Continental sells 1 MMBBL of Bakken crude to China

After years trapped in the U.S. market, crude from the Bakken is going overseas. Continental Resources (ticker: CLR) announced today that it has sold crude specifically for export to China.

Continental has sold 1,005 MBBL of Bakken crude to Atlantic Trading and Marketing, a subsidiary of Total (ticker: TOT). ATMI will make daily prucahses of 33,500 barrels per day in November, then will transport the oil for loading on tankers in Texas.

Such a trade was only made possible recently, when the crude oil export ban was lifted in December 2015. Since then, crude exports have grown from 392 MBOPD in December 2015 to a high of 1,116 MBOPD in February 2017, and have averaged 914 MBOPD so far in 2017.

Hamm to world: this is going to be global oil’s new normal

“This is a historic day for Continental and begins a new chapter in our long-term strategy to establish multiple international markets for American light sweet oil,” said Harold Hamm, Continental’s chairman and CEO.

“This new normal was created by the American shale energy revolution and the lifting of the 1977 crude oil export ban. We expect to see many similar industry transactions in coming months and years,” Hamm said.

“We recognized back in 2015, when we were working to lift the export ban, that American light sweet oil would be a good fit for these refineries, especially in Europe and Asia. The current $6 discount to Brent should not exist, given the consistency and high quality of WTI, as well as relative shipping costs,” Hamm said.

“Stabilized U.S. production and increasing industry sales of American crude to international markets will drive down U.S. inventories, correcting much of the recent disparity between Brent and WTI prices. Modern modes of transport in the crude oil sector today eliminate price disparities between markets and allow free markets to work,” Hamm said.

Bakken very likely to become a separate export grade

Today’s announcement by Continental seems to add confirmation to an early trend reported by Argus and covered by Oil & Gas 360®, when the firm said in a webinar that based on what it was seeing in the global markets, Bakken crude may emerge as its own export grade.

Argus VP Jeff Kralowetz commented, “We think that Bakken could well become a fairly robust new export grade within the next couple of months. Our market team is already getting trades of spot Bakken being traded at Nederland and Beaumont reported to us, and we think within the next couple of months we will be able to initiate coverage there. It’s a consistent quality grade which buyers are looking for and there is a large volume; so the liquidity of this new market could be very strong from the very early days.”

Hess first to ship Bakken light sweet crude—to Europe

On April 3, 2016, Hess Corp. (ticker: HES) announced that 175,000 barrels of Hess light crude left St. James Parish, La. for a refinery in Rotterdam, Netherlands. The shipment was the first reported sale of Bakken crude outside the United States since the 40-year ban on exporting U.S. crude was lifted by Congress and signed into law by the president in December 2015, Hess said.

Hess CEO John Hess said at the time, “By putting more crude in the open marketplace, you’re going to create more energy security.”

Bakken crude heads to Singapore in a VLCC

Almost exactly a year later—on April 26, 2017— Reuters published a story saying that the first ever reported export of North Dakota’s crude oil to Asia had left port in March, “according to a shipping document seen by Reuters on Wednesday, in what is expected to be the first of numerous cargoes once the key Dakota Access pipeline starts moving oil in May.

In its story, Reuters said that Swiss-based Mercuria Energy Trading S.A. loaded more than 600,000 barrels of Bakken crude in late March off the coast of Louisiana onto the very large crude carrier (VLCC) Maran Canopus, destined for Singapore, according to the bill of lading and ship tracking data.

Reuters pointed out that the Dakota pipeline can carry 470,000 barrels per day of North Dakota’s Bakken oil to the Gulf, “the starting point for the lion’s share of U.S. oil exports.”

At least two Asian refiners told Reuters that they are interested in Bakken light crude because of the products it can yield through refining. “There seems to be increasing demand for light quality crude in Asia,” said Michael Cohen, head of energy commodities research at Barclays. “I think with Dakota Access coming online, it makes the pipeline route from the Bakken to the Gulf Coast more economical.”

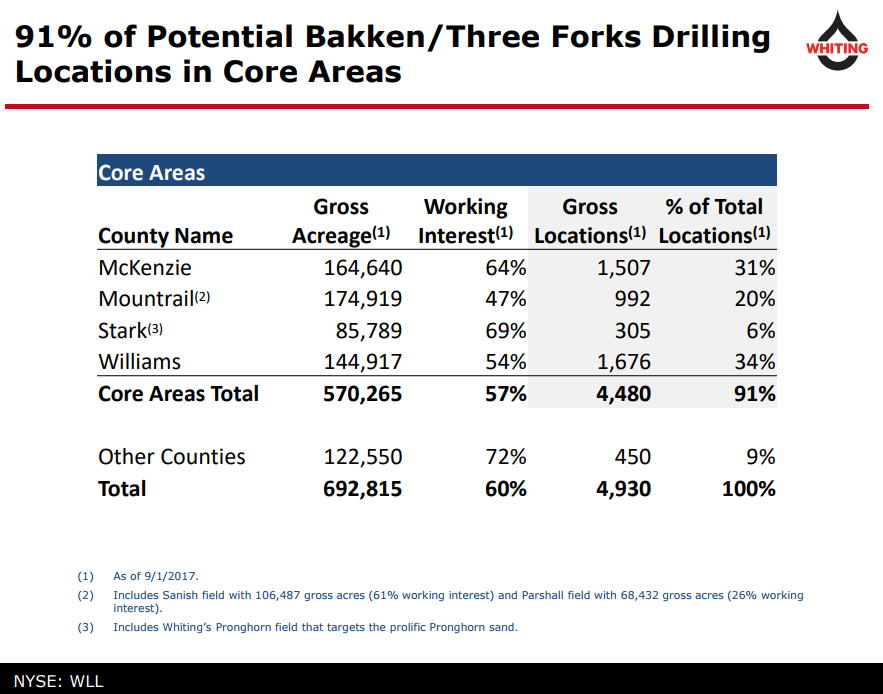

Whiting Petroleum: ~4,500 drilling locations in Bakken/Three Forks core

Another company that stands to benefit from shrinking WTI/Brent differentials and capitalize on an export trend for a specific Bakken export grade of crude oil is Denver’s Whiting Petroleum (ticker: WLL). AS of September 1, 2017, Whiting had identified 4,480 gross drilling locations on its core Bakken/Three forks acreage, representing a long runway of future Bakken crude oil for export to global markets.