Concho Resources Inc. (ticker: CXO) produced 19 MMBOE in Q4 2017, an average of 211 MBOEPD. This is 28% more than Q4 2016 and 9% more than Q3 2017. Average daily crude oil production for fourth-quarter 2017 totaled 130 MBOPD, an increase of approximately 30% from fourth-quarter 2016 and 9% from third-quarter 2017. Natural gas production for fourth-quarter 2017 totaled 487 MMcf/d.

For full-year 2017, total production increased 28% to 70 MMBOE, or 193 MBOEPD, driven by a 29% increase in crude oil production to 119 MBOPD. Natural gas production for full-year 2017 was 441 MMcf/d.

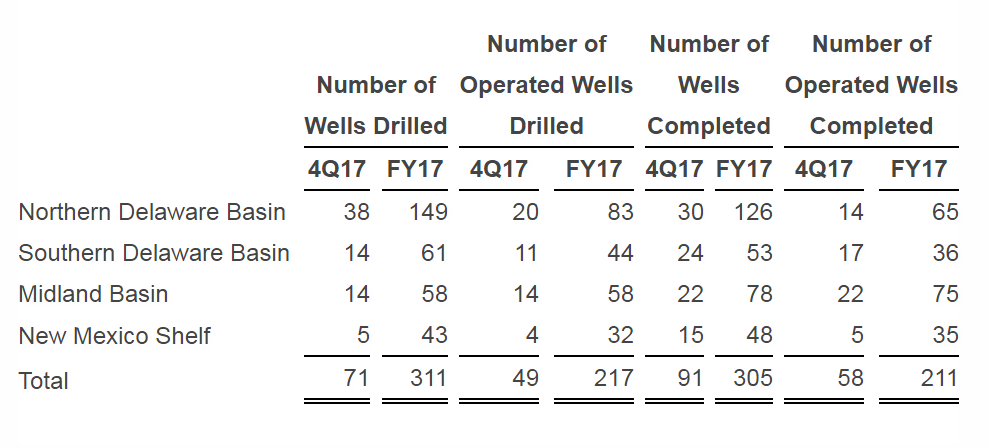

During fourth-quarter 2017, Concho averaged 16 rigs, compared to 19 rigs in third-quarter 2017.

The company is currently running 19 rigs, including eight rigs in the Northern Delaware Basin, six rigs in the Southern Delaware Basin and five rigs in the Midland Basin. Additionally, the company is currently utilizing six completion crews.

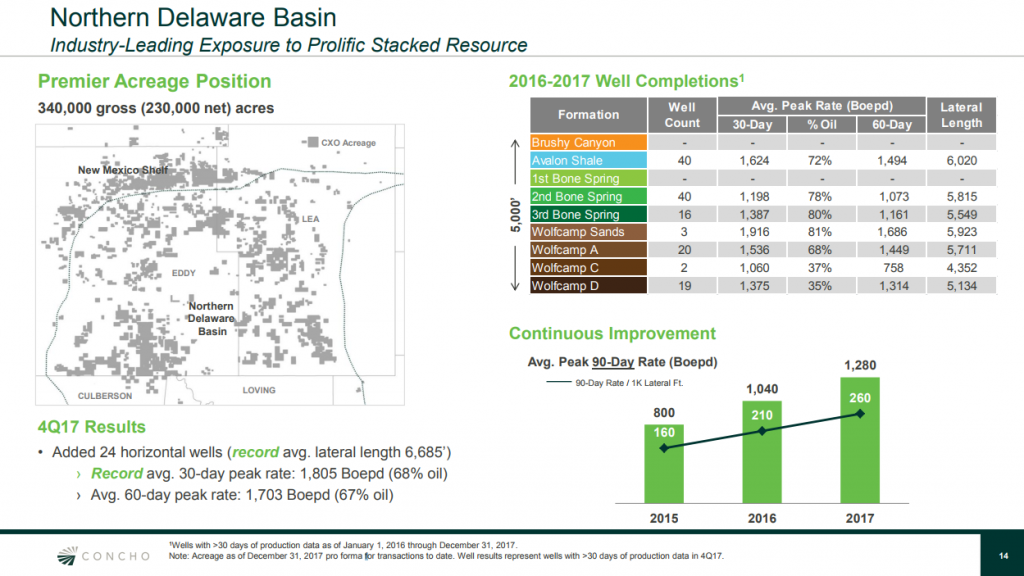

Northern Delaware Basin

In the Northern Delaware Basin, Concho added 24 wells with at least 60 days of production as of the end of fourth-quarter 2017. The average 30-day peak and average 60-day peak rates for these wells were 1,805 BOEPD (68% oil) and 1,703 BOEPD (67% oil), respectively. The company also recorded an average lateral length of 6,685 feet during fourth-quarter 2017.

Concho said it sees “strong performance” from the Vast and Windward projects, two large-scale development projects in the Red Hills area. The Vast project includes seven wells targeting the Wolfcamp sands and Wolfcamp A shale, and the Windward project includes eight wells targeting the Avalon shale. The Vast and Windward projects have produced an aggregate 3 MMBOE (71% oil) in the first four months of production.

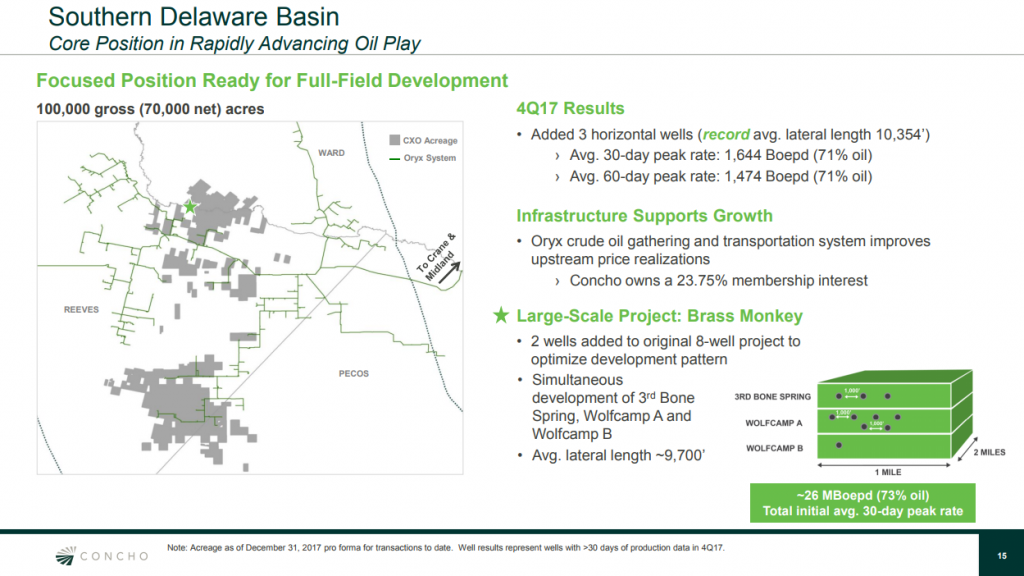

Southern Delaware Basin

In the Southern Delaware Basin, Concho added three wells targeting the Wolfcamp A with at least 60 days of production as of the end of fourth-quarter 2017. The average 30-day peak and average 60-day peak rates for these wells were 1,644 BOEPD (71% oil) and 1,474 BOEPD (71% oil), respectively, and the average lateral length of 10,354 feet set a company record for the Southern Delaware Basin.

Concho also recently completed a large-scale, multi-well project in the Southern Delaware Basin. The Brass Monkey project, originally an eight-well project, includes 10 wells testing simultaneous development of the 3rd Bone Spring, Wolfcamp A and Wolfcamp B with an average lateral length of 9,700 feet. The average 30-day peak rate for the project was 26 MBOEPD (73% oil).

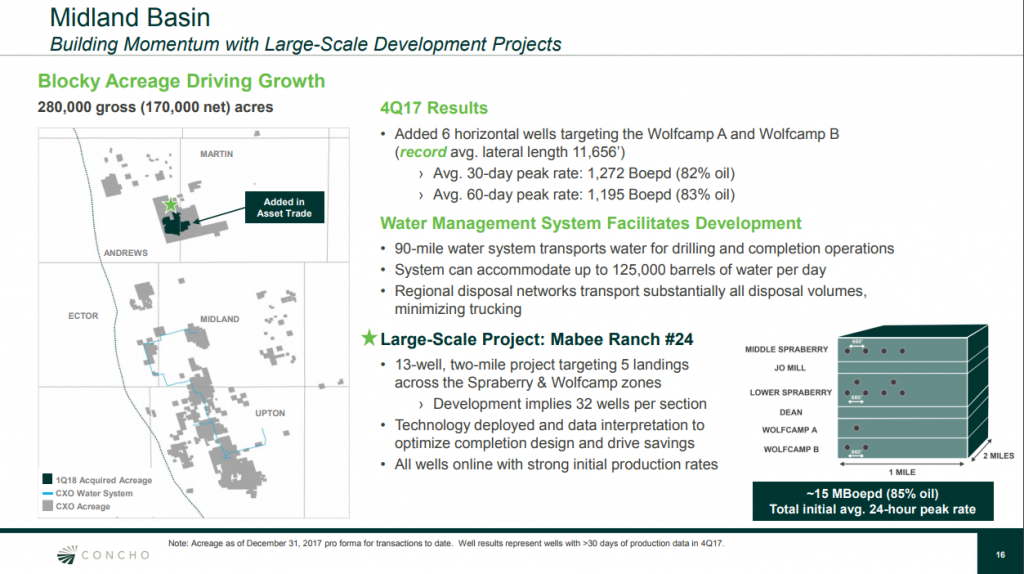

Midland Basin

Concho added six wells targeting the Wolfcamp A and Wolfcamp B in the Midland Basin during fourth-quarter 2017. The average 30-day peak and average 60-day peak rates for these wells were 1,272 BOEPD (82% oil) and 1,195 BOEPD (83% oil), respectively, and the average lateral length of 11,656 feet set a company record for the Midland Basin.

Concho recently completed the 13-well, two-mile Mabee Ranch project located in Andrews County, Texas. The Mabee Ranch project has recorded an initial 24-hour peak rate of approximately 15 MBOEPD (85% oil).

Reserves

At December 31, 2017, Concho’s estimated proved reserves totaled 840 MMBOE, an increase of 17% from year-end 2016. The company’s proved reserves are approximately 60% crude oil and 40% natural gas. Proved developed reserves totaled 588 MMBOE, an increase of 26% from year-end 2016. The company’s proved developed reserves represent approximately 70% of total proved reserves.

During 2017, Concho added 194 MMBOE of proved reserves primarily from drilling and completion operations, resulting in a reserve replacement ratio of 275%. The company’s proved developed finding and development cost was $8.68 per BOE for 2017.

Concho estimates current net resource potential to be approximately 10 billion BOE, including total proved reserves, an increase of 25% from year-end 2016. Concho’s current resource potential is attributable to approximately 21,000 gross horizontal drilling locations in the Permian Basin.

Q4/FY 2017 financial summary

- During first-quarter 2018, Concho completed the sale of non-core leasehold in Ward and Reeves Counties, Texas, for approximately $280 million

- Net income for fourth-quarter 2017 was $267 million, or $1.79 per diluted share, compared to net loss of $125 million, or $(0.86) per diluted share, for fourth-quarter 2016

- Net income for full-year 2017 was $956 million, or $6.41 per diluted share, compared to net loss of $1.5 billion, or $(10.85) per diluted share, for full-year 2016

Net income for fourth-quarter and full-year 2017 reflected income tax changes related to the Tax Cuts and Jobs Act. Due to the reduction of the U.S. federal corporate income tax rate and subsequent re-measurement of the company’s net deferred tax liability, the company recorded a provisional non-cash decrease to its income tax provision of $398 million and a corresponding provisional reduction to its net non-current deferred tax liability.

For 2018, the company estimates an effective tax rate of approximately 25%, including state taxes.

2018

Concho expects 2018 capital spending to be at the midpoint of its capital guidance range of $1.9-$2.1 billion. The 2018 capital program is expected to be funded with cash flows from operations and generate 20% crude oil growth and 16%-20% total production growth year-over-year.

Approximately 93% of the capital program is allocated to drilling and completion activities, with approximately 65% of that capital directed towards large-scale manufacturing projects, Concho said.

The company’s 2018 capital program is allocated among the following areas: Northern Delaware Basin (40%), Southern Delaware Basin (25%), Midland Basin (30%) and the New Mexico Shelf (5%).

Conference call Q&A excerpts

Q: You estimated that you sourced 50% of your 2018 sand volume in-basin. Is that kind of mix you’re happy with long-term, or do you anticipate that increasing over time?

President and CFO Jack Harper: Yes, I think that’s going to go up over time. The whole capability of those mines is just starting to come on now and in the second quarter and so I think it will be a growing part of our portfolio.

Q: What are your thoughts with regards to what to do with that excess free cash flow if that cash balance builds if commodity prices stay high?

Chairman and CEO Tim Leach: I’m going to give you a very high-level answer, and then maybe go down a little bit more on the weeds. But in my comments, I talked about how the increase in commodity prices had been choppy in the fourth quarter and how we’re positioned ourselves to take advantage of that. So, I think being able to demonstrate free cash flow generation over a long period of time, that’s something we’ve done, something we’re striving to do more of.

But we also did a lot of other things with – we improved our balance sheet. I think for the long term, having a strong balance sheet is going to be a real strategic advantage for us. I would like to see our balance sheet further strengthened.

But clearly, when you look out, we talk about decades of growth and work and things like that and as we become more and more efficient, we create a really efficient cash generation machine.

And when we started this company a decade ago, we talked about, would it be possible to deliver private equity types of returns for public shareholders like we did for the decade when we were private. If you look back on the – and when we were private, we delivered high-20s kind of compounded rates of return. When you look at the last decade now that Concho is a public company, we’ve kind of done that. And the value proposition has been through our development machine and also through our focus on the Permian Basin and consolidation.

And so, I think when somebody buys Concho, they’re buying into that value proposition. Now, at some point in time when you look down the road, you can see how much cash flow we’re going to generate. And I think when we get in the mode of starting to return capital to our shareholders it will be in the form of a new value proposition. It won’t be just a nominal type of return of capital, but it will be something that you say, okay I get it. This is how these guys are going to create value going forward. And so, that’s kind of how I’m thinking about it right now.

Q: So, a question on services, you mentioned the sand and different things. Could you talk about if you’re locking in just with those rigs that you have? Do you sort of stagger or think about locking in now these days on longer contracts?

And same thing on the frac spreads, are you able to – and people say you really can’t lock those in. But can you at least ensure that you have those same spreads over a period of time?

Harper: Yes. We really value flexibility as we’ve said in the past. And with some of those costs, some things are going up this year, some things may go down. But right now, we see minimal increase to cost. But it’s also a year where you’ve already seen about a 10% increase in rig count. So, that’s something we’ll work throughout the year, but maintaining flexibility is a key aspect of what we’re trying to do.

Leach: I would also say that part of our strategy has been running a steady operation and we think the size and scale of that gives us preferred pricing and doesn’t really involve locking things in. It involves being somebody that runs a steady program.

Q: You mentioned a lot of infrastructure. Could you just talk – you generally seem to stay ahead of even more than others, as far as water. Could you just talk about where you sort of sit there and plans around the water with your growth?

Leach: I think that water is one of the most important things, both the acquisition of water for the drilling program and also the proper handling of water after it comes out of the ground. So, that’s going to be a key part of our business.

We’ve become really good at that, I think. And we’re also getting our property base more concentrated and focused which allows us more efficiency in all the water handling. So, I think that’s going to be a huge business in the future and I think that’ll be a huge expertise in business embedded in Concho going forward.