Barnett Assets produced 5 MBOEPD in 2016

ConocoPhillips (ticker: COP) announced today the sale of all of its interests in the Barnett to Miller Thomson & Partners.

ConocoPhillips reports that 2016 production from the assets that will be sold was 11 MBOEPD, made up of 55% natural gas and 45% NGL. Proved reserves associate3d with the properties is about 50 MMBOE. The sale will reduce production guidance by less than 5 MBOEPD, but will not have any effect on expected cash flow or other 2017 guidance.

ConocoPhillips will receive $305 million from Miller Thomson, which will be used for general corporate purposes. However, the current net book value of the assets is about $900 million, meaning ConocoPhillips will record a non-cash impairment on the assets in Q2 2017. Closing date for the transaction is expected in Q3 2017.

Miller Thomson & Partners is a private firm that acquires and develops natural gas assets, particularly shale properties. The company focuses on providing gas to chemical, power and LNG plants in the Gulf.

$16.6 billion divestment program funds strategic goals

This sale adds to ConocoPhillips’s overall divestment program. In March, the company announced the sale of its Canadian oil sands and Deep Basin assets to Cenovus. This transaction, valued at $13.3 billion, left ConocoPhillips with only a small footprint in Canada. Three weeks later, ConocoPhillips announced the sale of its San Juan Basin assets to Hillcorp for $3 billion. These gas-producing assets in Colorado and New Mexico accounted for 124 MBOEPD of production in 2016.

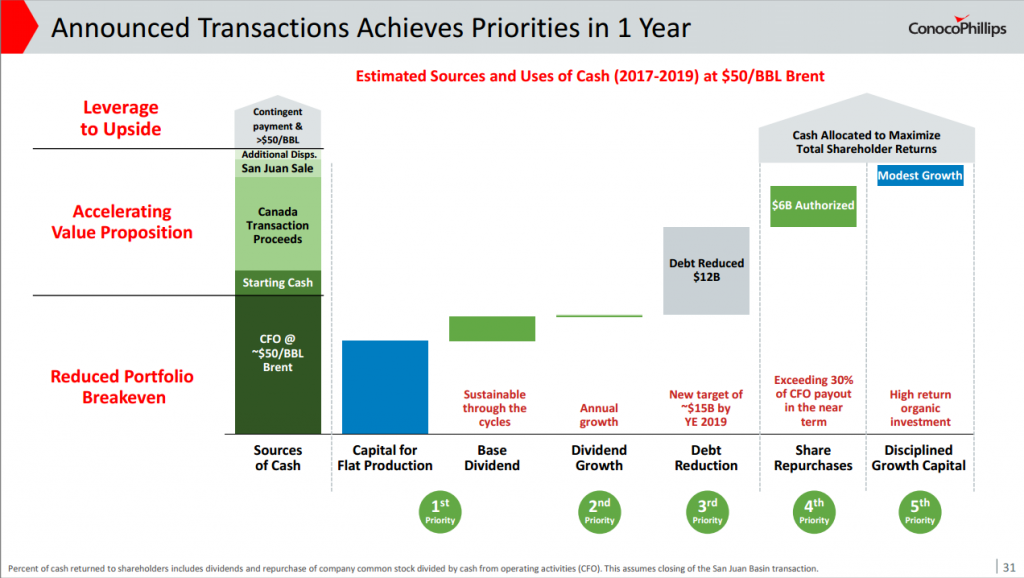

The funds from the divestment program are being used to achieve the priorities Conoco laid out at the end of last year. In order, these goals are:

- Invest capital to maintain production and pay existing dividend.

- Annual dividend growth.

- Reduce debt and target ‘A’ credit rating.

- 20-30% of cash from operations total shareholder payout.

- Disciplined growth capital.

The original goal prescribed $12 billion in debt reduction by the end of 2019. However, this goal has already been reached. Therefore, the new target is $15 billion in debt paid down by 2017. A further $6 billion in share repurchases is planned, the company said.