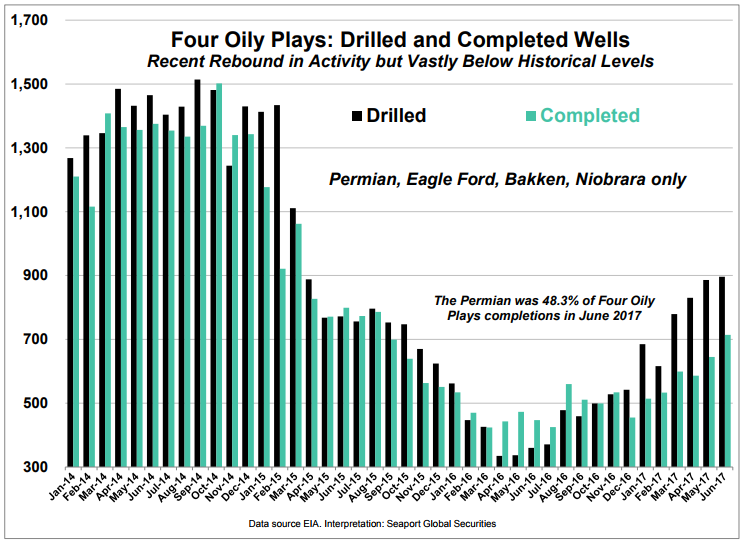

A report by Seaport Global indicated that, since monthly numbers for drilled and completed wells bottomed out in mid-2016, the number of wells drilled and completed has made a significant comeback but have not come close to pre-crash levels in the top four oily plays—the Permian, Eagle Ford, Bakken and Niobrara.

Even though completions have not yet caught up to pre-crash levels, tight oil production out of the seven largest plays climbed, and are expected to continue climbing, through August 2017. Tight oil production itself grew by 772,751 BPD since August, 2016. The same trend is visible in tight gas production, which increased by 8.97%, since August, 2016.

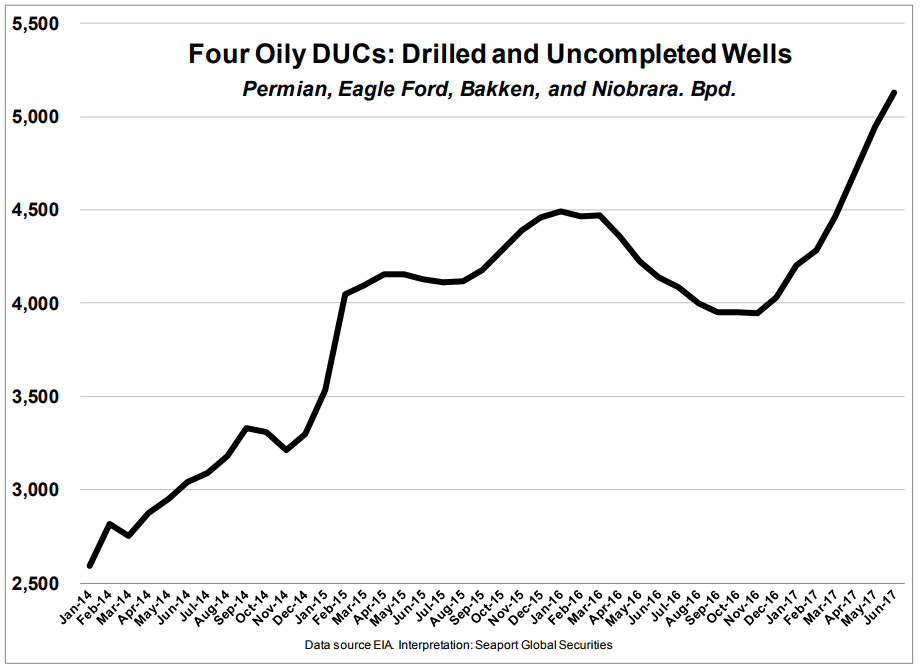

The disparity between the monthly number of drilled wells and completed wells has resulted in an increase in the number of drilled and uncompleted (DUC) wells in the four oily plays.

The opposite is true in the two gassy areas, the Marcellus and Utica shales, which are experiencing a decrease in the number of DUCs.