Despite shrinking domestic numbers, demand for coal is growing internationally

Recent years have been difficult for the coal industry in the United States. James River Coal Co. (ticker: JRCCQ) laid off a quarter of its workers, and Consol Energy Inc. (ticker: CNX), another major player in the coal industry, sold off five Appalachian mines to privately held Murray Energy, representing close to 50% of Consol’s coal output, according to the Wall Street Journal. The overall level of people employed in the U.S. coal mining industry has declined 15% in the last 20 years.

Despite these pessimistic numbers, the coal industry is far from being out of the game. Coal still remains the biggest source of fuel for generating electricity in the U.S. and demand for coal abroad is growing quickly. The Energy Information Administration says it expects U.S. coal production to remain relatively constant over the next three decades, and reports U.S. weekly coal production over the last year being relatively constant as well.

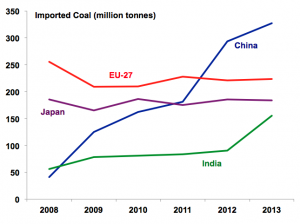

Outside the U.S., demand for coal is being stoked by the rise of ever wealthier middle classes in emerging economies, especially China and India. Wall Street Journal reported in January that a study by Wood Mackenzie showed coal surpassing oil as the world’s dominant fuel source. “China’s demand for coal will almost single-handedly propel the growth of coal,” Wood Mackenzie’s William Durbin told the Journal.

India seems to be taking cues from its neighbor China, however, and has nearly tripled its own coal consumption since 2008, according to Forbes. Despite India’s state owned Coal India Limited (ticker: COALINDIA) being the world’s largest producer at 465 million tons/year, the country is still struggling to keep up with demand. Because of the expanding supply gap, India is looking to bring in foreign companies to build coal fired plants and pick up India’s coal industry’s slack.

Although the numbers in the U.S.’s historically high output Appalachia are down, open-pit mines in Wyoming and coal operations in Illinois and Indiana continue to grow, according to the EIA. EIA statistics show Wyoming’s coal production hit 34 million short tons in Oct. 2014, compared to 31 million short tons in Oct. 2013. Illinois produced 4.7 million short tons in Oct. 2014, compared to 4.2 million short tons in Oct. 2013. Indiana produced 3.4 million short tons of coal in Oct. 2014, compared to 3.3 million short tons in Oct. 2013.

The Associated Press reported in October that Murray Energy Corp. is adding 100 million tons of reserves and other resources to its southern Illinois portfolio. The movement of coal production from Appalachia into states like Illinois, coupled with increasing international demand is good news for coal, with exports in 2012 at 114.2 million tons, more than triple the level a decade earlier, and export revenues at $14.8 billion, up from $1.6 billion in the same 10 year period, according to the Wall Street Journal.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.