LAUNCESTON, Australia – China is likely to have dipped into its crude oil stockpiles in April, the third time in the past seven months it has done so, a sign that the era of massive inventory builds may be coming to an end.

Source: Reuters

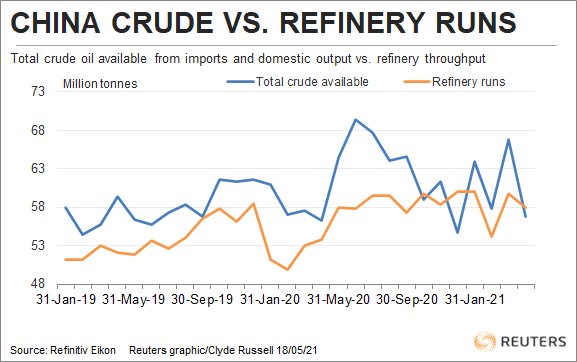

China’s refiners processed about 280,000 barrels per day (bpd) more crude than what was available to them from imports and domestic output, according to calculations based on official data.

China doesn’t disclose the volumes of crude flowing into strategic and commercial stockpiles. But an estimate can be made by deducting the total amount of crude available from imports and domestic output from the amount of crude processed.

Refiners processed 57.9 million tonnes of crude oil in April, equivalent to about 14.09 million bpd, according to data released on Monday by the National Bureau of Statistics.

The world’s largest crude importer brought in 40.36 million tonnes of the fuel in April, while domestic output was 16.41 million, giving a combined total of 56.77 million tonnes, which is equivalent to about 13.81 million bpd.

Subtracting that from the crude available from the refinery runs leaves a gap of 280,000 bpd, meaning refiners likely used some of their bulging inventories, largely built up during last year’s price collapse.

China snapped up large volumes of crude when prices plunged to two-decade lows during the coronavirus pandemic, which coincided with a brief price war between top exporters Saudi Arabia and Russia.

China imported so much crude in the middle part of last year that it resulted in long vessel queues outside ports, and it struggled to offload the cargoes.

By the end of last year Chinese refiners tapered imports as they exhausted permits, resulting in rare inventory draws in October and December.

April’s small draw on inventories means that for the first four months of the year flows into stockpiles have eased back to about 670,000 bpd, or about half of 1.29 million bpd averaged over all of 2020.

Source: Reuters

INVENTORIES FILLED?

The question for the crude oil market is whether China is likely to continue building inventories at the pace it has done so in recent years, or is it closer to filling its strategic petroleum reserve (SPR)?

If the SPR is close to reaching its target, it does suggest that China’s future crude oil imports will be more closely aligned to its refinery processing rates, and whatever decisions refiners make about the level of commercial inventories they wish to hold.

What would this mean for China’s crude imports?

If refinery processing is likely to be in a range of 14 to 14.5 million bpd, and domestic output remains around 4 million bpd, it suggests that refiners will need to import between 10 and 10.5 million bpd.

But if China did run its refineries harder, it would likely produce more refined fuels than the domestic market requires, meaning product exports would likely rise.

This may have the effect of displacing crude demand elsewhere, working on the assumption that China’s more modern and efficient refineries would be able to win sales from other regional fuel exporting countries, such as India and Singapore.

Another factor worth considering is the role of the crude price in any decisions by Chinese refiners to add to inventories.

With Brent futures trading just under $70 a barrel in early Asian trade on Tuesday, the global benchmark is up more than 250% from its pandemic low in March 2020, and has gained about a third since the end of last year.

If Chinese refiners believe prices have risen too high too quickly, one method of taking some heat out of the market is to ease back on imports and dip into stockpiles.

The opinions expressed here are those of the author, a columnist for Reuters.