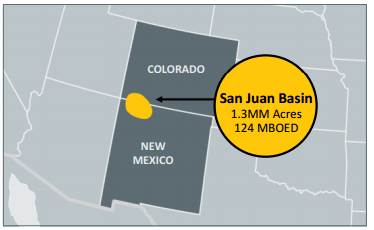

1.3 million acres in the San Juan basin sold to Hilcorp for $2,300/acre

ConocoPhillips (ticker: COP) announced the sale of its San Juan Basin assets for $3 billion, the second large sale by the company in the last month. Privately held Hilcorp Energy will purchase about 1.3 million acres from ConocoPhillips, giving it properties in Colorado and New Mexico.

ConocoPhillips’ San Juan Basin assets produced 124 MBOEPD in 2016, where 78% of production was natural gas, 20% was NGL and the remaining 2% was oil. The purchase price implies an acreage valuation of about $2,300/acre. Reserves associated with the assets total 0.6 BBOE.

The company reports that the net book value of these assets is approximately $5.9 billion, therefore an impairment is expected to be recorded in Q2 2017. Expected closing date is Q3 2017.

On a roll: COP has sold $16 billion in assets in the past 3 weeks

At the end of March, ConocoPhillips sold its oil sands and Deep Basin assets for $13.3 billion. The company reports that the oil sands and San Juan sales have reduced its cost of supply from $40/bbl to $35/bbl, and left the company with 14 BBOE with cost of supply below $50/bbl.

“Including our recently announced Canadian asset sales, we have line of sight to more than $16 billion of total considerations in 2017. These transactions will materially reduce our exposure to North American gas …,” ConocoPhillips Chairman and CEO Ryan Lance said in a statement.

Purchase price includes price-contingent payments

Hilcorp will fund this acquisition with $2.7 billion in cash, plus a contingent payment based on the price of natural gas. According to the terms of the transaction, over the next six years Hilcorp will make an annual payment of $7 million/month if the average monthly Henry Hub price is at or above $3.20/MMBTU. Payments from this contingency are capped at $300 million.

For reference, the average Henry Hub price for March was $2.88/MMBTU. ConocoPhillips reports that it will use the proceeds from this transaction for “general corporate purposes.”

Hilcorp busy in Alaska, Gulf, Marcellus and Utica

The buyer of the COP San Juan natural gas properties, Alaska and GOM operator Hilcorp Energy, is engaged in oil and gas operations in the Gulf Coast of Texas and Louisiana, the Appalachian basin and Alaska’s Cook Inlet and North Slope. Hilcorp says it is the largest oil producer in Louisiana.

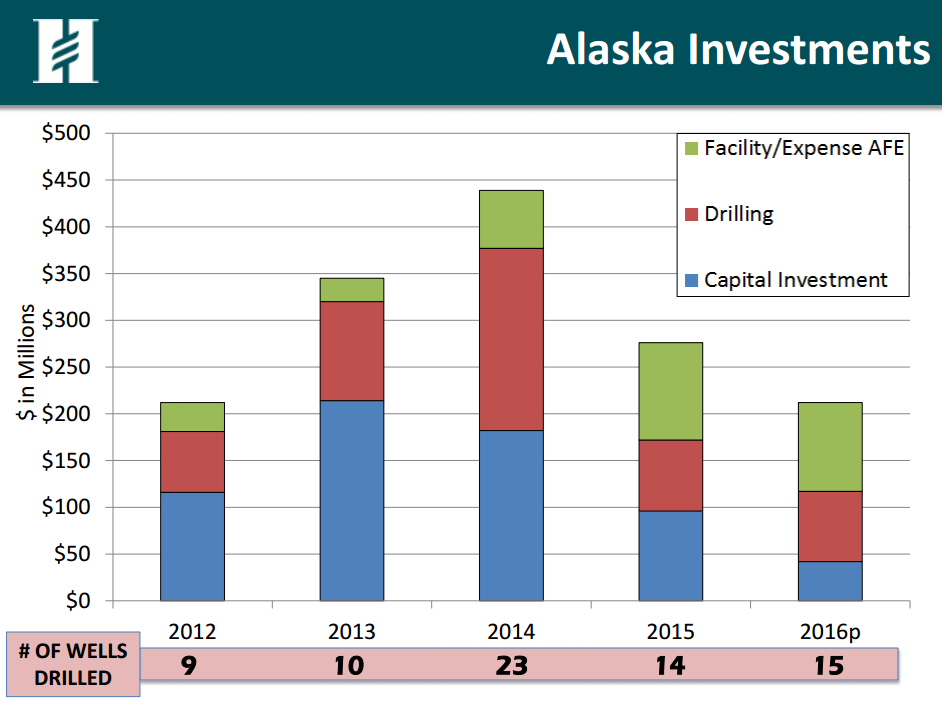

The Bureau of Ocean Energy Management (BOEM) lists Hilcorp with operations in 11 lease blocks in the Gulf of Mexico region. The Alaska Oil & Gas Association reported that in 2014 Hilcorp performed 88 well workovers and drilled 22 new wells in Alaska’s Cook Inlet, or almost one third of the new wells drilled in the Cook Inlet that year.

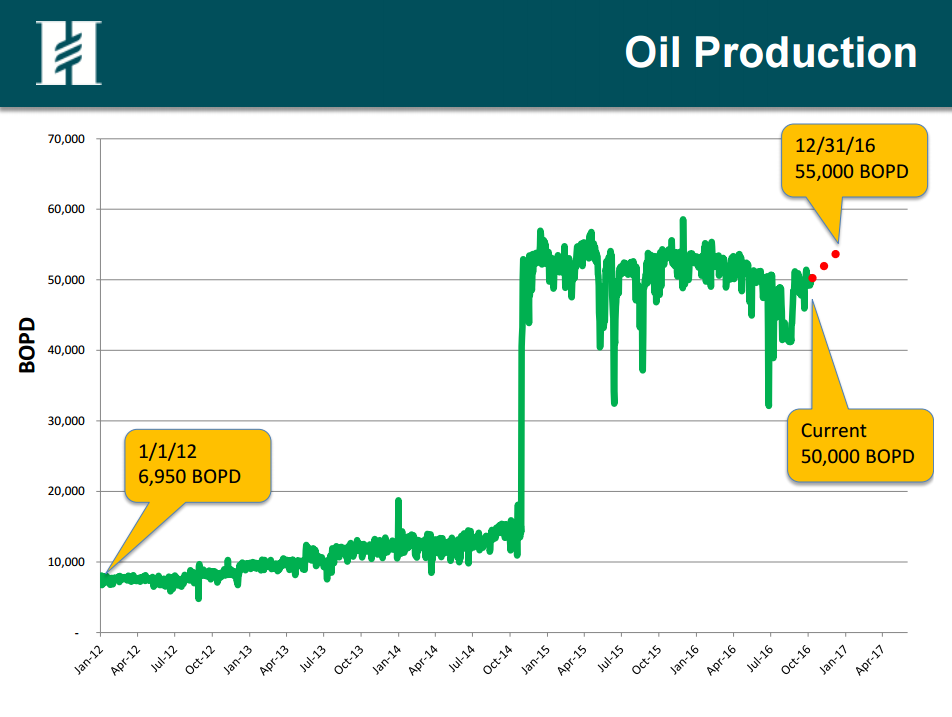

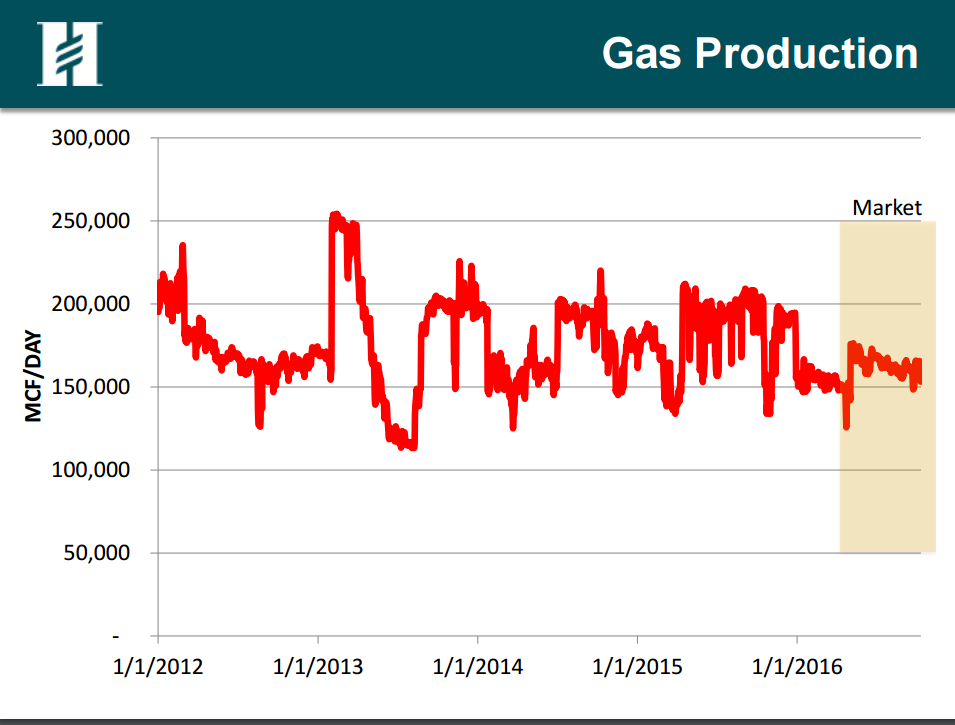

In its 2016 presentation for the Alaska Alliance, Hilcorp Alaska reported 50, 000 BOPD of oil production and approximately 150,000 Mcf/day of natural gas in Alaska. The BOEM reports that in November 2014, primary ownership and operatorship of the Liberty prospect was acquired by Hilcorp.

Hilcorp estimates that the Liberty Unit contains approximately 150 million barrels of recoverable, high-quality crude oil, according to BOEM. The Liberty prospect is located 8.85 km offshore inside the Beaufort Sea’s barrier islands 32 km east of Prudhoe Bay.

In Dec. 2015, Carlyle’s Energy Mezzanine Opportunities Fund, LP and Carlyle Energy Mezzanine Opportunities Fund II, LP said they would invest up to $1.24 billion in Hilcorp Energy Development LP. Hilcorp has been active in the Utica and Marcellus gas plays in the Appalachian basin. Hilcorp is based in Houston.

Hilcorp made headlines in 2015 when CEO Jeff Hildebrand awarded all 1,381 employees a $100,000 Christmas bonus as a reward for achieving his goal of doubling the size of the company in five years.