, said on Wednesday at a briefing in Beijing, according to Bloomberg.

Increasing Debt Loads

Peabody Energy has had a major dip in market cap and a consistently rising debt load over the last few years, this has been a major factor in the potential chapter 11 filing as the value of their stock a has continued to fall relative to the amount of debt held. A good portion of this is attributable to the loss in business outlined above, while another major factor is the fall in commodity prices. Oil and gas have also fallen in commodity value in recent years. The table below outline the average debt to market cap of the top ten U.S. companies in each industry.

| 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | |

| Coal | 51% | 65% | 93% | 96% | 574% | 1027% |

| E&P | 26% | 29% | 40% | 29% | 40% | 96% |

| OilService | 15% | 23% | 29% | 24% | 38% | 53% |

Coal has easily been the hardest hit out of this group with debt levels relative to market cap soaring over the last few years. Peabody Energy certainly isn’t the first one to address the need to file for Chapter 11, and it almost certainly won’t be the last.