Contango Oil & Gas built a position in the hottest play in the U.S. at a fraction of the going cost

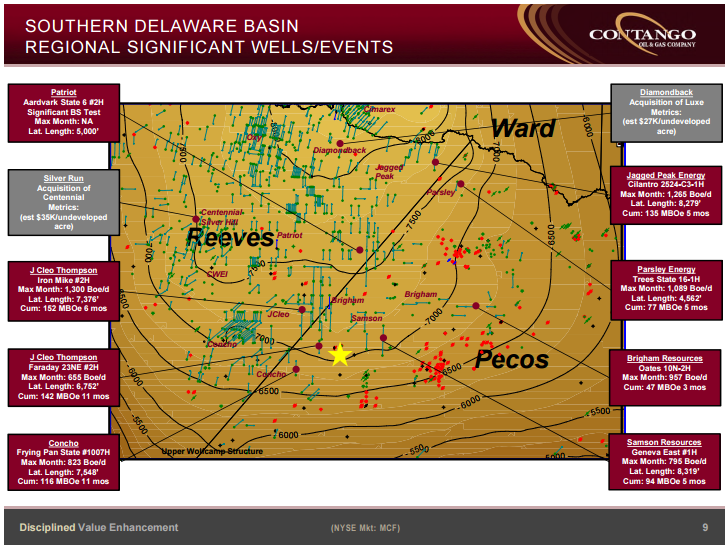

The Delaware Basin has become the U.S.A. focal point for oil and gas acquisitions over the course of the last year, with the per-acre value of deals sky-rocketing compared to other plays in the country.

The Delaware’s high rates of return have prompted a rush of capital into the basin that have seen per-acre costs on some deals reach $30,000 per acre and above.

But Contango Oil & Gas (ticker: MCF) has been able to move into the play at approximately $5,000 per acre.

Contango has acquired approximately 12,000 gross acres with approximately 41% operated working interest and 32% net revenue interest (NRI). “We were able to enter the basin in a very economic way,” Contango Senior Vice President and CFO Joe Grady told Oil & Gas 360.

The deal structure that the company employed to secure its footprint in the Delaware meant that Contango had a small upfront cash payment and a conservative deal structure moving forward. MCF will have $10 million in drilling carryover the next six to fourteen months, and up to $5 million in contingent success fees on the 7th and 20th wells drilled.

Contango Oil & Gas estimates it has 157 gross locations on its acreage which could generate 54% or greater internal rates of return at current strip and cost estimates, according to its most recent corporate presentation.

“We have been very conservative with our capital, maintained the strength of our balance sheet throughout the downturn, and we have a conservative financial plan moving forward,” Grady said.

The focus of the company’s 2017 budget will be its Delaware Basin assets, Grady explained. Contango has already drilled three wells in which it holds an average 48.8% operated working interest, according to a press release from January 7, 2017.

Contango drilled and completed its Lonestar-Gunfighter #1H in the Upper Wolfcamp in late November, and is drilling the lateral portion of its second and third wells, the Rude Ram #1H and the Ripper State #1H currently.

“Similar to the Lonestar-Gunfighter, these recent wells will also be drilled to a total measured depth of approximately 21,000 feet, including a 10,000 foot lateral with approximately 50 stages of fracture stimulation. Completion operations on the Rude Ram and the Ripper State wells, utilizing a zipper frac strategy, are currently scheduled to begin in mid-March, with initial production expected to commence in mid-April,” Contango said in its press release.

“Our current development plan is to drill and complete four wells in sequence, take a pause in drilling to assess initial production performance from those first four wells, and then recommence drilling operations after making any appropriate adjustments to our completion techniques with the goal of maximizing well performance and ultimate recovery,” the company said in the press release. “We currently estimate that we will resume drilling in July and expect to drill five more Southern Delaware basin wells over the remainder of 2017.”

“If we experience results as good as expected, or better, or prices improve, we have the flexibility to increase our drilling program during the year,” Grady added.

Contango Oil & Gas is presenting at EnerCom Dallas

Contango Oil & Gas will be presenting its story at the Tower Club Downtown Dallas on Thursday, March 2, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The event also provides energy industry professionals a venue to learn about important energy topics affecting the global oil and gas industry. The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear Contango present, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.