Production to grow by 20%-24% in 2017

Concho Resources (ticker: CXO) announced fourth quarter earnings and reserves today, showing a net loss of $125.1 million, or ($0.86) per share. Full year results were a net loss of $1.5 billion, or ($10.85) per share. Adjusting for impairments and other non-cash items yields better results. Net adjusted earnings for Q4 and the full year are $0.20 and $0.81 per share, respectively.

2016 reserves were up 15% to 720 MMBOE, from 624 MMBOE in 2015. 59% of these reserves are comprised of oil, while natural gas makes up the remaining 41%. Concho spent $1.15 billion on exploration and development last year, meaning its F&D costs for 2016 were $9.21/BOE.

Concho to operate 19 rigs in 2017

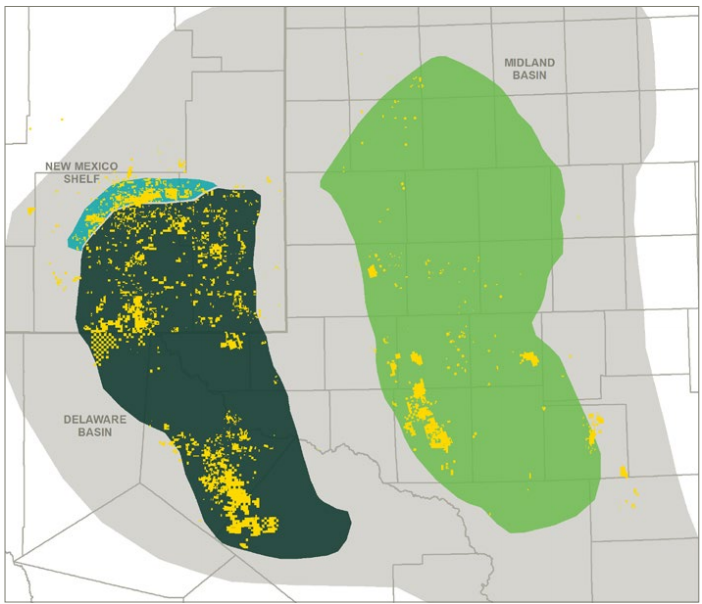

Concho expects to 2017 CapEx to be between $1.6 and $1.8 billion, with 90% of this spent on drilling and completing wells. 60% of CapEx will be spent in the Delaware basin and 30% will be spent in the Midland, with the remaining 10% going to operations in the New Mexico Shelf. Concho expects to operate an average of 19 rigs in 2017, down slightly from the 21 operating currently. These rigs will fuel production growth of between 20% and 24% in 2017, with oil production growing 25%.

Record average 30-day peak production in Midland basin

Concho Resources is a pure-play Permian E&P, with all its acreage in the basin. The company owns about 540,000 gross acres in the Delaware basin, where Concho is currently operating 13 rigs. Concho is currently testing multi-zone pads in the Delaware, which seek to access several of the stacked pay intervals available from the same location.

Concho’s Midland basin development, where the company owns 260,000 gross acres, has seen recent success. Extensive use of multi-well pads in the basin allowed Concho to add 11 wells in Q4, which produced a record average 30-day peak rate of 1,299 BOEPD. In the basin in 2017 the company plans to exclusively drill 10,000’ laterals from multi-well pads.

Concho owns 130,000 gross acres in the New Mexico Shelf, which was the company’s first Permian basin property. While the New Mexico Shelf has historically been accessed with vertical wells, Concho is currently testing horizontals on the acreage. If these tests are successful the company will be able to further access the resource potential of the asset that allowed it to go public in 2007.

Q&A from CXO Q4 conference call

Q: I wanted to get your perspective on where you think we are in terms of the Permian land grab? We’ve seen some recent M&A with Clayton Williams and Noble. And specifically, I want to get your thoughts on what you plan to do with some of the proceeds from ACC?

CXO Chairman, President and CEO Timothy A. Leach: We’ve talked in the past about how generally the land grab is starting to come to an end, and execution is going to be the theme. We talked about that throughout last year. I will say that I think from a pipeline of M&A and acquisitions and things like that, there’s still opportunities out there that we can get excited about. But as a theme, I think execution is going to be the next theme, and the acquisition part of its over with, and now I think we’ll enter a consolidation phase where we’ve consistently described how big chunky blocks of acreage are valuable because you have to drill these laterals longer and you have to drill them at the same time and it’s very capital intensive. So I think the nature of the game will change over time. But it’s not all going to happen in 2017. These things take quite a while for them to play themselves out. We will still continue to execute on consolidating in our core areas. But I think operationally, you’re going to see the impact of pad drilling, longer laterals, the optimized completions, bringing these wells all along at the same time really have a big influence on the productivity of the well.

Your second question was about redeploying the ACC proceeds. That was a terrific outcome for us. As Jack described, we captured all the strategic reasons that we wanted to build a pipeline, we keep all of those strategic advantages for Concho and we got a 6 to 1 on our money, that’s the pretty good days work. And I don’t want to confuse the 2017 plan really too much by, and when we say we can grow so dramatically within cash flow, I want everybody to be able to see us demonstrate that. At the same time, we now have the ability to – we also talked about delevering our balance sheet and keeping it delevered, and also I guess there is a lot of dry powder for continuing to work on our high-grading our properties and the bolt-on acquisitions and things like that. And then, out in the future, we have plenty of flexibility and capital to reinvest in our high rate of return drilling opportunities. So it’s a good story for us I think.

Q: My question pertains to service cost inflation, and while I understand you might be reluctant to put out a specific percentage change that you might expect, I’d like to get your high-level thoughts on what you are seeing as far as how service cost are increasing, where its intended to be tightest and also are people now getting tight and had you had any jobs delayed because of the lack of people?

Timothy A. Leach: Well, let me first emphasize that in the guidance we’ve given out and the plan that we’ve announced, we think we’ve accounted for all that. We’ve accounted for what we think the service costs are going to be throughout the year. And what we haven’t accounted for is additional efficiencies that we think we’re going to get through the drill-bit, which last year were substantial. So, I think, we have a robust plan that accounts for the service cost that we expect. I think the service costs at a very high-level are related to, how many rigs are running and how much excess capacity there is out there. I will say at $50 oil, when I think about the service cost inflation, you certainly hear companies talking about that, you certainly hear the expectation that with more rig utilizations and frac spread utilizations that the cost will go up some.

I would emphasize, the size and scale of our company and our ability to keep cost down, because we can run efficiently, because we have so many rigs running and we can keep them running because we’re kind of the steady as she goes operation. So, I think whatever the cost environment is going to be, we’re going to have an advantage.

Analyst Commentary

From KLR Group:

Concho reported recurring 4Q/16 EPS of $0.27, above our estimate of $0.15 due to lower DD&A and a slightly higher gas price realization partly offset by lower production and higher LOE/G&A expense. Production in 4Q/16 of ~164 Mboepd (~61% oil) was ~3% below our ~169.4 Mboepd (~61% oil) estimate and ~1% below the consensus estimate of ~166 Mboepd. The company increased its ’17 capital plan $200 million to $1.6-$1.8 billion and production growth guidance from 18%-21% to 20%-24%. Preliminarily, we expect 1Q/17 production to be at the high end of guidance (172-176 Mboepd) and ’17 volumes to at the midpoint of revised guidance. YE ’16 proven reserves increased ~15% y/y to ~720 Mmboe (~59% oil, ~65% PD) with a reserve replacement ratio of ~344%. This announcement should have a positive value impact due to a slightly lower capital intensity, oil composition and higher gas price realization partly offset by higher LOE/G&A expense.

From Capital One:

Positive. Solid financials beat with generally in-line production. Midland Basin saw a large increase in year-end proved reserves, and the company's estimated net resource potential highlights quality inventory. 2017 guidance points to 25% y/y oil production growth while planning to spend within cash flow.

From BMO Capital Markets: We view Concho's 4Q16 results as in line as a higher oil mix offset total

production at the low end of guidance, while driving better-than-expected EBITDAX on

lower capex. Capital spending in 2017 was moved higher, although it is still within cash

flow, moving production growth to 20-24% (vs. 18-21%).