Six Straight Weeks of Decline

The Department of Energy reported a draw of (6,812) MBO from United States crude oil inventories for the week ended June 5, 2015, marking the largest draw of the year and the most since the week ended July 11, 2014. Inventories have now declined for six straight weeks, and amount of stored oil has dropped to 470,603 MBO from 490,912 MBO (about 4%) at the end of April.

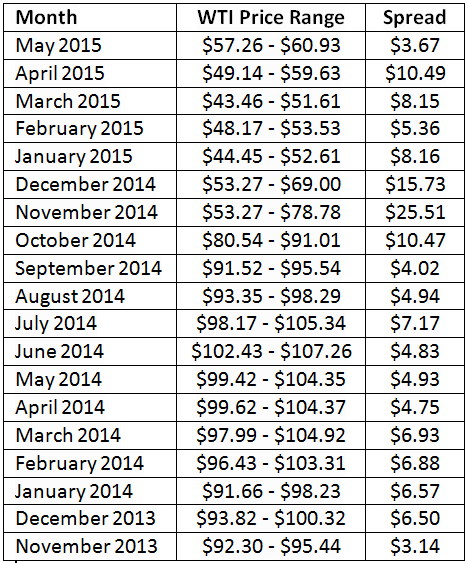

The price of West Texas Intermediate (WTI), meanwhile, has experienced price stability in recent weeks. WTI ranged from $57.26 to $60.93 throughout all of May 2015, equaling a monthly spread of only $3.67 – the slimmest spread since November 2013. The United States benchmark traded above $61.00 for most of the day after the inventory update was issued.

Coincidentally, the report was issued the same day as the Organization of Petroleum Exporting Countries’ (OPEC) Monthly Oil Market Report for June 2015. In the release, OPEC commented on the maintaining its 30 MMBOPD output quota in their latest meeting, adding that “Member Countries confirmed their commitment to a stable and balanced oil market, with prices at levels suitable for both producers and consumers.”

The cartel also said market fundamentals are pointing to production declines, and, hopefully, an ease in the oil market glut. The U.S.-based Energy Information Administration projects domestic output to decline in July 2015. Stocks at Cushing, Oklahoma, declined by 1,000 MBO to about 58,000 MBO overall, down from a high of roughly 71,000 MBO in March. Of the five Petroleum Administration Defense Districts (PADDs), only PADD 5 (the West Coast) has stocks within the five year range. Overall, inventories are still 19.8% above the five year average.