Gasoline stocks increase for second week

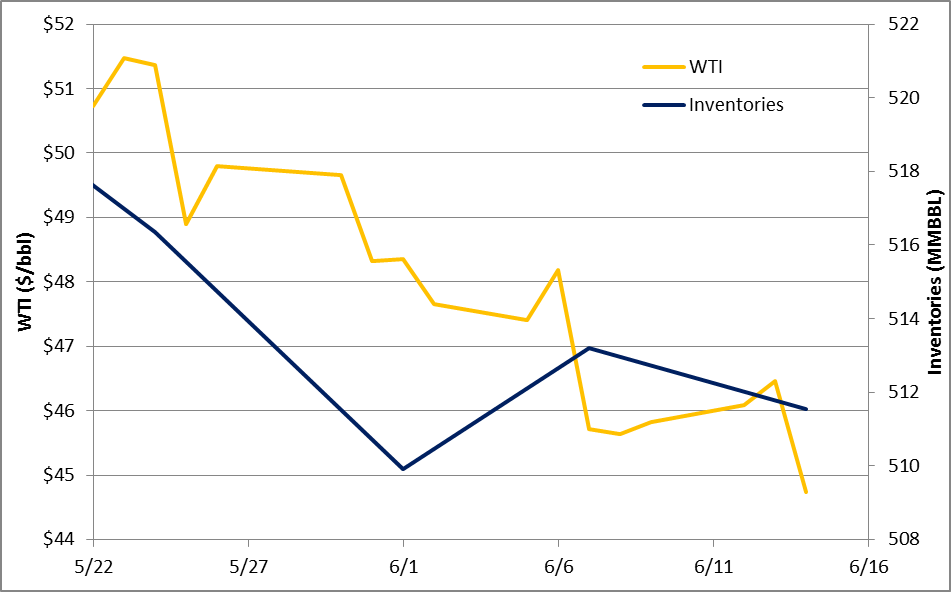

Crude oil prices have fallen on disappointing inventory data today, in a repeat of what occurred after the inventory build last week.

Unlike last week’s Petroleum Supply Weekly, the EIA did not announce a build in crude oil inventories today. Commercial crude oil inventories (excluding the Strategic Petroleum Reserve) decreased by 1,661 MBBL from June 2 to June 9. This is below the average analyst expectation, which was reported by Bloomberg to be 2,300 MBBL.

Gasoline stocks, however, did see a build, rising from 240.3 MMBBL to 242.4 MMBBL. A build in gasoline stocks is disconcerting, as this point in the year typically represents the beginning of the summer driving season, in which gasoline demand increases. This is the second-straight week of gasoline inventory builds, as the EIA reported a build of 3.3 MMBBL last week.

Stocks of other refined products grew as well, with the EIA reporting distillate fuel oil and “all other oils” inventories growing from June 2 to June 9. Like last week, the SPR’s stocks decreased slightly, in compliance with laws that have mandated sales from the reserve.

Oil dropped sharply on the release of the report, falling below $45/bbl WTI. At the time of writing, WTI has dropped by $1.67/bbl to $44.79/bbl, a decrease of 3.59%. Brent fell by the same increment, falling by $1.67/bbl to $47.05/bbl.

Inventory reports continue to disappoint

Three out of the four most recent inventory reports have failed to encourage oil traders.. When the report was released on May 24, a significant inventory draw failed to excite traders awaiting OPEC’s decision regarding cut extensions. That day saw crude slide somewhat, ending down by 0.21%. The large inventory draw reported on May 31 was barely enough to counterbalance fears of increasing U.S. production, and oil finished the day up 0.08%. The surprise build reported last week sent prices reeling, and WTI dropped 5.13%.