COP posts smaller loss than expected

ConocoPhillips (ticker: COP) reported fourth quarter earnings today, with a loss much narrower than expected. Net loss for the fourth quarter was $35 million, or ($0.03) per share, giving a full-year loss of $3.6 billion, or ($2.91) per share. Earnings were buoyed by several special items, including a sale in Senegal and net benefits from non-cash impairments. After adjusting for these items fourth quarter net loss is $318 million, or ($0.26) per share. This result is significantly better than the Zacks Consensus Estimate of a loss of $0.39 per share.

COP announced preliminary 2016 reserves, with year-end reserves estimated to be 6.4 billion BOE. This is down 1.75 billion from 2015 reserves, a decrease of 21%. The vast majority, more than 90% of the decrease, is due to revisions from low commodities prices. Approximately 70% of these revisions are from reductions in oil sands reserves. As commodity prices rise the company expects to rebook much of these reserves, it said in a statement.

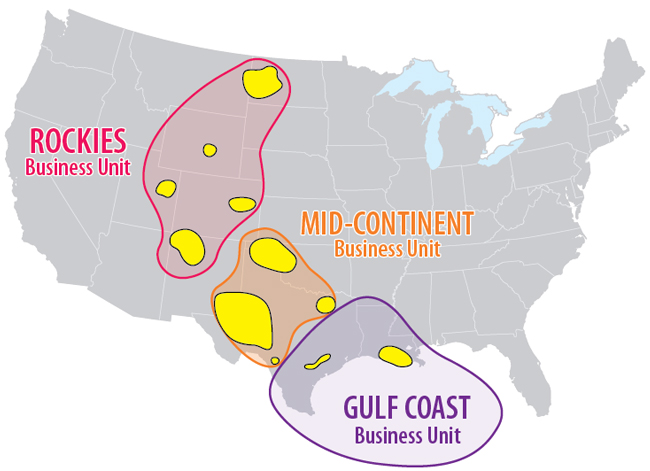

ConocoPhillips expects greater U.S. shale activity—boosting rig count: 11 rigs in the Eagle Ford, Bakken and Permian

ConocoPhillips 2017 CapEx is estimated at $5 billion, slightly less than 2016 CapEx of$5.2 billion. The company plans to spend significantly more in the Lower 48, where it expects to increase operated rigs from 8 to 11 in 2017. There will be 5 in the Eagleford, 4 in the Bakken, 2 in the Permian, and possibly one more active in the Permian and Niobrara. The company is continuing to emphasize its short-cycle unconventional assets and reduce large projects that are not near completion.

In Canada ConocoPhillips is continuing to ramp up production at its oil sands assets. They have also added significant acreage in the Montney, where shareholder return has outperformed any of the major U.S. basins.

The company also recently announced the Willow discovery in Alaska, in the Greater Mooses Tooth unit. Two discovery wells, the TinMiaq 2 and 6, encountered 72 ft and 42 ft of net pay in the Brookian Nanushuk formation. Preliminary estimates put recoverable resource potential in excess of 300 MMBO. With appraisal to begin immediately, ConocoPhillips estimates commercial production could begin in 2023.

ConocoPhillips has recently achieved project startups in several large international projects including:

- Train 2 of APLNG, an LNG plant in eastern Australia,

- Malikai, a deepwater oil project in Malaysia operated with Shell and Petronas,

- Bohai WHP-J, an offshore oil project in the Bohai Bay in eastern China,

- Alder, a high-pressure, high-temperature gas condensate field in the North Sea

Q&A from COP conference call

Q: Can I just ask about the new U.S. administration, how that influences your thinking and particularly maybe your view around the Canadian heavy oil position?

COP Chairman and CEO Ryan M. Lance: Well I think it’s a little early to tell. We certainly hope the new administration, at least in terms of what they’ve talked about, is going to give us a little bit of regulatory relief, which we think is good. There are some things that the last administration were proclaiming that were a bit worrisome on sort of how it might slow the business down, both on the regulatory side and on the infrastructure side.

We’ve seen President Trump make his decisions on DAPL and on Keystone, so hopefully some of that infrastructure will get moving that’s needed to be there. I think there is a lot of uncertainty on the Border Adjustment Tax and its potential impact on how crude and other products move across the border, whether it’s south to Mexico or some of the crude that moves down from Canada into the U.S. I think there’s a little bit to be seen yet as to what that means. Does it get exempted or how are the details of that going to unfold? We’re watching it closely, but I think it’s a little bit too early to tell on that last piece.

Q: Then my follow-up is just on sort of the capital coming into North America. I mean, given your perspective and looking across the industry, is the pace of the restart in the U.S. surprising you?

Ryan M. Lance: Yeah. I guess it surprised us a bit to the upside. But in the heart of these unconventional plays, the costs of supplies come down. We’re still getting more efficient, and the technology and the innovation is still improving. So, yeah, there’s maybe some pace at which people are coming back is a bit surprising, but the idea is not surprising in terms of the overall macro. The growers are protecting their multiple, so they trade on multiples of cash flow. So they’ve got to get on and run hard.

Q: In Alaska, you talked about the discovery in the Greater Willow area, and obviously bolting on some acreage up there as well. Could you guys give us a sense of how that would play out? Like when could we see the potential impact of some of these high-returning conventional projects like that?

COP Production Director Alan J. Hirshberg: Yeah. Willow is a very interesting discovery for us in the Greater Mooses Tooth area, out west of Alpine. We not only have that discovery but we were also able in both the state and federal lease sales in December to pick up another 750,000 acres gross; we’re 78% across all this acreage in our ownership. And so we, really, we’ve stood up a team up there in Alaska to really do the work, the development planning work, to figure out what’s the most optimum way to develop this new discovery. You could see it being on the order of 100,000 barrel a day kind of production rate that would be supported by just what we’ve discovered so far. So we need to think hard about how we move forward around infrastructure, et cetera.

It’s tough to predict timing because, as you know, the regulatory up there, dealing with the federal government has been pretty uncertain in the past on our other step-out projects. But I would say the earliest you could imagine bringing on a new round of things like Willow, that we just discovered, to be out in the 2023 kind of timeframe.